ESG Rises to the Top of Investor Concerns

Environmental, social and governance issues now pervade all aspects of real estate allocations and ownership.

When commercial real estate investment managers discuss potential investments, they use a number of critical acronyms. They talk about NOI (net operating income), for example, and about ROI (return on investment), of course. And, increasingly, they emphasize ESG (environmental, social and governance).

“What’s changed is we are genuinely seeing investors making allocation decisions on the back of this, and they are selecting one manager or fund over another because of the strength of the ESG strategy.” said Abigail Dean, global head of strategic insights at Nuveen Real Estate. “Strong ESG performance of a fund is becoming a really core criteria and that definitely wasn’t the case five or six years ago.”

The growing emphasis on ESG, which Dean described as noticeable and swift, has been driven by the more socially and environmentally conscious goals of investors, tenants and managers themselves. And those goals have intensified with a global pandemic, more frequent climate disasters and a reigniting of the social justice movement.

ESG’s three main pillars are important when trying to raise capital for a fund as it has the potential to draw investment from a growing pool of capital focusing more and more on ESG.

“There’s gathering momentum from asset managers, like Norges Bank and BlackRock, that are pushing for an ESG focus among companies and funds they invest in,” said Brad Tisdahl, CEO of Tenant Risk Assessment.

Tisdahl, whose firm evaluates tenant risk for Class A office property owners, including institutional investors, says building owners are also more focused on the ESG compliance of building occupants.

Interest is growing for REIT investors, too. When 85 equity REITs participated in Nareit’s 2020 ESG survey, 95 percent of respondents by market capitalization stated investors had requested information about ESG, according to Fulya Kocak, Nareit’s senior vice president of ESG issues. Diversity and inclusion, climate change opportunities and risk topped the list of investor concerns.

25 Binney St. in Cambridge, Mass., is designed by Alexandria Real Estate Equities to be the most sustainable laboratory building in the market. Image courtesy of Alexandra Real Estate Equities

“People can see these issues causing social and economic turmoil and have become more focused on trying to do something,” said Helen Gurfel, head of sustainability and innovation for CBRE Investment Management. “Investors are asking questions of their managers, and the managers are responding with an intensified focus on ESG.”

Institutional investors often have their own staff members working on ESG, and many have carbon reduction goals they need addressed.

“They are being much more specific about what it is they want to see in the policy and asking us questions specifically about the transition to the low-carbon economy, net zero carbon, and how we’re taking account of that in our strategies,” Dean said. “They’re asking how we address physical climate risk.”

CBRE Investment Management takes “a partnership approach” to ESG. They share best practices with investors who are seeking to develop an ESG strategy, and they encourage fund managers and joint venture partners to adopt ESG best practices.

Investors want to understand how managers integrate ESG into investment strategy and company culture, said Cyndi Thomas, managing director of RCLCO Fund Advisors, rather than considering ESG as a separate strategy.

ESG is also rising to the top for real estate investors and investment managers because, throughout the business world, C-suite compensation is increasingly being tied to these targets. “At the corporate level, the focus is diversity, equity, inclusion, transparency and reporting,” Thomas said. “At the investment level, the considerations include sustainability and climate risk, as well as the overall impact of the investment on the community. ESG is no longer viewed in a vacuum but rather as part of the holistic approach to real estate investing.”

Focus on funds

Data based on 100 largest REITs by equity

market capitalization.

REIT ESG Dashboard, 2020, Nareit

As concerns about the environment and social justice intensify, ESG-dedicated funds continue to grow in force and number throughout the investment universe. But, more and more, ESG permeates all funds and strategies, managers report.

At the start of 2020, according to the Forum for Sustainable and Responsible Investment, institutional investors, money managers and community investing financial institutions reported considering ESG issues in their investment research, analysis and decision-making across $16.6 trillion in U.S. assets—a 42 percent increase from $11.6 trillion in 2018.

Alternative investment vehicles (private equity, REITs/property funds and hedge funds), meanwhile, identified $715.5 billion in ESG assets under management across 905 alternative investment vehicles at the start of 2020, up from $587.6 billion in 2018. The number of property funds/REITS identified increased to 126 from 108 in 2018, although assets in these funds declined $272 billion to $242 billion.

PGIM Real Estate’s Impact Value Partners fund has a dual mandate to create competitive returns for investors and provide positive social and environmental impacts. Lisa Davis, the fund’s executive director and portfolio manager, said the fund focuses on transformative development and affordable housing.

“For impact investing, which in some ways is one step further than ESG, we’re not only screening investments and enhancing our risk management by looking at ESG factors, we’re also seeking to proactively have a positive impact on social outcomes and the environment,” Davis said.

LaSalle Investment Management’s DTU+E investment strategy, which stands for Demographics, Urbanization, Technology + Environmental Change, has been in place for several years, said David DeVos, global head of ESG at LaSalle, and “is a factor in all of our funds.” The firm is always looking at new opportunities and investment products that enhance that focus.

Nuveen Real Estate also invests heavily in affordable housing due to investor demand, while managing climate risk and developing clear strategies to minimize those risks and impact on real estate values, Dean said.

“As stewards of our clients’ investments, we think it’s a really significant part of our role to pay attention to that,” she said. “And that’s the backdrop to setting our ‘net zero carbon by 2040’ goal.”

More reporting

25 Binney St. in Cambridge, Mass., was designed to be the most sustainable laboratory building.

Image courtesy of Alexandra Real Estate Equities

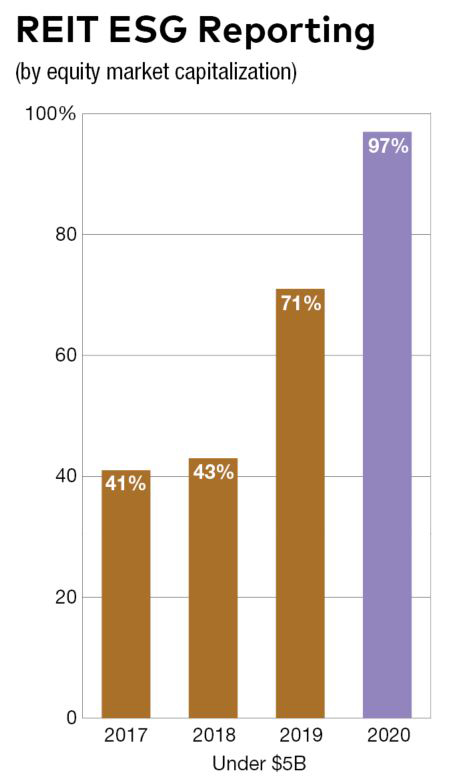

Transparency and reporting are key parts of the governance aspect of ESG. The number of REITs with an equity cap under $5 billion reporting on ESG jumped from 43 percent in 2018 to 71 percent in 2019 and 97 percent in 2020, according to Nareit’s third-annual REIT Industry ESG Report.

And it is not just public real estate entities that have increased their reporting. This year, 1,520 property companies, REITs, funds and developers with $5.7 trillion in assets under management participated in the Global Real Estate Sustainability Benchmark, which was established in 2009 to track ESG progress.

That’s up from 1,229 participants in 2020 with $4.8 trillion assets under management. The dataset covered 1,187 nonlisted funds and 326 listed property companies and REITs, up from 958 and 271, respectively, a year ago. In the United States, 300 entities participated compared to 52 in 2018.

“About two years ago, you became conspicuous by not participating in GRESB,” said Dan Winters, GRESB’s head of Americas.

CBRE Global Investors increased its GRESB submissions from 39 portfolios submitted in 2020 to 67 in 2021.

“We had more funds submitted to GRESB in 2021 than any other investment manager,” Gurfel said.

Meanwhile, LaSalle increased its GRESB reporting to encompass the majority of its AUM being represented for 2021. This year the firm submitted 14 funds, up from nine in 2020.

“That signals to the industry how seriously we’re taking this,” DeVos said.

ESG benchmarking with entities like GRESB, makes it easier for investors to compare different investment products and for managers and investors to monitor their progress.

LaSalle also made the commitment last year to align with the Urban Land Institute Greenprint Center’s goal to be net zero by 2050. LaSalle was among 11 real estate companies that publicly aligned with the goal in 2020. This year, PGIM Real Estate was among six more real estate companies that signed on to ULI Greenprint’s net zero carbon operations goal, and they are striving to reach that target sooner than 2050.

“The more we can embed and integrate the principles behind ESG and take an ESG lens to the work that we do, the more opportunity we have to both offensively improve investment performance and defensively protect it,” DeVos said.

You must be logged in to post a comment.