Economy Watch: US Hotels to Grow at Slower Pace in 2018

Excess supply is a major reason why 50 of the 60 top markets CBRE Hotels' Americas Research highlighted in the firm's latest report are projected to see a declined in occupancy in 2018.

By D.C. Stribling, Contributing Editor

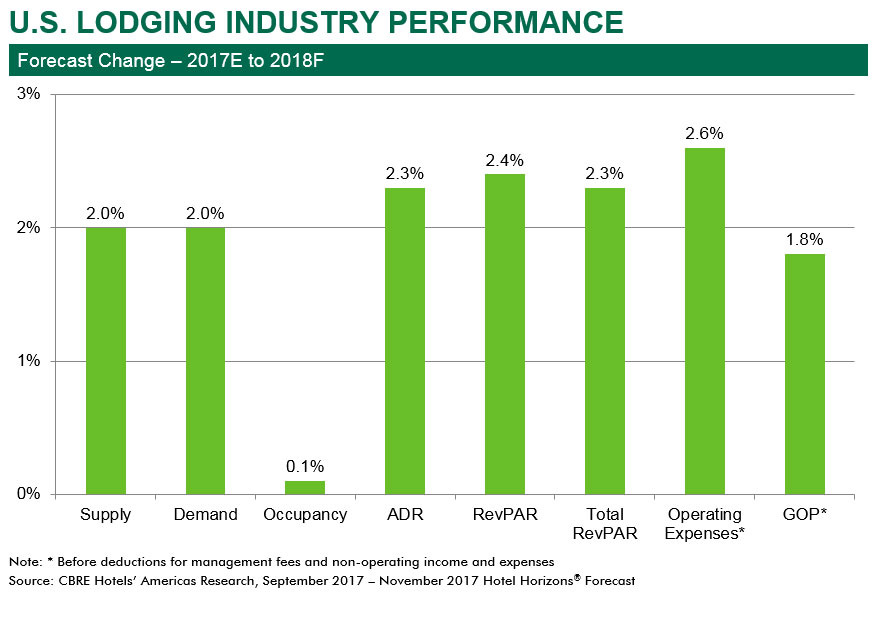

The U.S. lodging industry will continue to grow across all major metrics in 2018, but at a slower pace, according to a recent report by CBRE Hotels’ Americas Research. The company forecasts increases in occupancy, average daily room rate (ADR), revenue per available room (RevPAR), total operating revenue, and gross operating profits in 2018, compared with this year.

CBRE is forecasting a 0.1 percent occupancy increase, along with a 2.3 percent rise in ADR for 2018. The net result is a projected 2.4 percent boost to RevPAR.

Supply exceeds demand

The report also predicts an uptick in new lodging supply nationwide. For 2018, CBRE foresees a 2 percent increase in the number of available rooms. That exceeds the 1.8 percent long-run average annual rate of supply growth, as reported by STR.

Supply growth in excess of demand is the reason why 50 of the 60 major markets in the report are projected to see a decline in occupancy in 2018. The disparity between the performance of the overall national market and the major local markets is driven because of this development activity. Nearly 90 percent of the new hotel rooms entering the U.S. in 2018 will be in the top 60 hotel markets.

U.S. hoteliers have overcome various obstacles in recent years to achieve a very strong run. Profit margins for U.S. hotels have grown each year since 2009, and in 2017 are forecast to be at their highest levels since 1959, CBRE noted.

You must be logged in to post a comment.