Bernanke Weighs In on CRE Outlook During Marcus & Millichap Panel

The former Fed chair shares insights on GSE privatization, the pandemic’s long-term impact on commercial real estate, and the prospects for recovery.

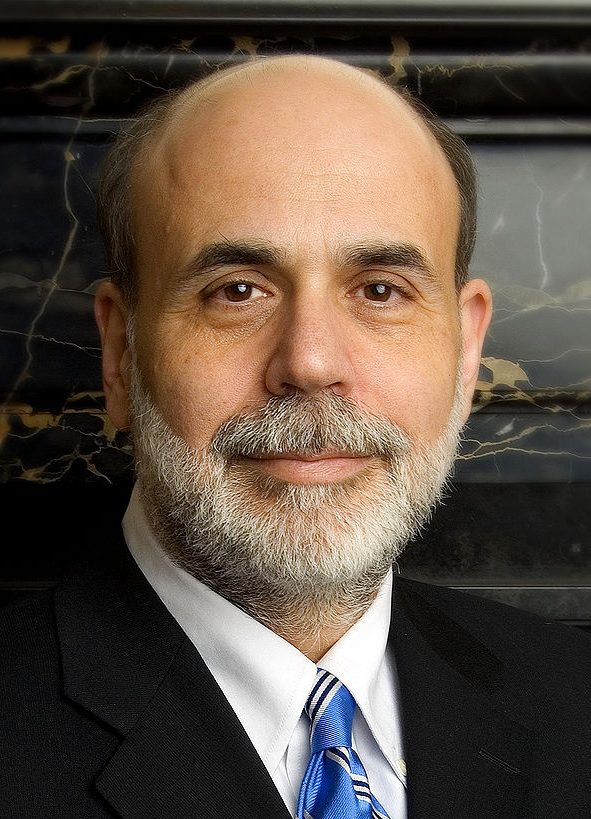

Brookings Institution economist and former chairman of the Federal Reserve during the Great Recession years, Dr. Ben Bernanke, shared his thoughts on the economy and a range of real estate issues during a webinar on Nov. 18.

Bernanke spoke with Marcus & Millichap President & CEO Hessam Nadji and TruAmerica Multifamily President & CEO Robert Hart during the webinar, which was jointly hosted by the two companies. The discussion touched on several important topics, including affordable housing, the pandemic’s long-term impact on commercial real state and his outlook for a recovery post-pandemic. Here’s what Bernanke had to say.

Fannie & Freddie privatization

Ever since Mark Calabria took the helm at the Federal Housing Finance Agency in April of this year, there has been a renewed push to privatize Fannie Mae and Freddie Mac and bring the mortgage giants out of government oversight. There has also been talk that the Trump administration will try to end the conservatorship before President-Elect Joe Biden takes office in January.

However, Bernanke was skeptical that will happen any time soon. “I don’t see full privatization very likely as a political or economic matter,” he said, pointing to strong political support for Fannie and Freddie. Instead, he sees “something close to the status quo” over the next four years.

Affordable housing and rent control

With rent control proposals and legislation popping up in localities across the country over the last few years, multifamily trade groups have been busy pushing back on the measures. Bernanke admitted that rent control has some “serious drawbacks” and cities would be better served in taking a responsible approach to increasing the supply of housing.

“I want to emphasize a balanced approach,” he said. He suggested policies that would create more housing units at a higher density that would help balance the supply and demand, therefore bringing prices down naturally, without controls.

Asked whether a major plan at the federal level would be the right move to tackle the problem, Bernanke pointed out that battles over housing almost always take place at a hyperlocal level, and would need to see action taken there, not in Congress.

“I think the battle has to take place at the local and state level,” he said. “It’s a longstanding one.”

The pandemic’s long-term impact on CRE

It has become clear over the last several months that the pandemic has had a disparate impact on the various sectors of commercial real estate. Hospitality and retail have been the hardest hit, while office, industrial and multifamily have fared better.

“Overall, if the economy comes back and grows as we expect, it’s good for commercial real estate generally,” said Bernanke, going on to suggest that the country could potentially experience a period of substantial growth following the end of the pandemic, as the U.S. did in the 1920s following the Spanish Flu pandemic.

The need to socially distance could create more demand for square footage in offices, senior housing could become weaker and warehouses and industrial facilities could become stronger, he said. But what could really make the difference for companies and individuals struggling to make rent payments will be support from the government.

“I think that the source of help is going to have to be the federal government in the near term,” said Bernanke.

Outlook for the post-pandemic recovery

The stock market soared following recent announcements from Moderna and Pfizer on encouraging developments with their respective COVID-19 vaccines. But when will they be widely distributed and be truly effective? Bernanke believes the process will take time, as will the recovery for the many people and businesses that were upended by the virus.

“I think this will go into 2022 at least,” he said. However, he said the next six months will be crucial in terms of how bad the pandemic will get in the U.S., and that will have a big impact on what the timeline for recovery looks like.

“Ultimately if we do get a strong control of the virus and don’t have the same issues and disruptions as the Great Recession, I think it will be faster and has been faster,” he said.

You must be logged in to post a comment.