Getting the Deal Done

Not all acquisition financing is created equal, as the quest for debt capital is influenced by both uncertainty and the flight to quality.

A combination of extraordinarily low interest rates, plentiful equity and debt, and an unexpectedly resilient operating environment has created a recent uptick in investment activity. In a metric that reflects both renewed investor confidence and the availability of acquisition financing, $68.4 billion of commercial properties traded in the third quarter of 2020, for a 37 percent increase over the second quarter, according to Real Capital Analytics. Third-quarter investment volume was down 57 percent year-over-year, but since the same time frame in 2019 included two massive portfolio deals closed by GLP, RCA noted that the rebound may even be understated.

“The level of uncertainty in the market has declined in recent months as more deals made it to the finish line,” said Thomas Edwards, global president of the valuation and advisory services business for CBRE. “But this market is really quite different than past recessionary cycles, where typically all asset classes moved in the same direction.”

These lending trends are emerging against the backdrop of investment activity that varies widely by asset category. Apartment deals led the market in the third quarter, totaling $24 billion led the market in the third quarter, followed by industrial sales ($15.4 billion) and office trades ($13.6 billion), according to RCA. By contrast, $6.5 billion in retail properties traded hands, and the hospitality sector rang up less than $2 billion in third-quarter sales.

These lending trends are emerging against the backdrop of investment activity that varies widely by asset category. Apartment deals led the market in the third quarter, totaling $24 billion led the market in the third quarter, followed by industrial sales ($15.4 billion) and office trades ($13.6 billion), according to RCA. By contrast, $6.5 billion in retail properties traded hands, and the hospitality sector rang up less than $2 billion in third-quarter sales.

Capitalization rates for Class A industrial properties have declined or held steady in all 29 markets covered in CBRE’s third-quarter cap rate survey, which compared the rates of stabilized properties over a two-week period in August to average ranges in the second half of 2019. But for a handful of markets that saw cap-rate increases, the same was largely true for Class A infill and suburban multifamily properties. New York City’s Class A multifamily cap rates increased in August, too.

Even within property sectors producing steady investment activity, however, demand and pricing power can fluctuate significantly. “Not all deals are created equal,” said Alan Pontius, senior vice president & national director of Marcus & Millichap’s office, industrial and health-care division. “If you have the right set of ingredients, there is plenty of liquidity in the market today. It’s far superior to the liquidity that was in the market in the second quarter.”

Additionally, uncertainty has contributed to a significant bid-ask spread in all but the highest-quality properties. Of note, the spread is pronounced even for downtown office buildings, and apartment projects have historically been considered safe havens during economic slumps.

Picking and Choosing

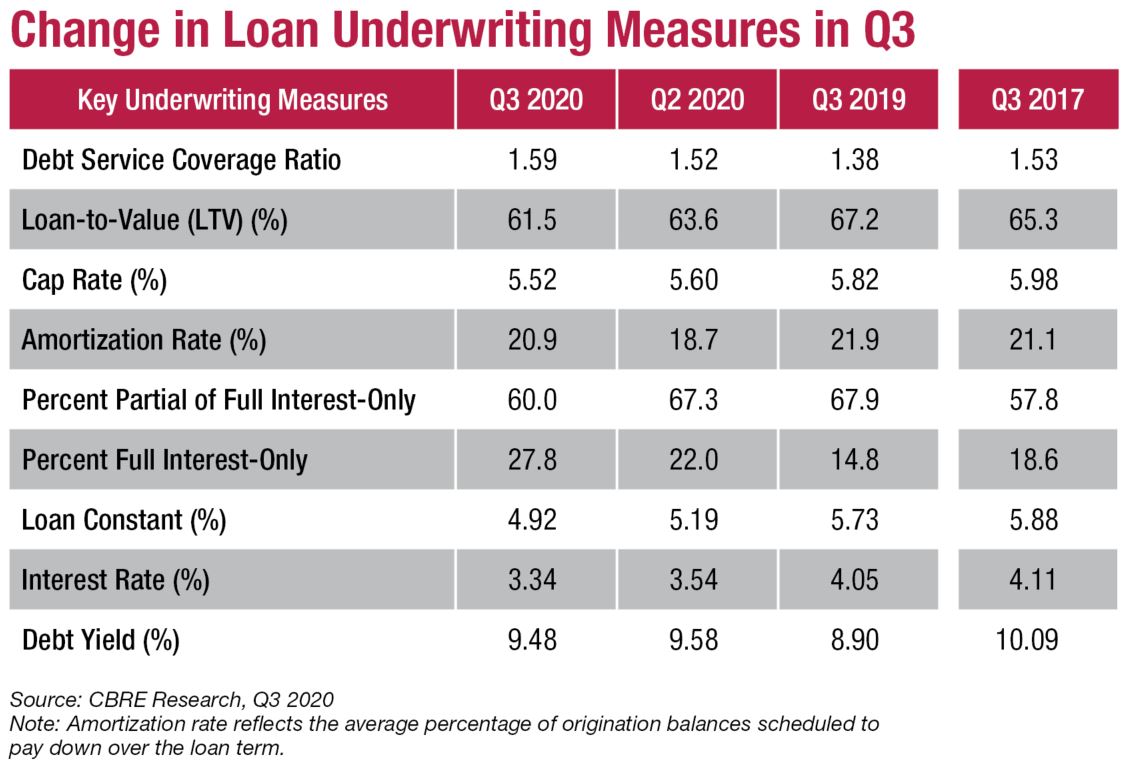

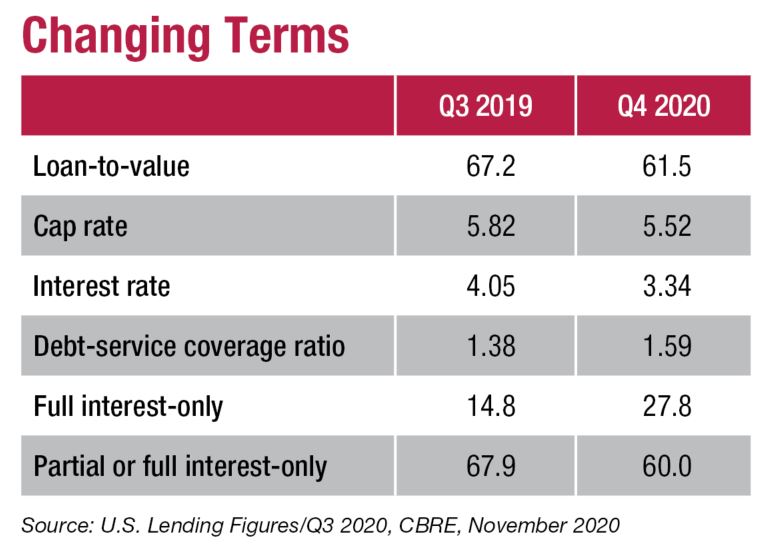

Loan underwriting is tracking the uncertainty, too. Commercial property and multifamily loan applications fell 47 percent in the third quarter from a year earlier, according to the Mortgage Bankers Association. The average loan-to-value rate for commercial and multifamily properties fell to 61.5 percent in the third quarter, the lowest level since the Great Financial Crisis and a year-over-year decline of 57 basis points, according to CBRE’s latest lending report.

Similarly, the average debtcoverage ratio rose to 1.59 in the third quarter, a 21 basis-point increase from a year ago, the report noted. Still, originations improved modestly over the second quarter, and all debt providers are active, including insurance companies, debt funds and commercial mortgage-backed securities lenders. Given that interest rates continue to bump along at historic lows and confidence in economic improvement is recovering, lenders are looking to put money to work.

Similarly, the average debtcoverage ratio rose to 1.59 in the third quarter, a 21 basis-point increase from a year ago, the report noted. Still, originations improved modestly over the second quarter, and all debt providers are active, including insurance companies, debt funds and commercial mortgage-backed securities lenders. Given that interest rates continue to bump along at historic lows and confidence in economic improvement is recovering, lenders are looking to put money to work.

“Certainly, lenders are requiring more equity, or demanding that the sponsor have a resume or that they have a prior relationship (with the lender),” Pontius said. “But for the higher-quality, high-credit deals, lenders are more aggressive for than they were three to six months ago.”

Buyers of creditworthy single-tenant warehouses and office buildings with 10 years or more on the lease can still find debt to cover 75 percent of a property’s acquisition cost, Jackson said. Borrowers that want to finance transactions outside of that box—such as industrial and office properties with shorter lease terms, multiple tenants, or a value add or transition component—should expect leverage of around 65 percent or less; to be charged up to 300 basis points more for interest compared with pre-coronavirus days, and to face higher debt coverage ratios or other financial structure, he explained.

Additionally, lenders are generally scrutinizing tenants and their industries a lot closer, unless they happen to be Amazon or a similar tier-one credit company, said Jeff Henson, an Atlanta-based senior vice president in Lincoln Property Co.’s disposition services group.

Meanwhile, ample liquidity exists for stabilized multifamily properties, particularly for low-leverage buyers. In October, LaSalle Investment Management closed on a multifamily transaction featuring a seven-year, interest-only loan at 2.1 percent and a 50 percent loan-to-value, reported Brad Gries, head of U.S. acquisitions at LaSalle Investment Management.

Yet lenders are providing attractive financing to more challenging assets, too. Marcus & Millichap Capital Corp. recently arranged a three-year, nonrecourse bridge loan to recapitalize and acquire a nonstabilized student housing property near Oklahoma State University in Stillwater, Okla. The buyer owned 30 percent of the project and bought out its 70 percent partner, an affiliate of Greystar, which had provided first-lien financing and equity to the project.

The Greystar affiliate discounted its position in the deal to make it work, said Todd McNeill, Dallas-based senior managing director for capital markets with Marcus & Millichap. The bridge lender structured the interest-only financing in such a way that LTV was 80 percent “as is” and 70 percent “as stabilized.”

“Challenging under normal circumstances, financing was further impacted by the property’s zero percent occupancy for the school year due to construction delays, issues related to COVID-19—including whether the university was going to open—and the softening of the student housing market in Stillwater,” he said. Additionally, Fannie Mae and Freddie Mac have suspended lending on student housing for the time being, which compounded the difficulty, McNeill added.

In general, debt capital is available for deals of all sizes in most property types, but fewer options are typically available for larger transactions. Securing loans for hotels and retail assets remains a challenge, too. Still, grocery-anchored centers with few small-shop spaces and retail deals under $25 million are easier to finance, especially with interest rates so low, said Margaret Caldwell, an Atlanta-based partner & managing director with Stan Johnson Co. Larger transactions typically have more tenants at risk, such as department stores, she added.

More broadly, however, lenders are more inclined to provide larger commercial and multifamily transactions with better pricing. Nearly all deals of more than $10 million carried a mortgage rate of 3.5 percent or less in the third quarter, for example, while roughly eight in 10 of smaller deals carried a mortgage rate of 3 percent to 4.5 percent, according to CBRE.

Hard Decisions Ahead

Given the market dynamics, more investors are bargain-hunting, although most are steering clear of hospitality assets and retail properties, with the expectation of distressed opportunities in the coming months. Some 61 percent of buyers are looking for discounts from pre-pandemic prices, and only 9 percent of sellers are willing to offer them, according to CBRE’s cap rate survey. That could change soon, especially for struggling property owners that may not have the financial wherewithal to keep up with mortgage payments or will have trouble refinancing maturing debt.

“A lot of owners are having to make decisions as to whether they should sell today and maybe take a 15 percent haircut or hold onto an asset for a period that could see rapid value recovery– that’s one scenario,” said David Bitner, head of Americas capital markets research for Cushman & Wakefield. “The other scenario is that the asset could actually be worse off if they don’t have the ability to sign new leases and renewals.”

Like investors, owner-occupiers need to make similar decisions as they relate to consolidation or closing entirely, Henson said. “Most of the users that are selling today are doing so because they have to,” he said. “We’re beginning to see companies downsize significantly due to the coronavirus, and I think you’ll see a lot of single-tenant, end-user office buildings hit the market next year.”

You must be logged in to post a comment.