Fitch: More U.S. Lodging Consolidation Is Expected

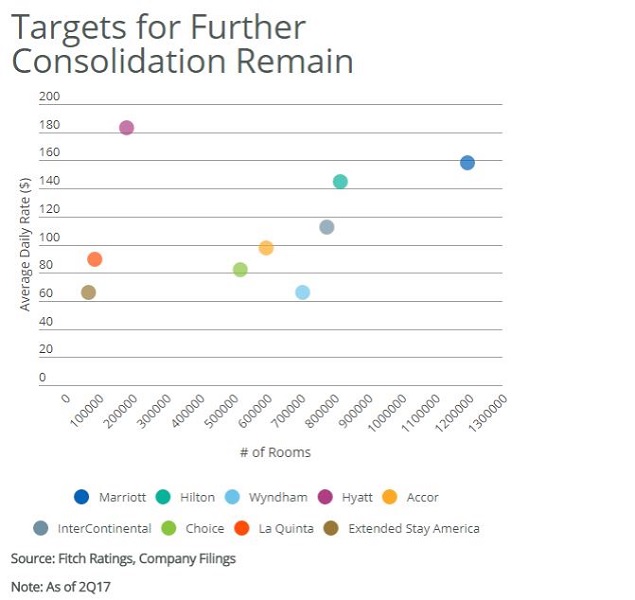

The growing power of industry leaders will drive more lodging consolidation, with Hyatt and La Quinta as desirable targets, per the rating agency’s most recent report on hospitality. Such growth strategies are also a way to balance the competitive environment disrupted by alternative accommodation operators.

By Alexandra Pacurar

Fitch Ratings’ most recent report on the hospitality industry, U.S. Lodging: What Investors Want to Know, touches a hot button in this real estate sector: consolidation. After the successful $13 billion Marriott-Starwood merger, smaller industry operators have been trying to cope with the competition from the new hospitality giant and the growing popularity of alternative accommodation companies such as Airbnb. Fitch Senior Director Stephen Boyd believes that second-tier operators, pushed by a need for scale, should focus on the luxury segment when it comes to growth in order to stay competitive. Boyd analyzed the report’s findings in an interview for Commercial Property Executive.

CPE: Why do you think there is such a need for scale in the hospitality industry?

Stephen Boyd: Having a large stable of hotels across the globe at a wide range of price points improves the value of customer reward programs, resulting in greater customer loyalty. Scale also provides purchasing and distribution cost advantages: lower negotiated online travel agency (OTA) commission rates are a great example. Hotel owners understandably favor brands that can generate strong customer demand at reasonable, all-in franchise and management costs.

CPE: Why are second-tier operators focusing on greater exposure to the luxury and upper upscale segments?

Boyd: I’m not sure that all are, but they arguably should if they want to achieve competitive positions that are similar to the industry’s leading performers—Marriott and Hilton. The smaller brand owner operators generally lack diversification in key areas across the price spectrum (i.e. economy to luxury hotels). Why does this matter? Many business travelers earn rewards during stays at lower-cost, limited service brands that they plan to use for personal travel. The Marriott/Starwood combination boosted the number of luxury resort destinations where the corporate transient-oriented Marriott rewards members could cash in their chits, which is one of several benefits from the combination.

CPE: Are consolidation efforts a way of coping with competition from alternative accommodation providers such as Airbnb, which are gaining traction?

Boyd: To some extent, yes. Alternative lodging accommodation providers, such as Airbnb, have unsettled the competitive landscape. There is a school of thought that, while nobody is exactly sure what the future holds, bigger is likely better, providing more flexibility and leverage to deal with the changes that may come.

CPE: What are the risks for smaller hospitality operators that are pursuing consolidation?

Boyd: First, the deals need to be capitalized in a manner that preserves adequate balance sheet flexibility to navigate the cyclical hotel industry. Also, companies that merge must successfully overcome any number of integration challenges, such as combining reservation and rewards systems, as well as technology and reporting and accounting platforms, to name a few.

CPE: How do you see consolidation efforts in the hospitality industry going forward?

Boyd: I expect the second-tier operators (by size) to acquire smaller players that enhance the size of their global rooms system and strengthen existing brands or provide entry into new price-tier segments.

Image courtesy of Fitch Ratings

You must be logged in to post a comment.