Economy Watch: Nonresidential Project Planning Slows in September

While the Dodge Momentum Index has fallen for four consecutive months, that doesn't necessarily indicate a turn in the building construction market, noted Dodge Data & Analytics.

By D.C. Stribling, Contributing Editor

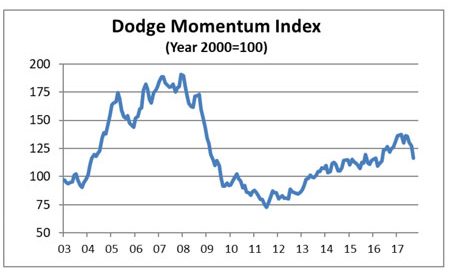

The Dodge Momentum Index fell in September, dropping to 116.4 (2000 = 100) from the revised August reading of 127.1. The index, produced by Dodge Data & Analytics, is a monthly measure of nonresidential building projects in planning, which lead construction spending for nonresidential buildings by a full year.

Both components of the Momentum Index declined in September. The institutional building component fell 11.5 percent from August, while the commercial building component fell 6.1 percent. While the overall Momentum Index has lost ground for four consecutive months, this should not be seen by itself as a predictor of a turn in building markets, Dodge posited.

Before its previous peak in January 2008, the index had suffered similar significant declines, only to rebound and post strong gains in line with overall economic growth. Similarly, the Momentum Index posted healthy gains from late 2016 through early 2017. Economic growth remains solid and building market fundamentals are supportive of further growth in construction activity.

In September, 10 projects entered planning, each with a value of $100 million or more, Dodge reported. In the commercial building sector, the leading projects were a $200 million office complex in San Jose, Calif., and a $200 million mall in Staten Island, N.Y. The leading institutional projects were a $400 million civic complex in Los Angeles and a $100 million casino in Tulalip, Wash.

You must be logged in to post a comment.