Economy Watch: CRE Prices Up in March, Except Industrial

Gains in four of the five property segments were enough to outweigh a 0.5 percent decline in the industrial pricing, according to Ten-X's March Commercial Real Estate Nowcast.

By D.C. Stribling, Contributing Editor

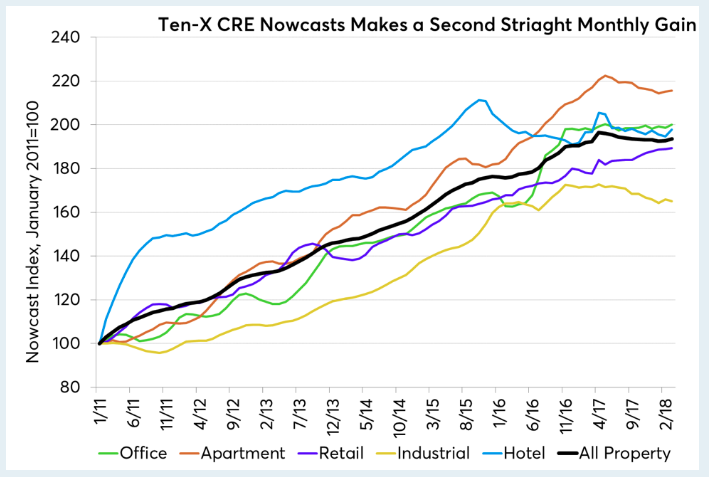

U.S. commercial real estate prices rose 0.5 percent in March, according to the March 2018 Ten-X Commercial Real Estate Nowcast, which the company released March 30. The increase represents the index’s second consecutive monthly gain, but even so it stands only 0.7 percent higher than a year ago. The index combines Google Trends data, Ten-X Commercial’s proprietary transaction data, and investor surveys to estimate CRE pricing trends in real time, according to the company.

Gains in four of the five property segments, including hotel, office, apartment and retail were enough to outweigh a 0.5 percent decline in the industrial pricing. Hotel prices bounced back from two straight months of decline, climbing 1.6 percent in March, the strongest increase of any property segment.

Pricing for office properties continued its up-and-down pattern, according to Ten-X, climbing 0.8 percent in March after a 0.3 percent drop in February. The segment’s year-over-year gains now stand at 1.3 percent, having only moved minimally since early 2017.

Pricing in the apartment sector edged up 0.2 percent in March, according to the the report, for the second monthly increase after seven consecutive months of contraction. Apartment pricing fell 0.7 percent annually, representing the first year-over-year decline for the apartment segment since the Nowcast’s inception in 2009.

Pricing for retail increased 0.2 percent in March despite consumers’ persistent move to online shopping. The index is now 6.5 percent above year-ago levels, an annual gain that far outpaces that of any other segment.

Industrial, the most recent darling property type among investors, reversed its impressive February gain and suffered a 0.5 percent decline in March, reported Ten-X. The segment’s year-over-year pricing decline deepened to 3.8 percent, the sixth consecutive month in which industrial failed to post an annual gain. The sector’s pricing declines come despite the e-retail tailwind that has driven major gains in both vacancies and rent conditions.

You must be logged in to post a comment.