Getting in the Heads of Industrial Tenants

Factors like greater access to power and EV infrastructure are increasingly important for almost all companies.

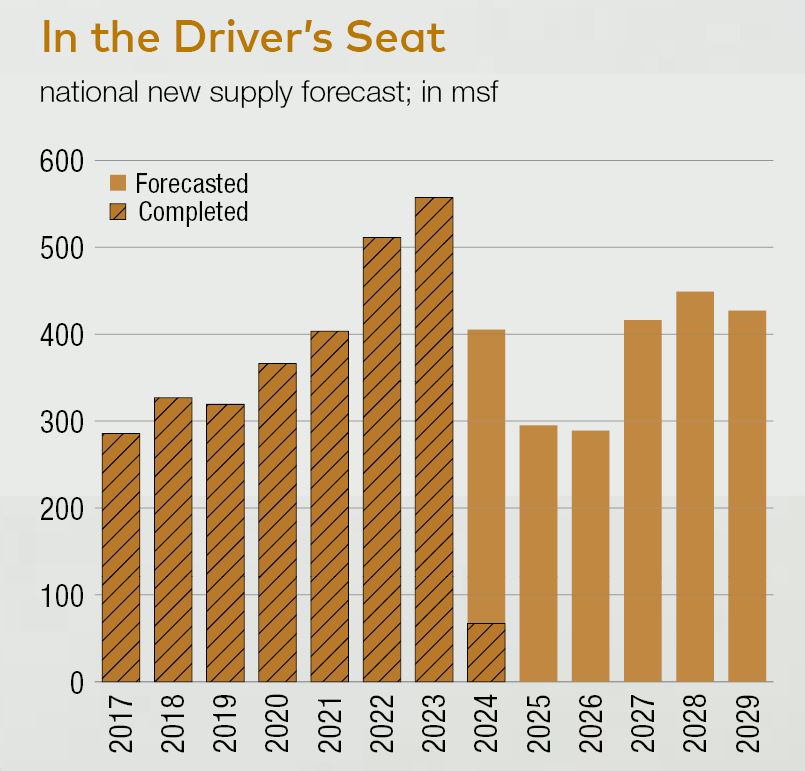

An excess of supply in some industrial markets has led to more rentable options and more favorable leasing terms for tenants. With new construction starts taking a more than 70 percent dive since early 2022, however, according to a 2023 Savills report, demand is likely to quickly outpace new deliveries. Until then, tenants have their pick of spaces and landlords.

“Looking ahead, 2024 is shaping up to be a year of rebuilding,” Mark Russo, senior director, head of industrial research, Savills, told Commercial Property Executive. “Lately, the market’s been swinging more in favor of tenants, mostly thanks to a surge in new development. But don’t expect that to stick around forever.”

Location, transportation access and available labor are key for all tenants. Beyond that, wishlists will vary depending on what the company makes or distributes. But still, trends can be observed.

“It’s a very nuanced picture market by market but overall demand for industrial product remains generally strong,” Mason Waite, managing director of asset management, BKM Capital Partners, said.

Zeroing on the building’s specs

Once tenants have narrowed down the submarket they want to be in, they start comparing the characteristics of different buildings—and today there are more to choose from.

“Questions like ‘does this place have the right ceiling height, column spacing, loading docks, truck access, parking and power supply for what we do?’ start to matter,” Russo explained.

Another key element of a building is its size. The RMR Group recently completed a 194,000-square-foot industrial lease expansion to give a tenant access to additional warehouse, manufacturing and trailer parking space.

“With increased e-commerce sales as a percentage of total retail sales, retailers are bolstering their omnichannel distribution channels, requiring additional warehouse space to fulfill orders at a faster rate,” Marc Krohn, vice president, The RMR Group, said.

Square footage isn’t always the determining factor, though. Richard Seybolt, vice president & fund manager, Realterm, explained.

“We have learned that building components translate to a more efficient property that can process more freight volume,” Seybolt said. “And a lot of that has to do with that abundance of yard area.”

Therefore, some tenants actually prefer a smaller building with excess parking to allow tenants the ability to more effectively and efficiently maneuver and stage trailers. Properly designed dock doors can limit bottlenecking when it comes to processing freight.

“The beauty of industrial space is that it all comes down to function,” Waite said. “The product that does the best has accessible drive aisles and loading docks, sufficient power, adequate clear ceiling heights, and—like every good piece of real estate—is well located.”

Powered up

Increasingly, access to power is the dominating factor when it comes to choosing a building.

“With respect to distributors, one of the things that they’re looking for today–outsized versus what it may have been pre-pandemic–is access to power, particularly electrical power to support ongoing operations,” said Adam Petrillo, executive managing director, Newmark’s Industrial Advisory Group.

Power is a priority because of increased automation within facilities and the increasing amount of power needed for the movement of goods.

“Today’s manufacturing processes often utilize advanced machinery, which require higher power supplies,” Waite said. “We’re seeing this across all the markets in which we’re active, regardless of unit size, and it’s a requirement that will only continue to gain attention as the U.S. continues its manufacturing overhaul.”

Add to that a shift towards electric fleets, and some companies rely on power to manufacture their products in the first place.

“Consider sectors like cold storage, advanced manufacturing, vertical farming, and even crypto-mining, all of which require substantial energy,” noted Russo.

Krohn said that for smaller industrial tenants, or those looking for less than 100,000 square feet, power needs might only be 200 AMP 277/480 volt 2-phase 4 wire service. But as that square footage and clear height increases, the power requirement might bump up to anywhere from 2,000 AMPS to 3,000 AMPS.

“If the warehouse is going to be heavily automated or the use changes to manufacturing, the requirement could easily exceed 4,000 AMPs,” Krohn said.

The search for sustainability

Sustainability initiatives are also increasingly sought after in the industrial space, and landlords may be more willing today to answer tenant requests in the form of green leases.

“Some of our offerings include onsite renewable energy programs inclusive of rooftop solar strategies, real-time monitoring to analyze energy and water consumption to optimize use of natural resources, installation of EV charging stations and adding motion sensors and LED lighting,” Krohn said.

EV infrastructure, which is being bolstered by new government incentives and mandates, is the most in-demand sustainability requirement, Russo said.

“Tenants with higher power requirements are generally looking to see if there is supplemental power available from a solar array,” Waite said. “Additionally, with increased EV adoption, tenants inquire about their employees’ ability to charge personally owned vehicles onsite.”

Flexibility is in

In today’s uncertain economy, tenants are also seeking out more flexibility. Often, they can get it.

Sometimes tenants are asking for leeway in terms of additional expansion space or they may request contraction rights, Petrillo noted. Also, tenants are asking their landlords or ownership groups for additional tenant improvements to help with financing handling equipment inside a facility.

And, perhaps most frequently, lease lengths are getting more flexible, too.

“Tenants are asking for, and in many cases receiving, concessions in the form of months of free rent along with shorter lease terms,” Russo said. He continued that tenants are also getting turnkey deals, something that landlords weren’t keen to provide during peak market conditions. Tenants are also asking for caps on HVAC repairs and controllable operating expenses.

You must be logged in to post a comment.