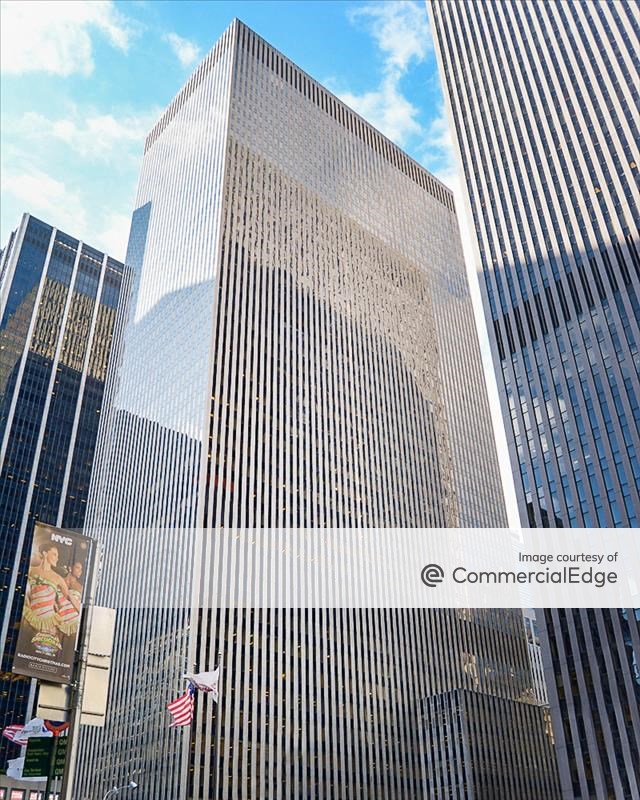

Fox to Exit 330 KSF at Manhattan Trophy Tower

Beyond the impending decline in occupancy, the property’s owners are also facing a maturing $1 billion CMBS loan.

The next few months could be challenging for the owners of Midtown Manhattan trophy tower 1211 Sixth Ave.—Ivanhoé Cambridge, the global real estate group of Canadian pension fund CDPQ, and RXR. Fox Corp. is planning to vacate about 330,000 square feet of space at the skyscraper in November and its $1 billion CMBS loan is maturing in August.

The space to be vacated by Fox is about a quarter of the approximately 1.2 million square feet leased by Rupert Murdoch’s Fox and News Corp. media empire, according to Crain’s New York Business. Crain’s cited a report Wednesday from credit-rating agency KBRA about the plan. KBRA downgraded the $1 billion mortgage because of the upcoming occupancy decline at the tower.

The mortgage, originated July 21, 2015, by Wells Fargo Bank as part of the pool 1211 Avenue of the Americas Trust 2015-2011, is set to mature on Aug. 6, according to CommercialEdge data. Wilmington Trust is the trustee and lender with Wells Fargo Bank listed as master servicer and special servicer. The loan payments are about $3.6 million per month, payable interest-only at a rate of 4.15 percent. A refinanced loan would almost certainly have a higher interest rate in the current environment.

Media empire anchor

It was not clear which Fox entity would be vacating the space. The media empire leases 1.2 million square feet at the skyscraper, which includes Fox and News Corp.’s corporate headquarters, Fox News studios and newsrooms for the New York Post and Wall Street Journal. Fox and News Corp. signed lease extensions in 2023 to secure roughly 55 percent of the building through 2042. The leases provided further extension options. Fox Corp.’s 670,000-square-foot deal will be effective starting December 2025, while News Corp.’s 486,000-square-foot agreement carries a December 2027 implementation date.

READ ALSO: Manhattan Office Visits Drop

However, about half of the 330,000 square feet of space to be vacated is subleased to Disney Streaming Services, according to KBRA. The Walt Disney Co. is in the process of moving its Manhattan offices and studios, including “Good Morning America” and ABC News, to new space at 7 Hudson Square and the streaming services operation is likely moving downtown as well.

The tower’s second-largest tenant, law firm Ropes & Gray, which leases at least 245,781 square feet, is moving a few blocks north to 1285 Avenue of the Americas in 2028. The law firm is more than doubling its space, taking more than 535,000 square feet in a 20-year lease at the skyscraper, which is also owned by RXR.

KBRA reported occupancy at 1211 Sixth Ave. would drop from 94 percent to 74 percent, before stabilizing at 88 percent after those changes take effect.

Ownership changes

RXR bought a 49 percent interest in the office tower in January from Ivanhoé Cambridge in a deal that valued the trophy building at $1.7 billion. Ivanhoé Cambridge has owned part of the tower since 2013 when it acquired a 51 percent stake from Beacon Capital Partners for $850 million. Beacon sold its remaining 49 percent to Ivanhoé and Callahan Capital for a slightly higher $895 million three years later.

Ivanhoé Cambridge and RXR are investing $300 million in a repositioning project that will feature a revitalized plaza and a redesigned multitenant lobby. The plan includes a new amenity center, conference rooms, a wellness center and other updates.

Manhattan leasing up

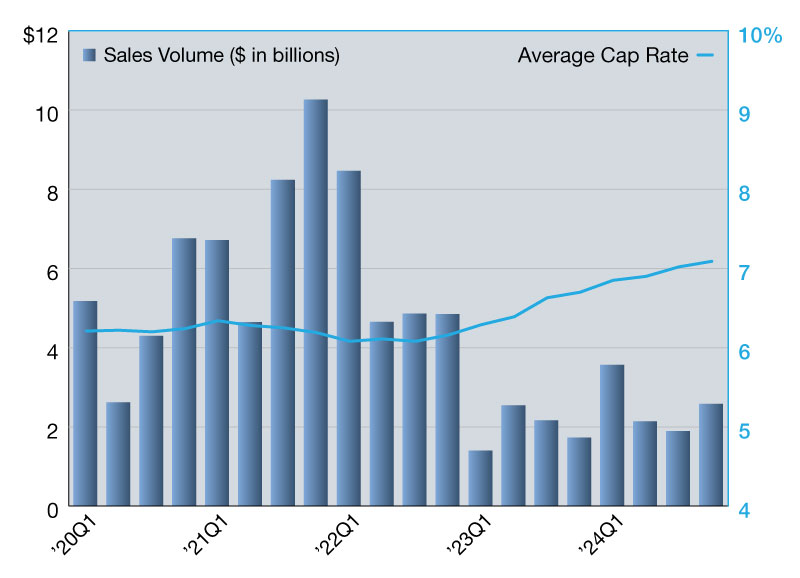

The Manhattan office market finished 2024 on a strong note with fourth-quarter leasing totaling 6.7 million square feet. It was the highest quarterly total since the third quarter of 2022 and 6.3 percent higher than the 10-year quarterly average, according to Cushman & Wakefield’s latest Manhattan report.

The strong fourth quarter brought annual leasing to 23.4 million square feet, up 30.2 percent year-over-year. Cushman & Wakefield noted there were 23 new leases and expansions greater than 100,000 in 2024, up from 16 in 2023.

The news was also good for the Midtown Manhattan submarket. Colliers reported Midtown’s demand increased by one-fourth between the third and fourth quarters of 2024. The submarket saw nearly 6.3 million square feet of leasing activity, the highest quarterly leasing volume since the third quarter of 2018. Midtown also had its strongest full year of leasing volume—about 19.2 million square feet—since 2018.

You must be logged in to post a comment.