Economy Watch: Food & Beverage Sales May Help Ailing Shopping Centers

Restaurants and other eateries account for more than 20 percent of units in new and redeveloped shopping centers in mature markets, according to a recent Cushman & Wakefield report. This trend will likely continue as consumer spending on eating out is expected to grow over the next decade.

By Dees Stribling, Contributing Editor

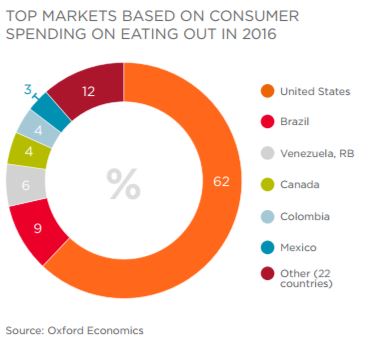

Source: Oxford Economics (courtesy of Cushman & Wakefield’s Global Food & Beverage Market Report, Summer 2017)

The increasing presence of food and beverage in shopping centers—often accounting for more than 20 percent of units in new and redeveloped centers in more mature markets—is being driven by rapid global growth in consumer spending on eating out, according to a new report from Cushman & Wakefield. It’s a trend that might help some retail properties from going under.

With spending on eating out expected to grow over the next 10 years and consumers’ desire to enhance a shopping trip with social and leisure experiences increasing, food and beverage is now critical to the success of any retail development, the report asserts. Moreover, that’s the case in most parts of the world.

All four global regions examined in the report are forecast to experience growth in food and beverage expenditure, led by Asia Pacific and the Middle East and Africa. Based on data from Oxford Economics, consumer spending is forecast to nearly double in the latter region ($182.5 billion to $363.5 billion) and more than double in the former region ($1.05 billion to $2.3 billion). As such, food and beverage spend is predicted to grow at an annual average of 7.4 percent between now and 2026 in both regions.

Europe and the Americas, as more mature markets, aren’t expected to see the same increases in consumer spending but are nonetheless expected to enjoy healthy food and beverage annual spending growth of 4.9 percent and 5.5 percent, respectively.

As spending increases, customer expectation does too. Once-ubiquitous food courts, made up of common seating areas surrounded by fast food outlets, are a dying breed, the report noted. While mainstream brands with the ability to pay higher rents still dominate, landlords are recognizing the importance of diversity. Other concepts, such as the food hall, have evolved, while there’s also a move toward creating different eating and drinking zones within shopping centers.

You must be logged in to post a comment.