February Pricing Remains Stagnant

Office properties are the standout asset category, posting a 5 percent year-over-year gain, according to the latest Ten-X Office Nowcast.

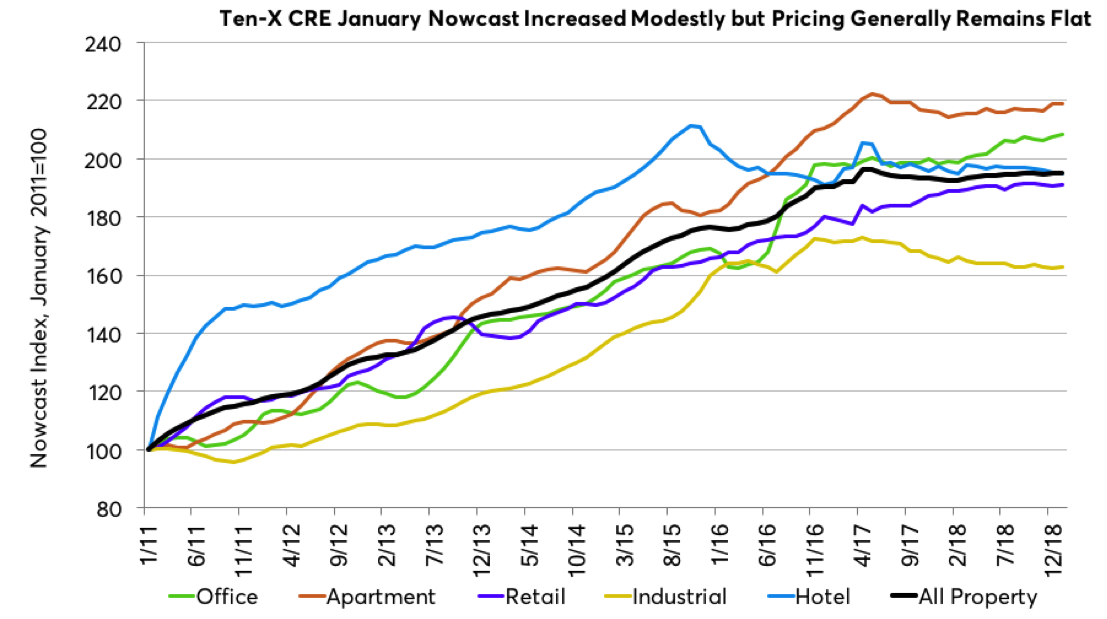

Commercial real estate prices continue to sputter along to start 2019 according to the Ten-X Commercial Nowcast. The All Property Index declined 0.1 percent in February, its third decline in the last five months, and stands just 1.2 percent higher than a year ago. The weakness in pricing has persisted despite healthy ongoing transaction volume.

The Ten-X Apartment Nowcast was the weakest property sector, as pricing declined 0.4 percent in February. This brings annual growth down to 1.3 percent, though this is still better than the year-over-year declines seen for multifamily properties throughout much of 2018. Pricing declined in every region except the West, where it eked out a 0.1 percent gain. Pricing was weakest in the Northeast, declining 0.9 percent from the month prior. Midwest pricing was also weaker, falling 0.7 percent from January.

Hotel pricing has completely stagnated, as the Ten-X Hotel Nowcast was flat from the month prior and a year ago. There was somewhat more variation regionally, with the Northeast showing a pricing increase of 0.4 percent in February from the month prior, while the Southeast and Southwest saw pricing decline 0.3 percent. Pricing remained roughly stable in the Midwest and West.

Despite a seemingly positive fundamentals story, the Ten-X Industrial Nowcast continues to weaken. The index declined 0.1 percent in February, the third decline in the last four months. Pricing is now 2 percent lower than a year ago, and has been negative on an annual basis for 17 consecutive months. While the e-commerce demand story remains intact, supply in the sector is on the rise diluting its tailwind. Additionally, trade tensions with China continue to linger despite positive rhetoric on a potential resolution in recent weeks. Regionally the performance was varied, with the Southwest and Midwest showing declines of 1.1 percent and 0.8 percent respectively. The Northeast was a bastion of strength however, with pricing increasing 0.7 percent.

Office pricing remains the strongest per the Ten-X Office Nowcast, which eked out a 0.1 percent gain in February but stands 5 percent higher than a year ago, the strongest annual growth of any segment. This is also the office sector’s fastest annual growth rate since the Fall of 2017. Pricing was very solid in the Northeast, showing growth of 1.6 percent, the only other region to see growth was the Southeast, which eked out a 0.2 percent gain. Pricing declined in the West and Southwest, falling 0.6 percent and 0.2 percent respectively.

Retail pricing continues to cool, dovetailing with the dour headlines that emanate from the sector. While the Ten-X Retail Nowcast did eke out a 0.1 percent gain in February from the month prior, annual growth remained just 1.3 percent, its lowest level in the Nowcast’s history. Retail pricing was divergent across regions, with declines of 0.7 percent and 0.5 percent in the Southwest and Northeast respectively. Pricing increased 1.1 percent in the Southeast and 0.7 percent in the Midwest.

Peter Muoio is the chief economist at Ten-X.

You must be logged in to post a comment.