Economy Watch: Home Prices, Jobs Up

CoreLogic is reporting the data: U.S. home prices were up 0.8 percent in May, following a revised gain of 1.3 percent in April. Take out distressed sales and the increase is 1.2 percent.

July 1, 2011

By Dees Stribling, Contributing Editor

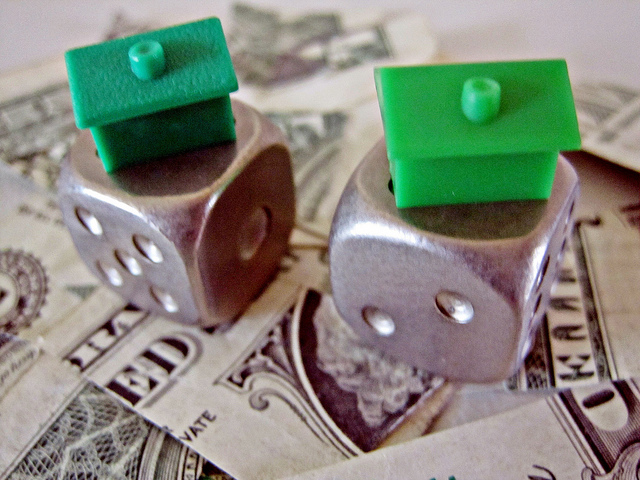

For the second time this week, a study of the housing market has said that prices were up in May. This time around, it’s CoreLogic reporting the data: U.S. home prices were up 0.8 percent in May, following a revised gain of 1.3 percent in April, the company said on Thursday.

Take out distressed sales, and the increase during May is 1.2 percent, according to CoreLogic. That seems to be even better news, so it’s no wonder that people trying to talk up the economy have been referring to the non-distressed housing market lately. Fed Chairman Ben Benanke, for example, mentioned it last week at his post FOMC-meeting press conference, asserting that if only that pesky distressed property backlog could be sold off, the housing market would find its bottom, even improve.

The chief economist at CoreLogic, Mark Fleming, voiced a similar sentiment. “Two consecutive months of month-over-month growth and continued relative strength in the non-distressed market segment are positive seasonal signs in the housing market,” he noted in a statement. “Slowly declining shadow inventory and stabilized negative equity levels are also positive signs. Nonetheless, the fragile economic recovery is still critical to the long-term recovery in the housing market.”

Majority of U.S. Counties See Employment Increase in 2010

The Bureau of Labor Statistics reported on Thursday that from December 2009 to December 2010, employment increased in 220 of the 326 largest U.S. counties. Remarkably enough, Elkhart County, Ind., posted the largest percentage increase, with a gain of 5.2 percent over the year, compared with

national job growth of 0.9 percent.

As RV capital of the known world, Elkhart has benefitted from the counterintuitive increase in RV sales since around the beginning 2010 (gas prices haven’t slowed things down for RVs, it seems). By contrast, Manatee County, Fla., experienced the largest over-the-year percentage decrease in employment among the largest counties in the U.S., according to the BLS, with a loss of 4 percent.

The U.S. average weekly wage increased over the year by 3 percent to $971 in the fourth quarter of 2010, the BLS also reported. Among the large counties in the U.S., Olmsted County, Minn., had the largest year-over-year increase in average weekly wages in the fourth quarter of 2010, with a whopping gain of 31.9 percent. Olmsted County happens to include Rochester, home of the Mayo Clinic, and health-related industries are doing fairly well these days.

So Long, QE2

QE2 came to an end on Thursday. Helpful, harmful or just another lackluster effort by officialdom to simulate an economy that doesn’t want to be stimulated? Depends on whom you ask.

“There is no evidence that huge inflow of money into the system basically worked,” former Fed Chairman Alan Greenspan said in a live interview with CNBC on Thursday.

On the other hand, Federal Reserve Bank of St. Louis President James Bullard, speaking on Thursday at a conference, said that, “QE2 has shown that the Fed can conduct an effective monetary stabilization policy even when policy rates are near zero.”

Wall Street, presumably happy that Greece isn’t going to default just yet, headed for the sky on Thursday, with the Dow Jones Industrial Average gaining 152.92 points, or 1.25 percent. The S&P 500 was up 1.01 percent and the Nasdaq advanced 1.21 percent.

You must be logged in to post a comment.