Fed Cuts Interest Rates Again

The widely expected step comes as the headline inflation rate nears the central bank's target.

The Federal Open Markets Committee cut interest rates by 25 basis points on Thursday, half the rate of the previous cut in September. The current target range is 4.5 to 4.75 percent, a federal funds rate last seen in February 2023.

The widely expected move comes as the headline inflation rate stands at 2.1 percent, just 10 basis points above the Fed’s 2 percent target. A softening jobs market contributed further to the decision, with the unemployment rate of 4.1 percent staying level, while recent hurricanes slowed hiring in October.

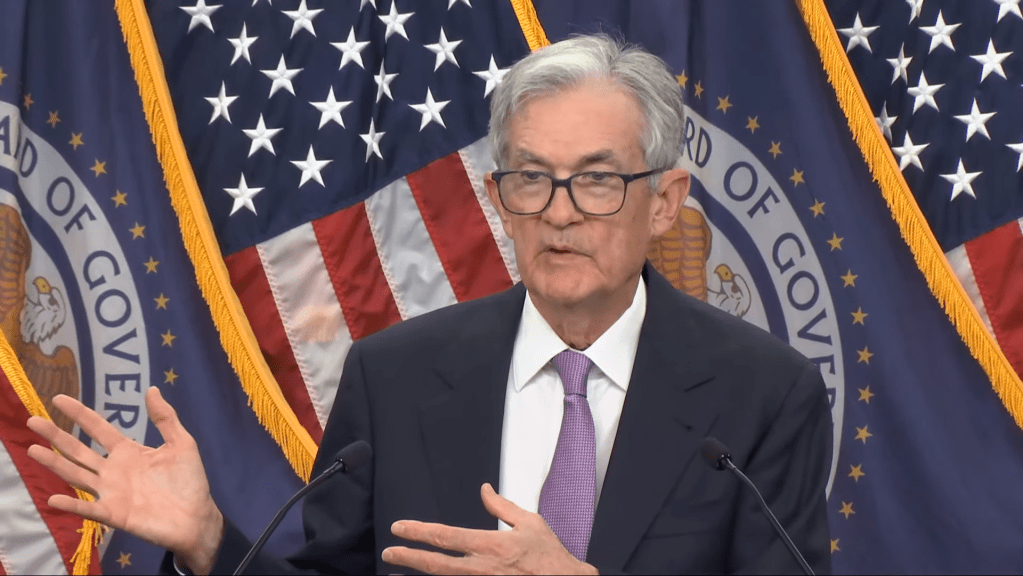

Acknowledging this during a press conference on Thursday, Fed Chair Jerome Powell said that the central bank is prepared to take a more neutral approach. “We know that reducing policy restraint too quickly could hinder progress on inflation,” he said. “At the same time, reducing restraint too slowly could unduly weaken economic activity and employment.”

Following the move, the Fed is widely expected to cut interest rates by another 25 basis points in December.

End of uncertainty, or the beginning of more?

What happens in 2025 is less certain. The election of Donald Trump to the presidency could potentially drive back up inflation, as the president-elect’s proposed tariffs up to 20 percent on imports could potentially increase costs of both consumer goods and labor. But Powell was quick to assuage concerns on the election’s impacts on near-term monetary policy, stating that it is too early to make decisions based on what the incoming Trump administration may do. “In the near term, the election will have no effects on our policy decisions,” he said.

READ ALSO: Capital Ideas: What to Watch for in the Trump Presidency

Other see the future a little differently. “Looking ahead to 2025, the potential for further rate cuts could narrow as President-elect Trump’s growth-focused policies place upward pressure on interest rates, potentially countering the Fed’s easing path,” said Greg Friedman, managing principal & CEO of Peachtree Group. “These inflation-driven policies will likely keep the U.S. in a higher interest rate environment for the next several years.”

But this news is hardly a shock for most CRE stakeholders. At the moment, investors are seeing select opportunities in the CMBS and secondaries markets, as well as through publicly traded companies.

That said, all indicators point to a warmer climate for commercial real estate in the medium term, particularly as investors will be better able to afford previously high costs of capital.

“With consumers feeling a bit more upbeat and public markets reaching record highs, the combination of strong economic fundamentals and declining interest rates could create an ideal backdrop for CRE investments over the medium term,” said Ryan Severino, chief economist & head of U.S research at BGO. “Certainly risks remain, but thus far they seem surmountable by the economy’s momentum.”

You must be logged in to post a comment.