Energy Demand During Pandemic Times and Beyond

A new International Energy Agency report details how lockdowns have impacted energy consumption around the world and how the COVID-19 outbreak will impact the industry going forward.

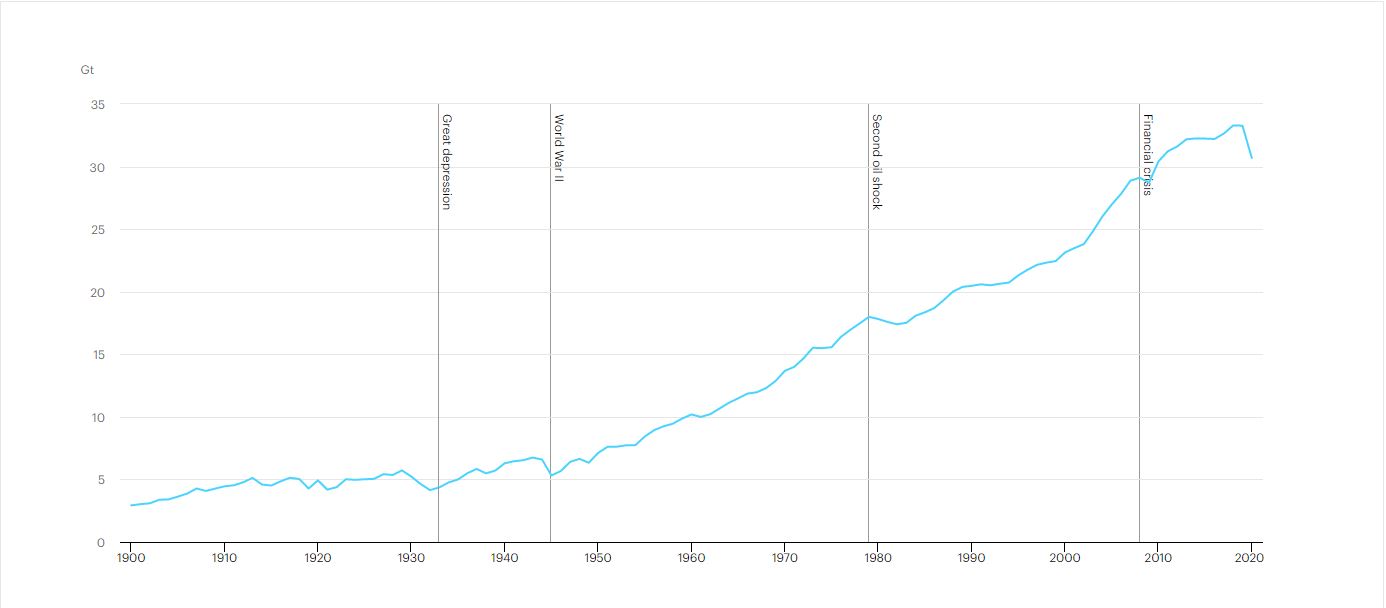

Energy-wise, the COVID-19 pandemic is anticipated to cause carbon emissions to decline this year by almost 8 percent, or 2.6 metric gigatons, reaching their lowest level since 2010, according to the International Energy Agency’s Global Energy Review study. Meanwhile, NASA’s satellites register rapidly falling nitrogen dioxide levels around the world, due to people spending more time at home and driving less during this period. The impacts of this health crisis, studied over more than 100 days by the IEA, also shows that the pandemic has halted 10 years of uninterrupted growth in energy demand.

The IEA’s analysis tracks global energy use and the corresponding carbon dioxide emissions as affected by the coronavirus pandemic, which, as of April 28, had three million confirmed cases and more than 200,000 deaths across almost 200 countries and territories. Its findings show that by the end of April some 4.5 billion people, or 54 percent of the global population—which represents about 60 percent of global GDP—were subject to partial or complete lockdown. Specifically, countries in partial lockdown registered an average 18 percent decline in energy demand per week, while those in complete lockdown have been experiencing an average 25 percent decline in energy demand.

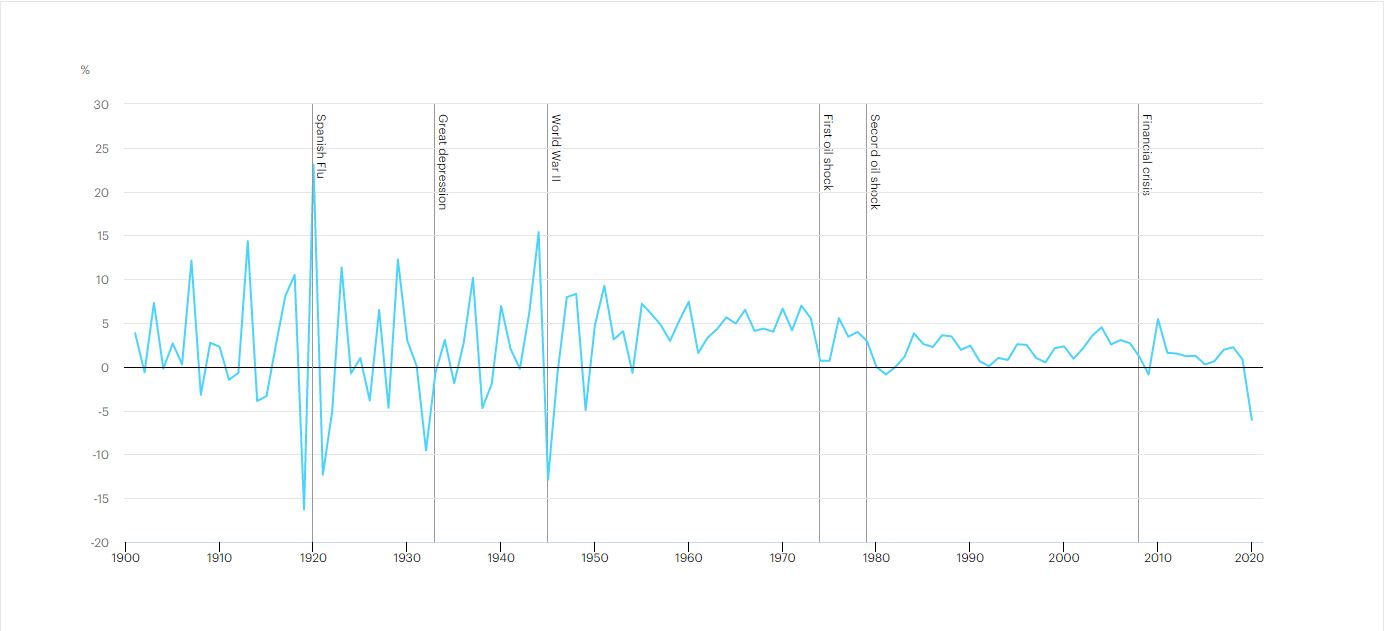

Rate of change of global primary energy demand, 1900-2020. Chart courtesy of IEA, Global Energy Review

Overall, in the first quarter of 2020, global energy demand declined by 3.8 percent; this was partly attributed to milder weather throughout most of the Northern Hemisphere. Specifically, across the U.S., energy demand fell by 6 percent compared to the first quarter of 2019. In the European Union it declined by more than 5 percent during the same period, while India’s energy demand rose by 0.3 percent, relative to the first quarter of last year. However, India moved into lockdown toward the end of March, so the impacts on energy demand here are anticipated to be notably larger in the second quarter.

Spotty evolution across energy sources

Renewable energy was the only energy segment that posted a demand increase—up 1.5 percent in the first quarter—but the segment is still poised to register lower growth rates than in previous years. The drivers here were last year’s larger installed capacity and priority dispatch, thanks to low operating costs. However, with the manufacturing sector badly hit by social distancing measures and supply-chain disruptions, growth will likely continue at a slower rate with deployment paused or delayed in several regions.

Global demand for coal and oil registered the biggest hits: Coal demand fell by nearly 8 percent year-over-year through March, while oil demand declined by almost 5 percent during the same period. Last year, China—a coal-based economy—accounted for 24 percent of global energy demand; with the most severe effects of COVID-19 hitting the country at the start of 2020, China’s stringent lockdown measures had strong macroeconomic impacts in late January, causing coal usage to collapse. This, in turn, pushed cheap gas and renewables to gain ground.

Oil was also highly impacted by the curtailment in mobility and aviation, which combined account for 57 percent of global demand. Numbers show that by the end of March, global road transport activity was almost half of 2019’s average and aviation was 60 percent lower.

Global energy-related carbon dioxide emissions, 1900-2020, Chart courtesy of IEA, Global Energy Review

Lockdowns have impacted not only transport activity but also global car sales, which have further negative implications for oil demand. In the U.S., car sales were down by 38 percent, across the EU sales fell 55 percent below 2019 levels, while March marked a 50 percent decline in India. Consequently, demand for gasoline and diesel will remain low in the foreseeable future. Moreover, the authors of the report expect gasoline demand to remain under pressure in the second part of 2020 as a result of the postponement of large events such as the Tokyo Olympics. The authors also forecast an overall 11 percent gasoline consumption decline for 2020. Diesel consumption is expected to drop by 7 percent this year.

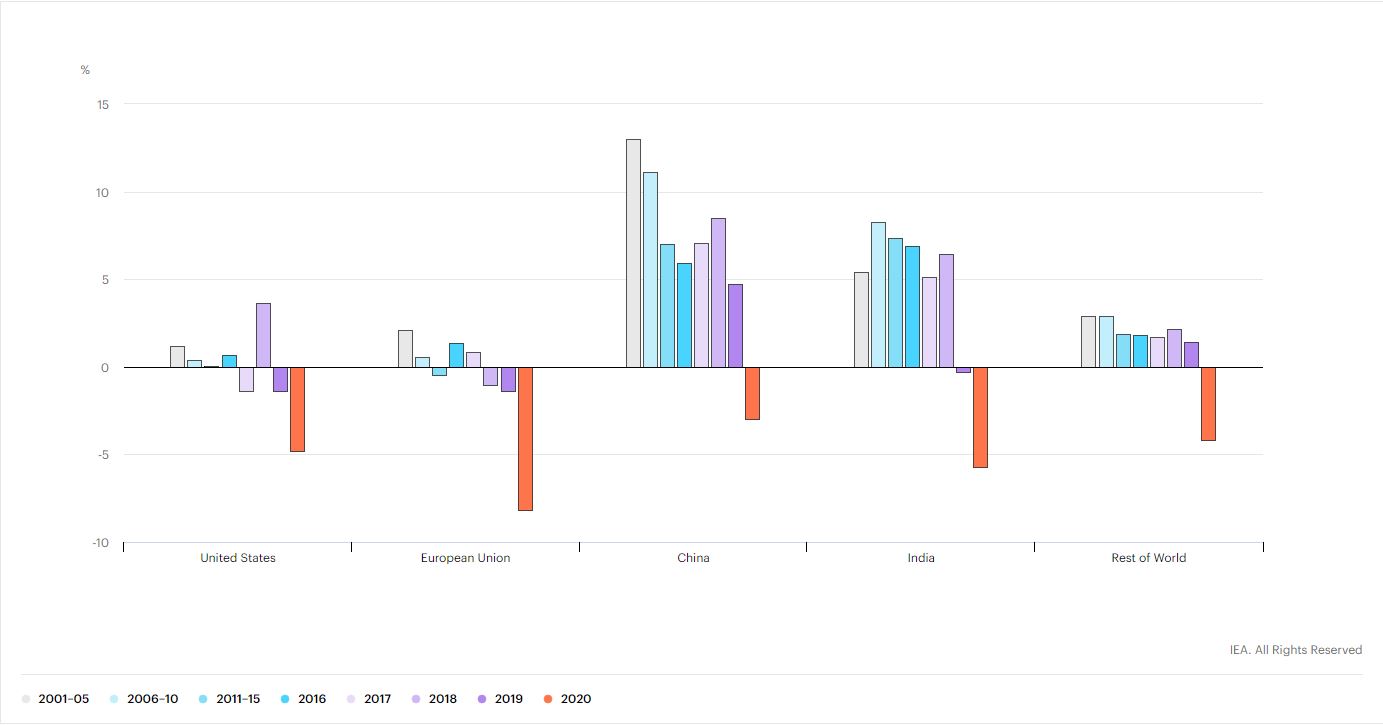

Electricity demand has also been affected—especially the power mix. Despite residential demand increasing considerably, this was far outweighed by reductions in commercial and industrial operations. Residential demand has increased in most economies as people are spending more time at home and are taking on more activities, including teleworking. The IEA report shows that in the last week of March and the first week of April, the weekly residential demand was up to 40 percent higher across certain European economies than during the same weeks last year.

However, global electricity demand decreased by 2.5 percent in 2020’s first quarter, even though at the time the lockdown measures were in place for less than a month in most countries. After adjusting for weather effects, the data showed that full lockdowns have reduced daily electricity demand by at least 15 percent in France, Italy, Spain, the U.K., India and the northwest U.S. Of course, the largest impacts have been felt in economies that implemented strict measures and those where services make up a larger part of the economy, as is the case of Italy, where electricity demand fell by more than 25 percent. Overall, the study forecasts a 5 percent decrease in global electricity demand by the end of 2020.

Annual average growth rates of electricity demand in selected regions, 2001-2020. Chart courtesy of IEA, Global Energy Review

As the report’s authors put it, for weeks, “the shape of demand resembled that of a prolonged Sunday.” The energy world is going through a shock, both on the supply and demand sides. Supply is floored through international limitations on economic activity—retail and industrial sectors have been almost completely shuttered to stop the spread of the virus. The low activity is compensated on a very small scale through e-business efforts and an increase in medical equipment production and sales.

Meanwhile, demand has been hit by consumers’ disposable income and corporate investment activity. Countries around the world are posting historically unprecedented losses in the labor market. In the U.S., initial unemployment claims by April 23 were in excess of 26 million, a number that indicates a rate of unemployment around 10 times faster than the rate following the Lehman Brothers collapse 12 years ago. The U.K. has had some 1.4 million new claims for unemployment benefits since mid-March, and early studies show that unemployment here could rise to almost 21 percent of the total workforce, which is higher than the metrics recorded during the Great Depression of the 1930s.

Another factor expected to further hit demand is the poorly synchronized revival of the Chinese manufacturing sector, which is occurring while North American and European demand for Chinese products is plummeting. This will only add to the macroeconomic challenge.

More precise estimations of the health crisis’ impacts are impossible to calculate, both on annual GDP and on energy use, as it all depends on the duration of the lockdowns. Once the global economy recovers, the indirect effects of the crisis will be determined by the shape of the recovery, which is another unknown factor.

What seems clear is that, regardless of how limited the lockdowns become, 2020 will mark the year of the deepest post-war recession, and even next year’s economic activity may fall below 2019’s levels.

By year’s end

Energy demand, the report’s authors believe, will continue to decrease throughout the year, falling 6 percent by year’s end—which is seven times the decline that followed the 2008 global financial crisis. The figure is unprecedented, and it is the equivalent of losing the entire energy demand of India, which is the world’s third-largest energy consumer. As the largest energy consumers, advanced economies are anticipated to post the largest declines—9 percent in the U.S. and 11 percent in the EU.

Obviously, the pandemic’s impact on energy demand is directly proportional to the duration and stringency of measures meant to curb the spread of the virus. As such, the IEA calculates that a month of worldwide lockdown at the levels exhibited in April will reduce the annual global monthly demand by about 1.5 percent.

On this downward trend, renewable energy demand is the only one anticipated to rise by 1 percent above 2019’s number, with renewable electricity generation likely to grow by 5 percent even with the supply chain disruptions and construction delays caused by the health crisis. However, the pace of growth will likely slow down.

Following the COVID-19 pandemic, the world will not look the same and that applies to the energy sector, as well. Low prices and low demand in all of the economy’s subsectors will weaken energy companies’ financial positions; companies with renewable projects will fare better in financial rankings. At the other end of the spectrum, private firms will be experiencing the most severe impacts.

While the pandemic will continue to affect investment, energy security will remain an essential component. Regardless of the time needed for the economy to rebound, investment in maintaining the existing levels of energy supply and reinvesting in aging infrastructure will have to continue. Electricity security has, once again, proven its vital importance, as solid, uninterrupted electricity supply is at the core of maintaining the health-care system, preservation of social welfare and stimulating economic activity in the online environment. The pandemic might also act as another reason to invest in microgrid expansion.

You must be logged in to post a comment.