Economy Watch: Suburban Office Markets Showing Strength

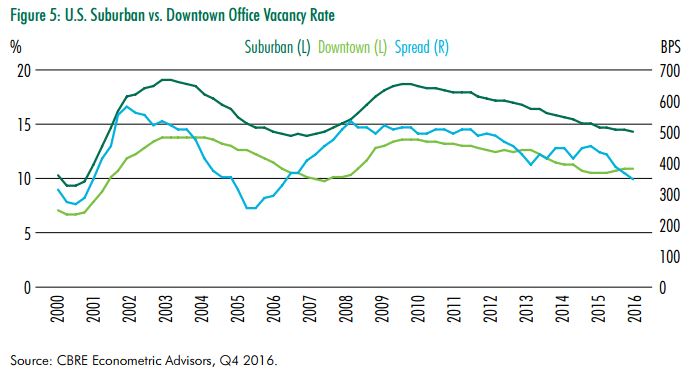

While downtown markets are still out-performing the suburbs, the gap in vacancy is shrinking in many places across the country as the U.S. suburban office market continues to tighten, according to CBRE's latest office market report.

By Dees Stribling, Contributing Editor

Many suburban office markets have resilience, according to a new report published by CBRE Group that analyzed data from the 58 largest U.S. suburban markets. One takeaway: while downtown markets are still out-performing the suburbs by some metrics, the gap in vacancy is shrinking in

many places across the country. The average suburban vacancy rate is still 340 basis points more than the downtown vacancy rate, but that’s still an improvement over the long-run average gap of 430 basis points since 2000, CBRE noted.

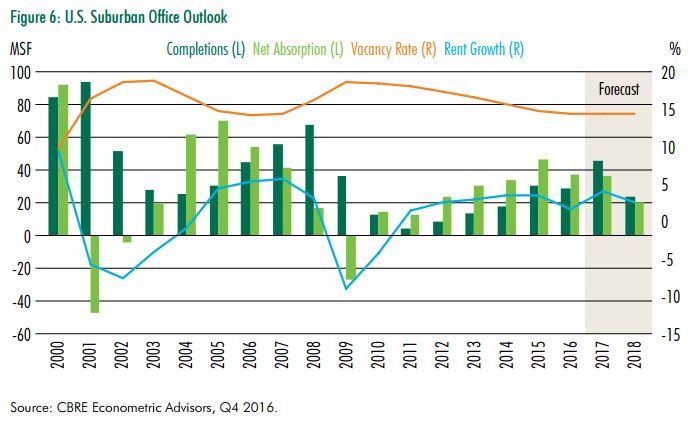

“Since the end of the Great Recession, the U.S. suburban office market has tightened at a steady clip, boosted by improving demand and low overall levels of new supply compared with previous cycles,” said Andrea Cross, CBRE Americas head of office research. “Still, the suburbs are having a hard time shaking the perception that they’re struggling to keep up with the allure of vibrant downtowns.”

Among the 58 suburban markets, 50 markets recorded positive absorption in 2016, including 15 with more than 1 million square feet of absorption. The Dallas/Ft. Worth suburbs alone accounted for 13 percent of suburban absorption and 11 percent of total office absorption among the U.S. metros in the report. Phoenix accounted for 8 percent of suburban absorption in 2016, tied for the second most with Los Angeles.

The report added that many markets that had lagged during the current expansion due to particularly severe housing busts, overbuilding or other factors—including multiple Florida markets, Detroit, Milwaukee, Phoenix, Long Island, Inland Empire and Los Angeles —posted year-over-year vacancy rate decreases of 200 basis points or more in the fourth quarter of 2016.

CBRE Economic Advisors projects positive net absorption and continued rent growth for the North American suburban office market through 2018, with submarkets containing high-quality amenities and efficient buildings likely to perform the best.

You must be logged in to post a comment.