Flex Office Sector Proves Resilient: CBRE

Despite the pandemic and subsequent recession, occupiers will seek more agile workspaces for their employees once they return to offices, a new report finds.

Fears that the COVID-19 crisis might cripple the flex office sector appear to be unfounded, according to a new CBRE report that states flexible space will ultimately become an integral part of office buildings and a sought-after solution once the pandemic ends.

READ ALSO: Designing for a More Effective Office Space

CBRE’s annual flex office report outlines how the sector, which had been surging prior to the pandemic, held its own during the resulting recession and rise in work-from-home employment. No less than 86 percent of occupiers surveyed by CBRE in September said flexible office space would play some role in their long-term commercial real estate strategies, compared to 73 percent in June.

Occupiers reporting it would play a significant role in their strategies rose to 36 percent in September from 23 percent in June. The Top 5 reasons cited for planning to use a flexible office space were: provide a network of locations for more mobile workforce access (45.5 percent); enter a new market/s (43.9 percent); short-term space solution for temporary dispersed workforce (42.4 percent); reduce capital expenditure (40.9 percent) and test alternate workspace or occupancy models (37.9 percent).

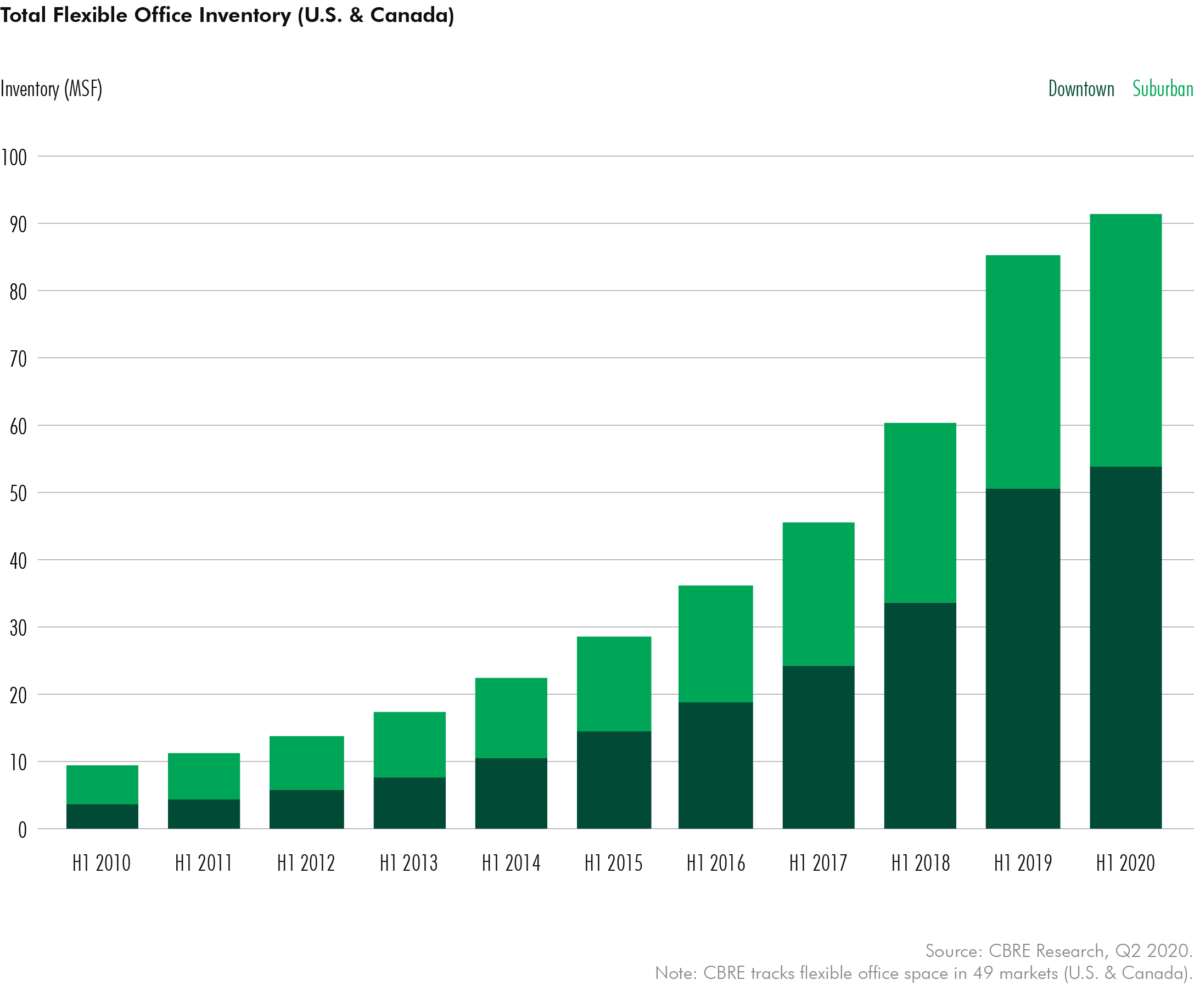

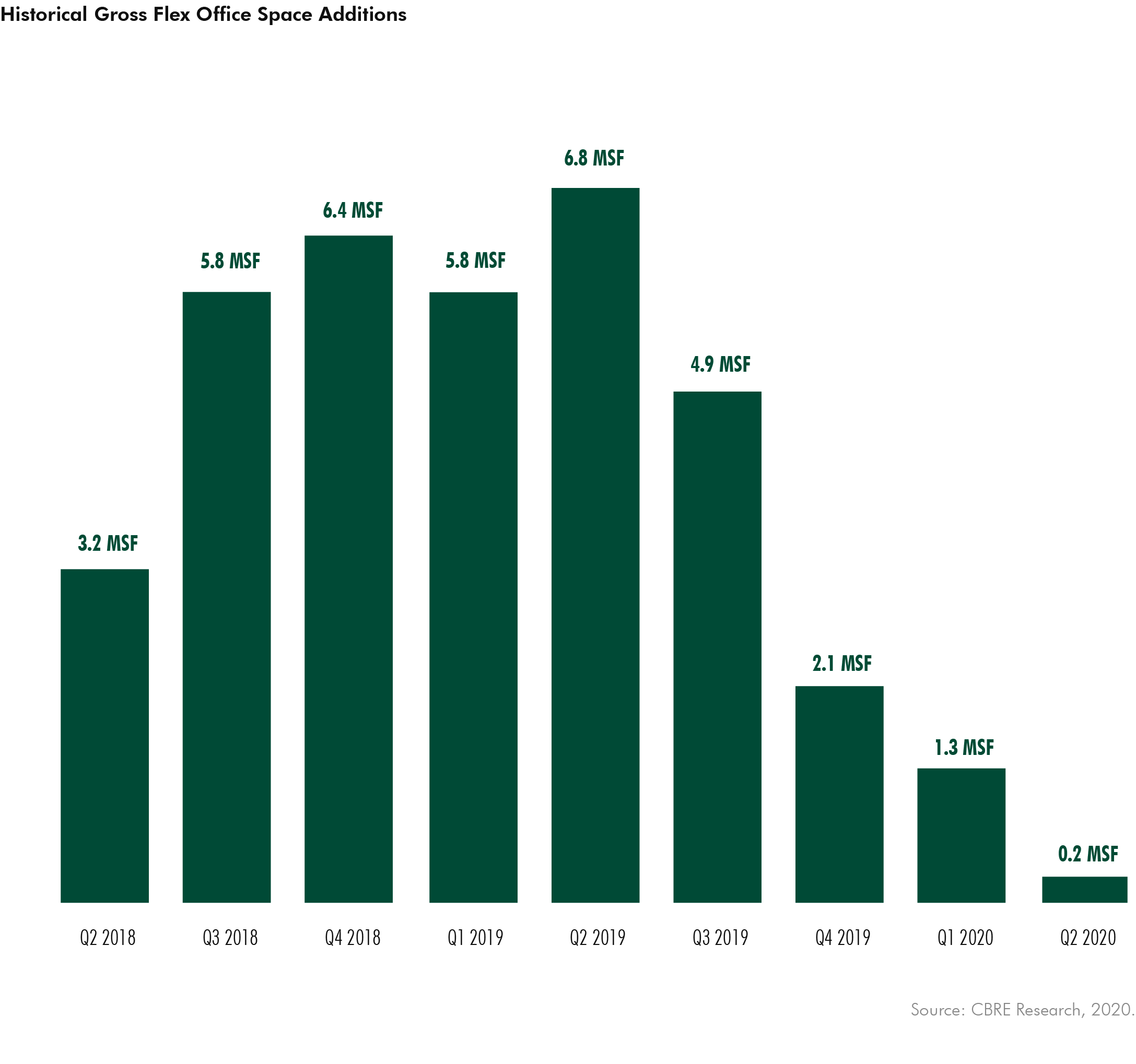

The report also found that even though the sector’s annual growth in square footage slowed to 7 percent in the second quarter of 2020 compared to 41 percent in the prior year, closures were lower than anticipated. In addition to the growing number of companies that planned to use flex space as a key part of their real estate strategies going forward, the survey of 77 major companies across the globe also found 82 percent said they will favor buildings that use flex-space offerings.

CBRE defines flex office space as multiple formats of office space leased for shorter-than-traditional terms. It includes coworking as well as faster-growing models such as private suites and enterprise offerings, which dedicate offices or entire floors for use by individual companies.

CBRE found landlords and providers are working together more this year, and partnerships are increasingly moving toward partnership agreements and away from traditional lease structures. Flexible office providers are also evolving their business models to meet current and future demand and interest is growing in subscription-based models that support a more distributed network of people and suite offerings.

The recession and pandemic also encouraged flex operators and their landlords to work together, sometimes by revising lease terms. Some operators are fine-tuning their portfolios as supply growth has slowed. That may help avoid a glut of unused space.

Building owners are also increasingly offering their own options, including prebuilt suites that are run by flexible office providers on the landlord’s behalf or partnering with the operator and sharing profits and losses. Julie Whelan, CBRE global head of occupier research, said in a prepared statement this growing trend has created a more stable foundation for the sector’s continued growth. She added that flex office space is becoming a strong alternative to traditional leases for many companies, particularly as they seek more agility in accommodating changing values among their workers.

Christelle Bron, CBRE Americas Agile Practice leader, said in prepared remarks there are enough different models and formats to fit the needs of most users. She noted the biggest driver of the sector’s growth going forward will be larger, enterprise users.

Calling the sector resilient, CBRE said the flex office space will provide companies a “nimble tool for expansion” as they return to growth mode. Companies will be adopting a “core + flex” model after the pandemic as they seek to bring back employees while avoiding large capital commitments. They may also mix conventional and flex leases within the same building. Hybrid models will become more common as companies move to include various options including hub-and-spoke, on-demand coworking and project offices.

Other changes are being seen in the growth of new markets for flex space. While Manhattan and other coastal markets had previously been the leaders for the flex office sector, CBRE said the fastest-growing markets now include many Midwestern and Southern cities such as Detroit; Tampa, Fla.; Kansas City, Mo.; Dallas-Fort Worth and Nashville, Tenn. Other cities in the Top 10 for flex office growth this year are Northern Virginia; Houston; Orlando, Fla.; San Francisco and Phoenix.

While WeWork closed the most offices in the first half of 2020—456,820 square feet compared to IWG’s closure of 119,926 square feet—it’s still the top flex office provider at 31 percent. IWG follows at 22 percent; remaining Top 10 providers have 15 percent of the supply. Other than WeWork and IWG, the remaining Top 10 providers are: Knotel, Industrious, Novel Coworking, Convene, Premier Workspaces, Boxer Workstyle, VariSpace and Serendipity Labs.

CBRE also notes coworking and shared-office concepts are becoming more common in other asset types including industrial, labs, studios and retail. New players in that part of the flex space world include Saltbox, Peerspace and Ghost Kitchens.

Read the full report by CBRE.

You must be logged in to post a comment.