Fixed vs. Floating: Let the Math Decide

As interest rates continue to rise, it’s important to take an analytical look at your cost of capital, observes Brandon Smith, vice president of CBRE's Multifamily Debt and Structured Finance group.

By Brandon Smith

As borrowing costs continue to rise and the likelihood remains that the Federal Reserve will raise interest rates another two or three times this year, real estate owners should take another look at the cost of fixed-rate loans as compared to floating rate loans. Additionally, LIBOR, the index that all floating rate loans are based on, is set to expire and be replaced by a yet-to-be tested index called SOFR. To limit volatility, many owners are focusing on fixed-rate executions.

As borrowing costs continue to rise and the likelihood remains that the Federal Reserve will raise interest rates another two or three times this year, real estate owners should take another look at the cost of fixed-rate loans as compared to floating rate loans. Additionally, LIBOR, the index that all floating rate loans are based on, is set to expire and be replaced by a yet-to-be tested index called SOFR. To limit volatility, many owners are focusing on fixed-rate executions.

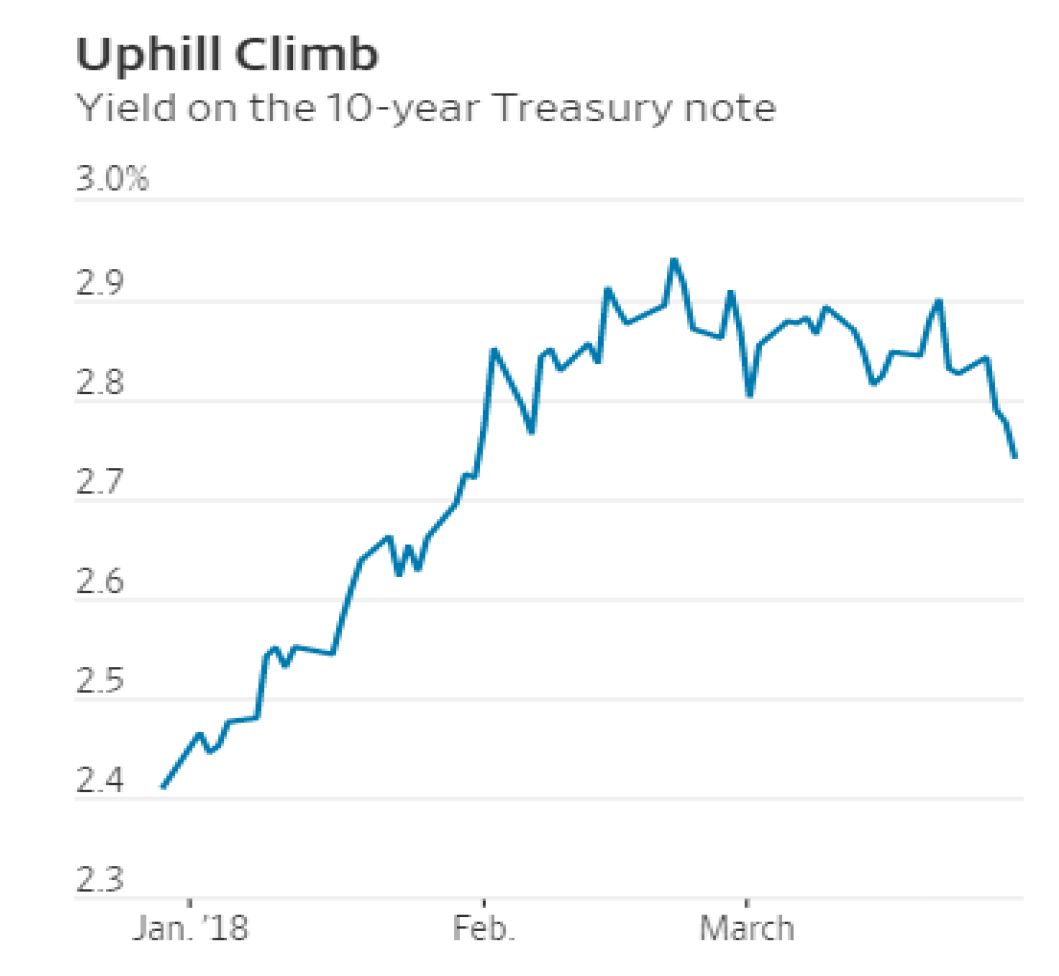

Long-Term Yields Drop

The 10-year U.S. Treasury has dropped to 2.74 percent and the two-year U.S. Treasury is currently sitting at 2.26 percent. The spread between the two (yield curve) is at its lowest level since September 2007; this compression tends to signal a weakening of the economy. LIBOR has also hit 1.89 percent and has climbed for 37 consecutive days, the longest such streak since 2005.

The rising supply of short-term debt being sold to cover increasing deficits and the Fed interest rate increases are both pushing up the two-year U.S. Treasury yield in relation to the 10-year U.S. Treasury. Investors see the yield curve as a measure of economic health, with more positively sloped curves signaling a better growth outlook.

The 10-year U.S. Treasury surged this year on expectations of higher inflation, driven by potential business investment and increases in worker wages because of the tax cuts. Data showed wages and consumer prices rose in January, encouraging more investors to sell government bonds and drive down yields. However, yields stalled in March, as January wage data was revised lower and weaker-than-expected and inflation data put a damper on the rosy expectations. The 10-year U.S. Treasury reached a four-year peak at 2.94 percent on Feb. 21, and has since fallen to 2.74 percent.

The March job report will be released Friday and the consensus forecast is a gain of 195,000 jobs. Last month was very strong with 287,000 jobs gained. The unemployment rate is expected to land at 4.0 percent, but a potential 3-handle on that number, along with strong average hourly earnings, could move rates up again.

SO… FIXED OR FLOATING RATE?

With a rising LIBOR and a flattening yield curve, clients are asking if they should go fixed or floating with new loans. The clients that float generally make that decision based on their short-term business plan—meaning they want ultimate flexibility to pay off the loan. However, depending on the LIBOR rate, the forward LIBOR curve and floating spread pricing, they are starting to consider fixed-rate options that provide prepayment flexibility, for economic reasons.

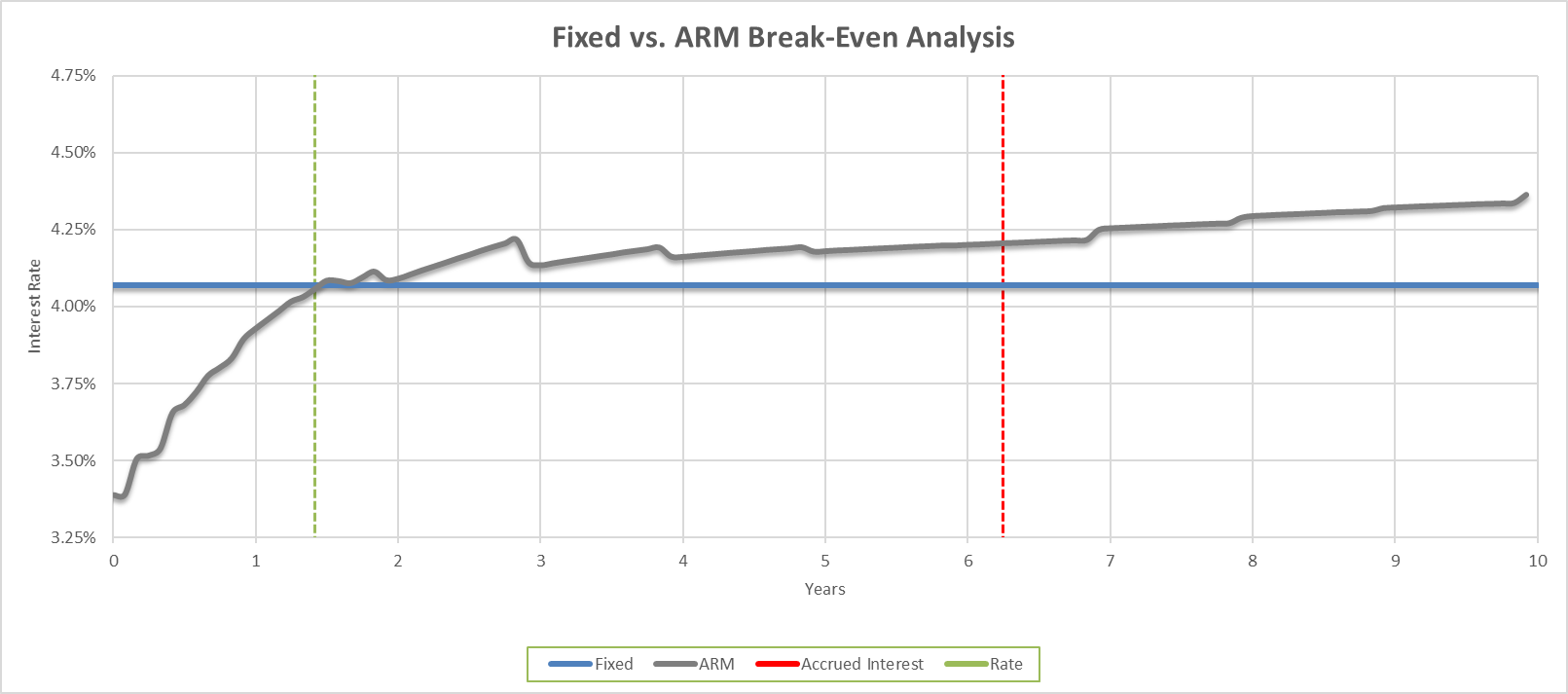

For a quick comparison, assume you had a 5 percent cap rate multifamily deal with 70 percent loan-to-value loan quotes. For a strong sponsor, the floating rate execution would price at about 145 over LIBOR for a start rate of about 3.33 percent. The seven-year, fixed-rate option, with the last two years open for prepayment, would price at about 140 over the seven-year U.S. Treasury for a rate of about 4.07 percent.

Based on the forward LIBOR curve released April 2, your pay rate for both options would be equal by month 17, and it would take you 6.3 years total to breakeven on accrued interest payments. Obviously for the short-term holders, the floating-rate execution is a no-brainer.

However, if your floating-rate spread was 20 basis points higher, it would only take 25 months to break even, making the fixed-rate option the better economic decision. That of course assumes you don’t mind waiting five years to sell.

As interest rates continue to increase, it’s important to take an analytical look at your cost of capital—the upfront math could save you significantly over the loan term.

You must be logged in to post a comment.