Bears Dominate but Bulls’ Numbers Grow in DLA Piper Survey

Highlights of the law firm's annual report reveal the most attractive asset classes and favored locations.

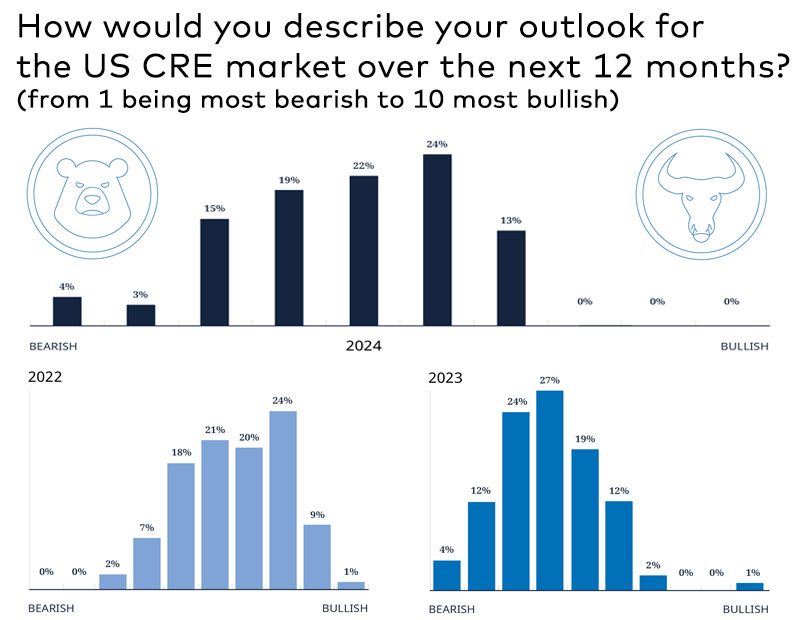

Caution may still be the watchword in commercial real estate, but a sense of optimism appears to be growing. At least, that’s according to DLA Piper’s 2024 Real Estate State of the Market Survey, where more than one third of CRE leaders surveyed—37 percent—responded that they are bullish about the sector over the year ahead.

While 63 percent of leaders are still bearish, that’s a notable change from the 2023 DLA Piper mid-year outlook, in which 86 percent of survey respondents reported a bearish market view. The study, which has been conducted since 2009 and surveys CRE leadership on their views about the next 12 months, showed a resilience and optimism in the industry.

“I think that this is actually quite significant,” John Sullivan, chair of the U.S. real estate practice & co-chair of the global real estate sector at DLA Piper, told Commercial Property Executive. “What it shows is that, although there’s still a lot of concern and uncertainty in the market, the skies are starting to clear and people are getting more confident that we’re at, or at least near, a place in the cycle where it’s going to make sense to start reinvesting.”

Why is leadership sentiment trending upwards? Mostly interest rates.

Interest rates and external drivers remain key

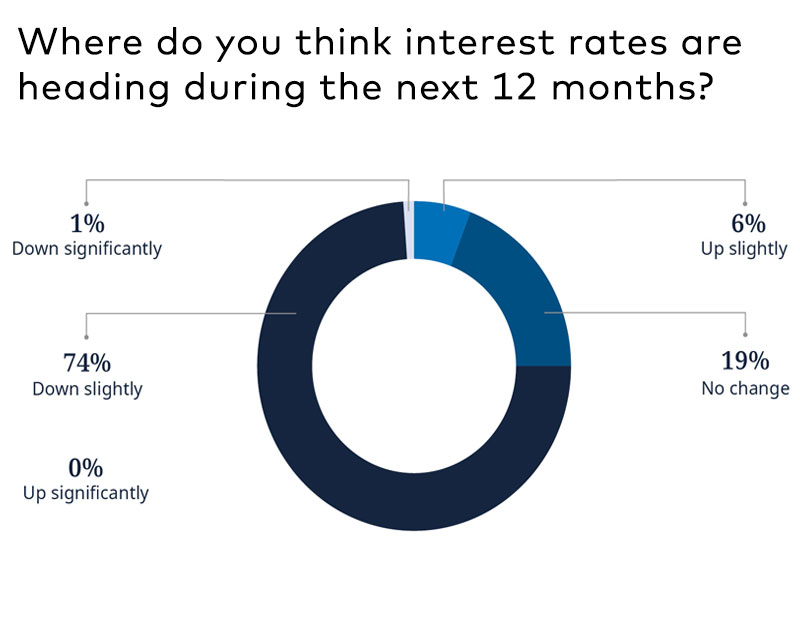

Last year’s State of the Market Survey revealed that a more negative or cautious leadership outlook stemmed largely from economic headwinds. Interest rates were named in 46 percent of responses last year and are again a key driver of CRE sentiment.

But how interest rates are influencing investors has altered. Of those who were bullish in this year’s survey, 28 percent indicated that the stabilization of interest rates is the top reason for their optimism. Another 20 percent cited the potential for lower interest rates.

Yet interest rates also figure prominently in the thinking of more bearish leaders. Thirty-one percent cited the issue as the number-one reason for their caution. To put these responses in perspective, it’s important to note that the survey was conducted in February and March, when the consensus was still that the Federal Reserve would cut rates several times this year. The Federal Open Market Committee’s decision last week to leave rates unchanged makes decreases less likely this year.

But even considering the altered expectations on interest rates, Sullivan doesn’t think that responses today would vary much from those in February and March. While rates may stay put longer, the general sentiment that stability and lower rates are ahead in the near term is still common among investors. Instead of focusing on specific months when rate cuts might happen, investors are training their sights on the larger picture.

“It’s more about the trend over the next six, 12 to 18 months, and I think that the feeling is still that the interest rate trend is more likely going to be down instead of up,” Sullivan noted.

Beyond interest rates, inflation continues to loom large; 74 percent of survey participants expect rising prices to have an impact on CRE throughout the next year. Similarly, 73 percent responded that the upcoming U.S. election will be impactful. And up 8 percent from last year, 59 percent of leaders indicated that geopolitical conflicts will impact CRE.

Which assets pose opportunity

In alignment with the uptick in positive sentiment, survey respondents mostly anticipated transaction volume in CRE to increase this year. While this won’t be without some headwinds, such as the $1 trillion in CRE debt coming due by year’s end, industry leaders are finding opportunity.

In a lemons-to-lemonade trend, respondents indicated that investment opportunities surrounding distressed assets are among the top five reasons for optimism this year.

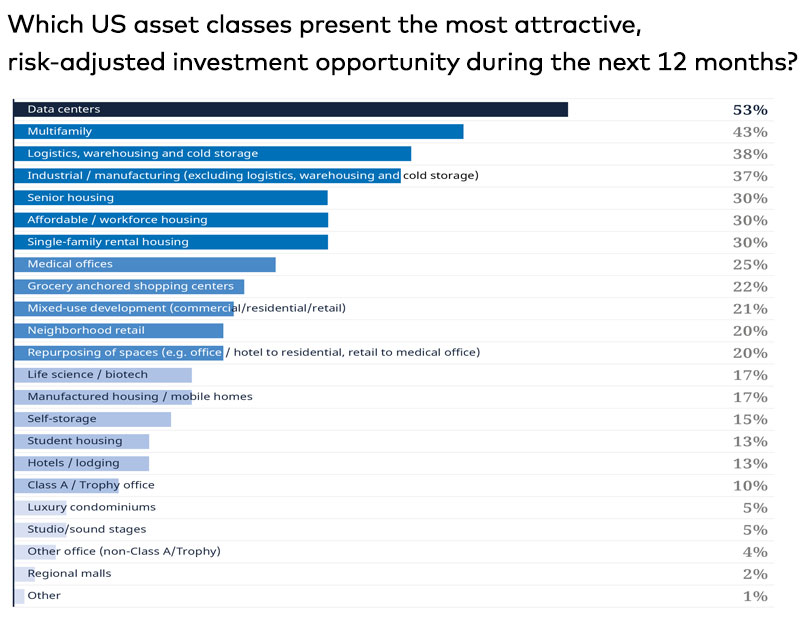

Regarding property categories, the survey identified several that are rising in popularity. Leading the pack, data centers were named by 53 percent of survey respondents as the most attractive assets, up 21 percent from 2023. “Across the industry, analysts and investors are very bullish about the prospects of data centers,” Sullivan said.

Multifamily followed with 43 percent. Logistics, warehousing and cold storage came in at 38 percent, marking a 15 percent drop since 2023.

READ ALSO: How CRE Deals Are Changing: DLA Piper

For all its much-discussed challenges, the office sector also inspired some positive notes. Sullivan believes that the source of optimism is twofold. First, there are the signs that in-person office work is increasing. And second, prices are adjusting to the point where new investment in the sector makes sense.

Similar to the 2023 State of the Market Survey, most leaders (59 percent) anticipate that in one year, roughly 50 percent of workers in urban areas will be back in the office consistently. Almost half of respondents, 47 percent, answered that office building vacancy will never return to pre-pandemic levels. Yet 37 percent of leaders were more optimistic and predict that vacancy will return to former rates more than three years from now.

According to the survey, repurposing space, including offices, is an attractive investment opportunity for 20 percent of respondents. And the redesign or rethinking of office spaces will continue to be impactful this year, 64 percent believed.

Where investors want to be

Industry leaders are still looking to gateway cities for opportunity, but the favored choices have evolved somewhat. While markets that were popular last year, such as Miami, Nashville, Austin and Dallas-Fort Worth, still present attractive investments, overall sentiment for these areas either remained the same or decreased compared to 2023 results.

Conversely, sentiment for major tier-one cities is on the upswing. When compared to 2023, optimism is up 5 percent for New York City, 12 percent for Chicago, 9 percent for Los Angeles by 9 percent and 8 percent for San Francisco.

Part of the reason Sullivan attributes the increased investor interest in gateway markets is pricing. With the higher cost of debt and general market volatility, investors are looking for better-priced assets.

“The places where owners have been most willing to recognize significant decreases in value have been in some of those gateway cities,” he noted.

You must be logged in to post a comment.