Getting Green to Go Green

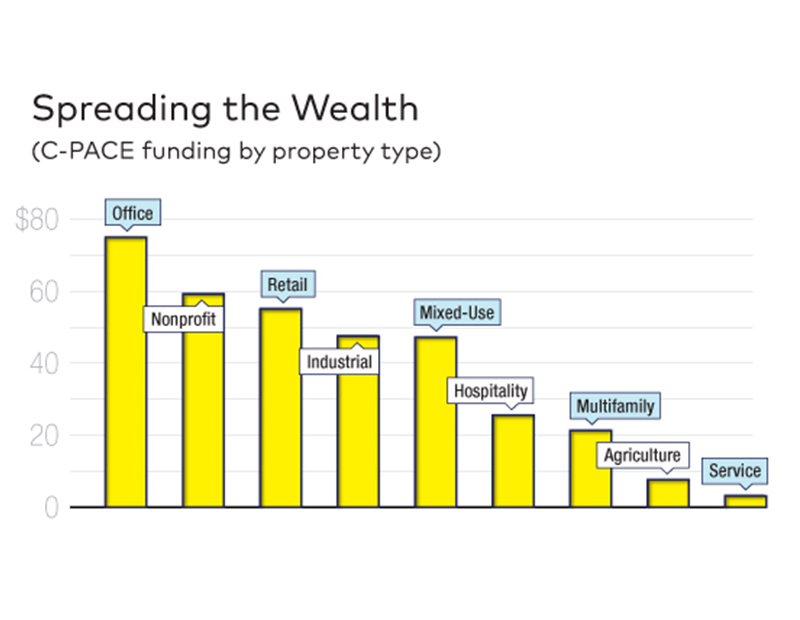

While office buildings consume 19 percent of U.S. energy, according to the American Council for an Energy-Efficient Economy, other sectors are also seeking retrofit financing. But some property types are easier to finance than others.

By Sanyu Kyeyune

While office buildings consume 19 percent of U.S. energy, according to the American Council for an Energy-Efficient Economy, other sectors are also seeking retrofit financing. But some property types are easier to finance than others.

Due to their scale, industrial retrofits provide high potential energy savings, but that property type presents some complexities. “As a non-bank lender, we acknowledge the risks to be distinct,” said Cleanfund CEO Greg Saunders. “A site’s environmental profile can make underwriting trickier.” Another barrier to industrial retrofits is the downtime required to complete property improvements, which can compromise revenue due to lost productivity.

Cleanfund focuses on financing redevelopments across a variety of property types, where PACE financing can offer a less expensive alternative to equity or mezzanine debt, Saunders noted. Repositioning unstabilized assets can result in higher valuations—which has led the firm to target non-core properties in niche segments, such as small retail centers and suburban office parks.

Retail retrofits carry several benefits. The property type typically has relatively large common areas, enabling owners to pass along energy savings in the form of reduced CAM charges to tenants.

At the River at Rancho Mirage, a 227,500-square-foot retail center in Rancho Mirage, Calif., the $2.4 million in financing for energy improvements provided this year by Cleanfund is projected to offset 95 percent of the facility’s common-area electricity use, while delivering annual CAM charge reductions of more than $200,000 to the tenants. The PACE financing paid for the construction of a solar PV-enabled carport in the shopping center’s parking lot, as well as the installation of a new water-pumping and control system. The retrofits also added covered parking and enable the property owner to generate renewable energy on site.

Enhanced shopping environments attract not only customers but also potential tenants, which can mean lower vacancy rates and improved margins for property owners. Another plus is that owners can underwrite higher renewal probability into their leases, in addition to improving the performance of their buildings.

Within the hospitality sector, retrofits can significantly reduce utility bills, due to the energy use habits of guests and the prevalence of common spaces, such as banquet halls and meeting rooms. Installing high-efficiency, dimmable bulbs in common areas and equipping parking lots with motion-sensor lighting not only cuts energy use but also enhances the guest experience. Although completing retrofitting projects without significantly impeding occupancy remains a challenge, there are still a wealth of opportunities to save energy in hotels and resorts, as evidenced by Stonebridge Hospitality.

Fairfield Inn by Marriott in Frankfort, Ky., – before and after (Image courtesy of Big Ass Solutions)

Upgrading lighting without compromising guest safety was a concern for the Kentucky-based hotel franchise owner. The company needed more reliable, energy-efficient parking lot lights for its Fairfield Inn by Marriott location in Frankfort, Ky., and due to franchise rules could leave no more than two lights out at once. Big Ass Solutions, an engineering and manufacturing company, and Sparkfund, a financial technology firm, teamed up to craft a turnkey fix, including equipment installation and ongoing maintenance, structured as a monthly subscription over a seven-year period. The technology subscription allows Stonebridge to pay for service and maintenance each month, using the energy savings brought on by more efficient lighting, with no obligation to pay if the equipment does not achieve the performance that Sparkfund guaranteed.

See also Implementing Efficiency in the October 2017 issue of CPE.

You must be logged in to post a comment.