Economy Watch: CRE Prices Up Slightly in February

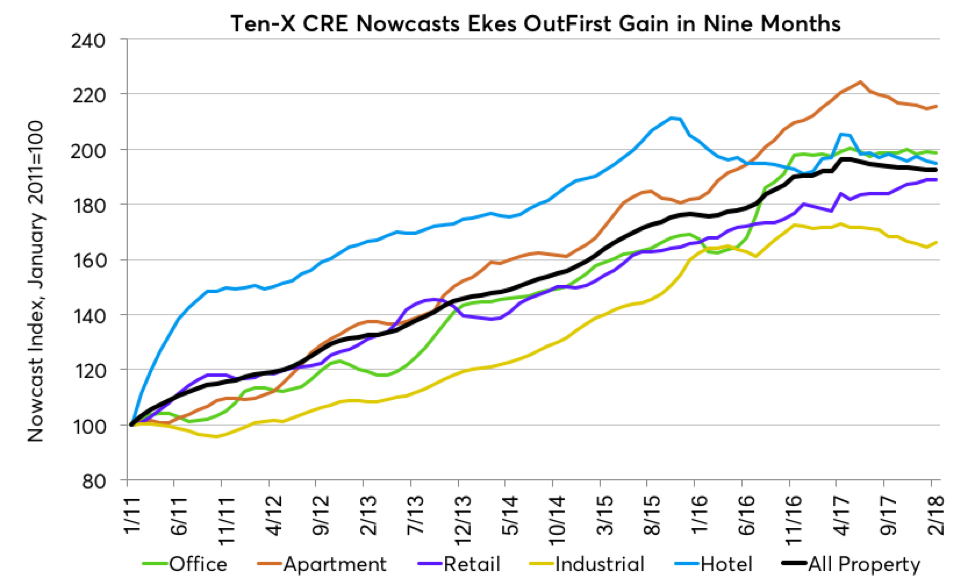

The increase in investment prices marks the first gain after nine months of contraction, according to Ten-X's latest Commercial Real Estate Nowcast.

By D.C. Stribling, Contributing Editor

U.S. commercial real estate investment prices rose 0.1 percent in February—the first gain after nine consecutive months of contraction, according to Ten-X Commercial’s February Commercial Real Estate (CRE) Nowcast. Even with February’s pricing uptick, however, the Ten-X CRE Nowcast is now just 0.4 percent higher than a year ago, the smallest annual increase since the Nowcast’s inception.

The company combines Google Trends data, Ten-X Commercial transaction data and investor surveys to calculate CRE pricing trends.

Sector Performance

The Ten-X Industrial Nowcast posted the largest increase in February, with prices rising by 1 percent. The strengthening of the industrial economy in recent months has given investors renewed confidence that demand will continue, the company posited, but threats about tariffs and other trade barriers remain a risk for the segment.

Like industrial, pricing in the apartment sector edged up in February, according to the Ten-X Apartment Nowcast, posting a 0.4 percent increase after seven consecutive months of contraction. In the past year, apartment prices have remained essentially flat, with pricing just 0.2 percent higher than a year ago.

The Ten-X Retail Nowcast increased 0.1 percent in February, even as the sector’s headwinds, such as e-commerce and shifting consumer spending preferences, remain. The index is now a solid 6 percent above year-ago levels, far outstripping the annual gains of any other segment.

The Ten-X Office Nowcast experienced a 0.3 percent decline in February. Office pricing is essentially unchanged since early 2017, with year-over-year gains at a measly 0.1 percent. Also, hotel prices remains weak. The Ten-X Hotel Nowcast posted its seventh decline in ten months, falling 0.4 percent in February. Hotel pricing is now 0.9 percent lower than a year ago.

You must be logged in to post a comment.