Economy Watch: More Rate Hikes Likely This Year

The Federal Reserve announced its plans for "gradual" interest rate increases due to the strength of the U.S. economy, according to the recently released Federal Open Market Committee meeting minutes.

By D.C. Stribling, Contributing Editor

The Fed is on track to raise the federal funds rate again in the near future— perhaps as many as three or maybe even four hikes all together in 2018—because of the strength of the economy, according to recently released minutes from the most recent Federal Open Market Committee meeting (March 20-21). The central bank raised rates at the March meeting, to the current 1.5 percent to 1.75 percent.

“With regard to the medium-term outlook for monetary policy, all participants saw some further firming of the stance of monetary policy as likely to be warranted,” the FOMC said in the minutes. “Almost all participants agreed that it remained appropriate to follow a gradual approach to raising the target range for the federal funds rate.”

Gradual, but not too gradual. “A number of participants indicated that the stronger outlook for economic activity, along with their increased confidence that inflation would return to 2 percent over the medium term, implied that the appropriate path for the federal funds rate over the next few years would likely be slightly steeper than they had previously expected,” the minutes said.

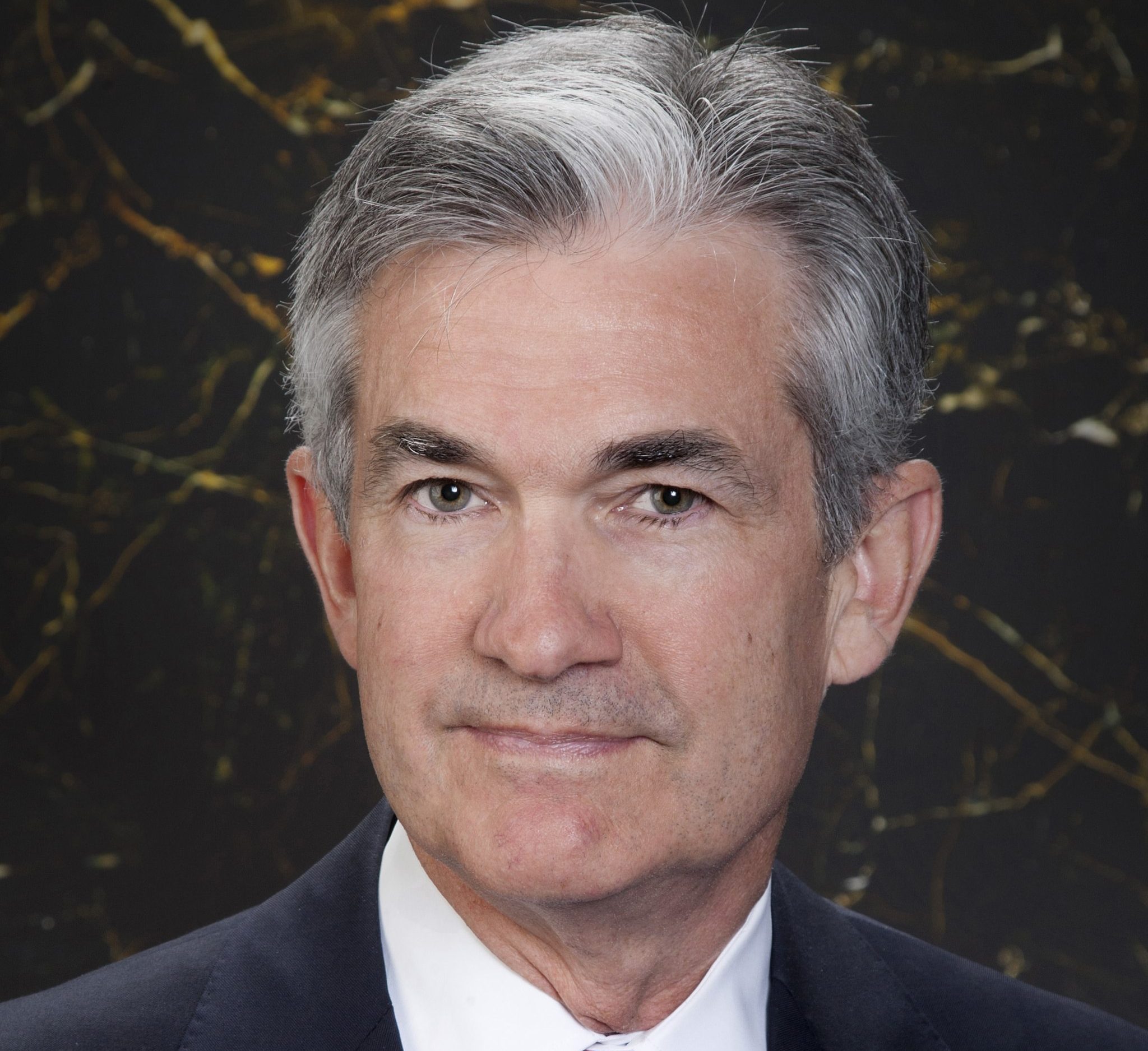

The minutes of meeting, which was the first one chaired by Jerome Powell, also hinted at uncertainty about the future of the economy. The impact of tax cuts remains a question, as does the possibility for a trade war, the central bankers agreed. Both are essentially wild cards for the U.S. economy, though that term was not used. A “strong majority” of the FOMC believe that a trade war would harm the economy.

You must be logged in to post a comment.