Energy Choices, Climate Change and Risk Management

Byron Carlock of PwC on how managing the risks of climate change is influenced by owners' energy choices and ESG strategies.

Byron Carlock, National Partner & Real Estate Practice Leader, PricewaterhouseCoopers. Image courtesy of PwC

As the reality of global climate change becomes clearer, real estate investors have compelling reason to analyze its potential impact on their favored markets and on their portfolios.

In an interview with Commercial Property Executive, Byron Carlock, national partner & real estate practice leader at PricewaterhouseCoopers, advised on the potential risks and effects climate change can have on the commercial real estate market. He shared insights on how real estate asset managers are rethinking investment in cities prone to rising sea levels and also expanded on why ESG policies are helping shape investment strategies.

What do commercial real estate decision-makers need to know about climate change and how can they minimize the threat to their assets and portfolios?

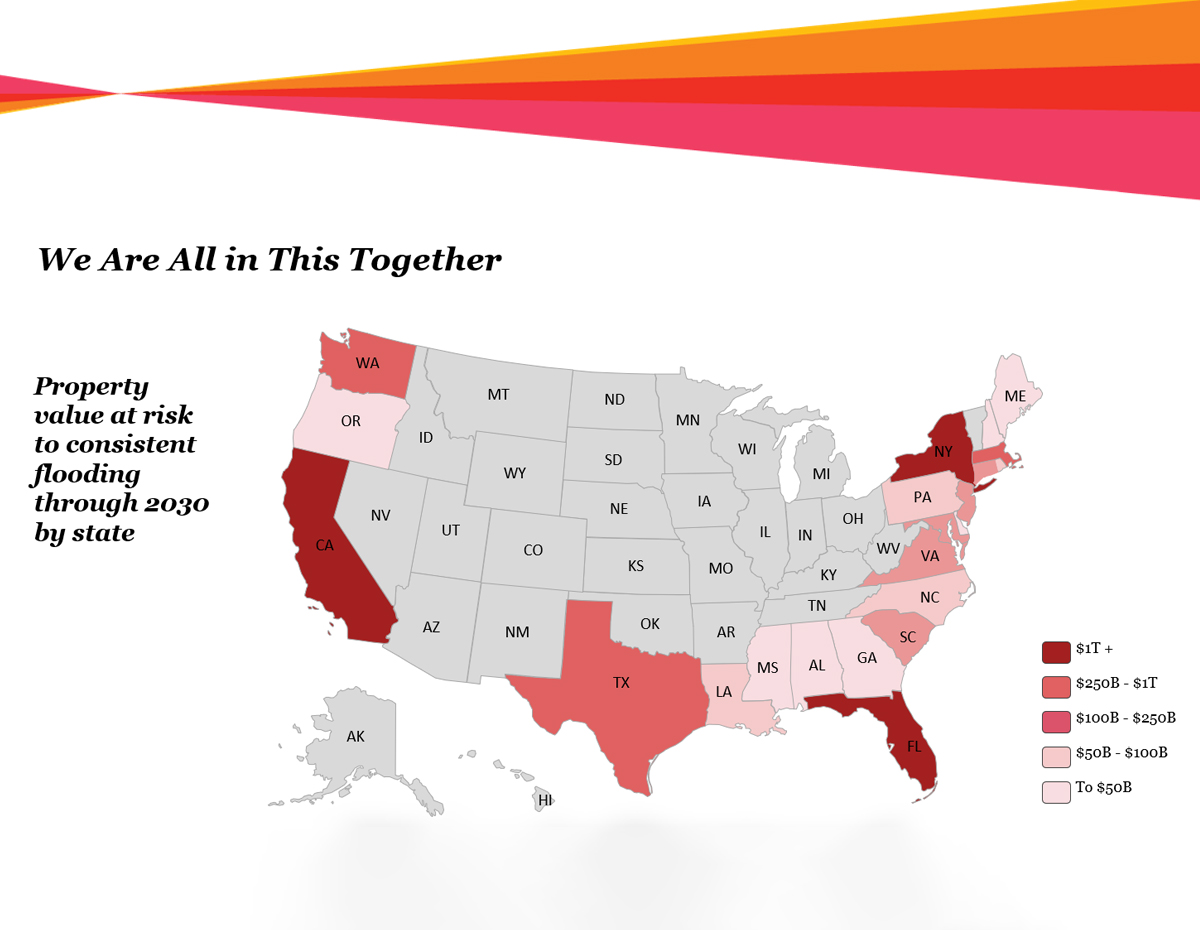

Carlock: Developer and owner responses to climate change are multi-faceted. From a portfolio management perspective, there are asset managers that are evaluating the increased cost of property and casualty insurance for coastal and hurricane-prone geographies. There is an increased awareness of rising sea levels as it relates to long-term ownership in coastal cities. The more practical response, however, relates to improving building resilience in the extent of a natural disaster, with improved structural enhancements as well as self-generating power and disaster recovery readiness.

Are asset managers rethinking their investment strategies for locations that are most prone to rising sea levels, increased storm activity and related issues? And if not, should they be revising those strategies?

Carlock: We have seen no indication of a sell-off of coastal investments. However, the presentation at the ULI fall meeting last year highlighted rising sea levels as an investment consideration that certainly increased awareness on the topic. Simultaneously to this consideration, there has been an increased investment emphasis on certain interior growing cities such as Nashville, Tenn., Dallas and Denver. Classic portfolio allocation theory would say allocations should eliminate certain risk by careful diversification. Thus, an asset manager’s desire to have coastal exposure matched with interior exposure seems to be a strategy worth pursuing.

Recent research found that overall commercial property values in areas affected by the costliest hurricanes decreased by almost 6 percent one year after the storm and by 10.5 percent two years after. What are the opportunities you’re seeing for maintaining/improving the value of the existing properties located in such areas?

Carlock: This is likely an overreaction to losses sustained that were in that geography. Classic portfolio allocation theory and enlightened asset managers would likely look at that phenomenon over a longer period.

What do you view as the most effective approaches for investors to assess the risks of climate change to their assets?

Carlock: The most opportunistic view is to evaluate new technologies for reducing grid dependency by using alternative energy and generators when needed and disaster recovery preparedness. Real estate is an important long-term durable asset that even amidst issues of climate change has an important position in everyone’s portfolio. This is an issue of adaptation, not exodus.

ESG criteria are an increasingly popular way for investors to determine their investment strategy. What are the most common behaviors investors analyze?

Carlock: The first step is to look at the E, S and G separately. The “E” in Environment is related to a reduction in the carbon footprint of each building. This is largely accomplished through recycling programs, lighting conversions, plumbing conversions and using low VOC paint and carpets. Additional investments can be made in alternative energy programs such as solar panels, trash to energy conversions and new energy systems management. We all have a responsibility to be ecologically sensitive and that sensitivity is growing. This movement began nearly 20 years ago in Europe, which now requires ESG compliance statistics to be part of property and fund financial statements.

As to the “S”—this is a growing level of importance as a business realizes its responsibility to the community and broader social context. Whether it is a company’s desire to tackle societal issues around homelessness or affordable housing through thoughtful impact investing or merely creating programs for company associates to be engaged in education mentoring and other community services, the “S” in ESG is highlighting the need for greater and broader social responsibility and the opportunity to talk about it in annual reports, popular press and statements of corporate responsibility.

The “G”—primarily relates to the importance of governance structure, board composition and governance activities that reflect diversity and inclusion across gender and ethnic profiles.

Which are the cons of ESG criteria?

Carlock: The cons historically have related to the cost of innovation and compliance. Many of those issues have been raised to table stakes in order to attract tenants and employees. Although there might be a cost of evaluating the stature of ESG in any given property or portfolio, such costs are necessary, justifiable and, frankly, accepted in this environment. Longer term, the payback can actually become economic, not unlike the analysis that a consumer of an electric car analyses.

To what extent is climate change putting pressure on the insurance industry, which is the primary means of protection against the effects of extreme weather and climate change?

Carlock: In the short term, property and casualty rates will be expensive, that is why programs such as disaster insurance are so important and continue to be relevant topics around the real estate investment community. A recent report from the Urban Land Institute and Heitman, titled Climate Risk and Real Estate Investment Decision-Making, states: “Climate change will increase weather volatility, which will reverberate through the economy. While we have a good supply of capital in insurance due to increased confidence in our modeling, long periods of price stability should not be assumed.”

How effectively is the industry engaging with policymakers on resilience in the face of climate change?

Carlock: All trade associations and legislative groups that PwC is affiliated with—ULI, NAREIT, AFIRE, RE Roundtable etc.—are sensitive to the effects of climate change as it relates to portfolio and asset management. Development and owner responses may vary by individual person or company, but the industry is keenly aware of the importance of the issue and is in varying stages of adapting.

You must be logged in to post a comment.