Foreign Investment Update: Where Capital Will Travel in 2021

Singapore and South Korea boosted their year-over-year investments in U.S. real estate by 48 percent in 2020 and are expected to remain active this year.

Foreign investment in U.S. commercial real estate declined 31 percent in 2020—a seven-year low—to $28 billion, as COVID-19 restrictions impacted cross-border capital flows across the globe. Worldwide, cross-border investment dropped 19 percent to $217 billion, according to CBRE.

READ ALSO: Global CRE Industry Optimistic About the Future: SIOR

The decline in U.S. inbound investments is likely even deeper, noted Richard Kleinman, head of U.S. research and strategy & Co-CIO Americas at LaSalle Investment Management, who said data on cross-border activity in the U.S. can often miss the amount of investments that flow through funds.

“Many foreign investors don’t buy direct properties that Real Capital Analytics and others are able to pick up. Rather they’re going into co-mingled funds whether they are open-ended or closed-ended funds and investing that way alongside domestic investors,” Kleinman said. “We did see a slowdown in that similar to the direct transaction market.”

That may not be surprising because JLL noted in a February global real estate report the “fundraising environment was still challenging, with closed-end fundraising in 2020 declining 35 percent year-over-year.”

But JLL also reported the average fund size had reached an all-time high and that despite market volatility, commercial real estate allocations were generally stable or growing, with logistics and multifamily sectors showing the most strength, while there was a moderate recovery in the office sector, as investor interest expanded in global gateway markets.

A new CBRE report on U.S. inbound investment trends for the second half of 2020 found EMEA-based investors accounted for the biggest decline in foreign investments—63 percent of the total volume decline. Canada retained its position as the top cross-border investor in U.S. commercial real estate, with $10.5 billion in investments, or 36.6 percent of total 2020 investments.

“Canadian capital is always pretty dominant in U.S. markets. They know the U.S. market well,” said Richard Barkham, CBRE global chief economist & head of Americas research, noting the geographic closeness and Canada’s well-funded pensions that are major institutional investors.

Both Barkham and Kleinman highlighted the growth of Singapore and South Korea investors in 2020. Capital inflows from Singapore and South Korea increased by 48 percent over 2019, Barkham said. South Korea was the second-highest cross-border investor in the U.S. in 2020, with $3.4 billion in investments, representing 11.7 percent of the total cross-border investments in 2020. Singapore placed fourth with $2.5 billion invested, or 8.8 percent of the overall total. Germany, with $3.2 billion in investments and the U.K. with $1.5 billion, rounded out the top five sources of inbound capital in the U.S., according to CBRE.

Lower currency hedging costs caused by low short-term interest rates in the U.S. and depreciation of the U.S. dollar likely played a role in the increased activity by Singapore, South Korea and other foreign investors, including the U.K.

“Often the cost of a hedge is dependent on the difference between the short-term interest in the U.S. versus whatever country their currency is in. So pre-pandemic short-term interest rates in markets like Japan and in Europe were close to zero. U.S. short-term interest rates were climbing above 1 percent. With the onset of the pandemic, the Fed cut short-term interest rates close to zero and so there’s less cost with those hedges now,” Kleinman said.

Barkham said he expects investments from South Korea and Singapore to continue to grow. Last week, Singapore-based Mapletree Investments acquired Uptown Station, a 397,000-square-foot Class A creative office and retail building in Oakland, Calif., reportedly for more than $400 million. In December, the National Pension Service of Korea formed a joint venture with Stockbridge to acquire core logistics properties across the U.S. and purchased a 23-asset, 14.3 million-square-foot Class A logistics portfolio as its first transaction.

London-based Knight Frank does expect Singapore to be a major player in global cross-border activity in 2021 along with the U.S., Germany and the U.K. Knight Frank expects COVID-19 will continue to impact real estate investment and mobility and so predicts cross-border flows will happen more frequently in 2021 between “near-neighbors” and to safe-haven locations led by Canada to the U.S. and from the U.S. to the U.K.

In its “Where Will Capital Flow in 2021?” report, Knight Frank projects cross-border investments from Canada to the U.S. will reach $13.3 billion this year, the largest amount of foreign investment in its Top 10 list. The firm lists Germany in the sixth position with a prediction of $4.2 billion in investments into the U.S. in 2021 and South Korea in ninth position with about $3 billion projected to be invested in the U.S. this year. Overall, Knight Frank expects the U.S. to receive the most amount of cross-border capital investments in 2021 followed by the U.K., Germany, Australia, France, Japan, Netherlands, Mainland China, Canada and Finland.

Logistics leads

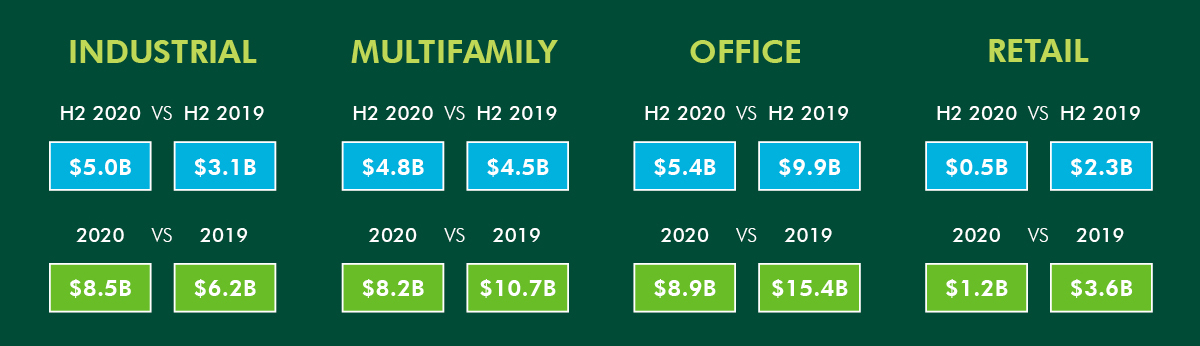

Foreign investments in U.S. industrial and logistics properties rose 36 percent between 2019 and 2020, reaching $8.5 billion last year, according to CBRE.

“One of the key findings was how strong industrial fundamentals were. Some of the areas that foreign capital targeted in the U.S. (for industrial acquisitions) were Atlanta, Indianapolis and the Inland Empire,” Barkham said.

Barkham noted overseas investors are also very interested in U.S. multifamily, which saw transactions in markets like San Diego and Sacramento, Calif.

While logistics is the most-active space for investments currently, Kleinman said foreign investors are also beginning to focus on niche property types including medical office, life sciences, self storage and data centers.

“Often cross-border investors may not be as familiar with those but we have seen activity from them in those sectors in 2020,” Kleinman said. “They are working side by side with domestic institutions to better understand these property types that may be more prevalent in the U.S. market than their home markets and getting comfortable with them as part of diversified real estate portfolios.”

Read the full report by CBRE.

You must be logged in to post a comment.