Global Annual Property Index

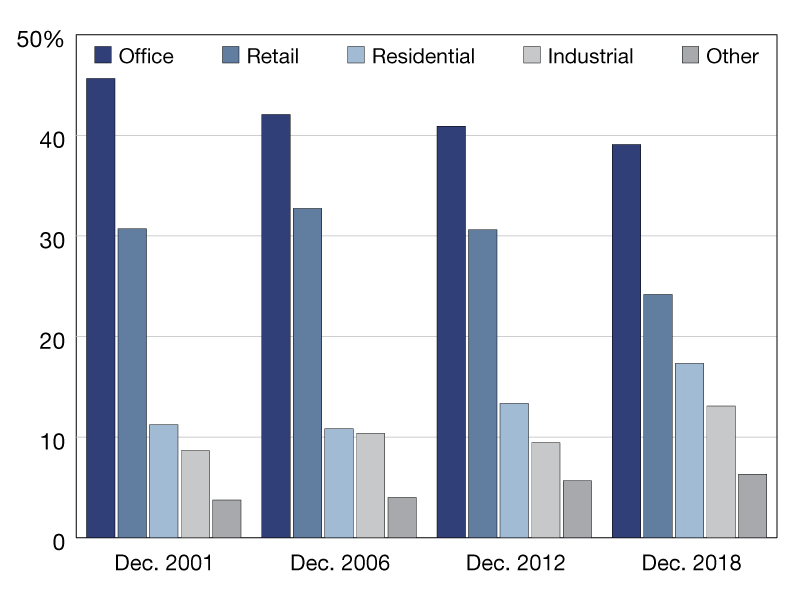

In 2001, office and retail accounted for 46 and 31 percent, respectively, of capital value in the MSCI Global Annual Property Index. However, now they account for less than two-thirds.

Percent of capital value by property type

Investors in commercial real estate face a dilemma when deciding on the appropriate mix of property types for their portfolios. Office and retail assets have traditionally made up the bulk of portfolios; and while they still do, their dominance has diminished over recent decades, as allocations to other real estate sectors have increased. The shift in the composition represents an evolution of the asset class and highlights how technology and the search for yield have led investors to diversify and seek exposure to other property types.

The preeminence of office and retail properties can probably be attributed to established markets, more transparent operating models and their proven track records. But over time, their dominance has waned, as investors have increasingly shifted their portfolio allocations to other property sectors. Back in 2001, office assets accounted for 46 percent of the capital value in the MSCI Global Annual Property Index, and retail assets accounted for 31 percent. Together, these two sectors made up over three-quarters of the total index. As of the end of 2018, however, they accounted for less than two-thirds of the index, with office falling below 40 percent and retail’s weight down to 24 percent. They are still the two largest sectors in the index, but their share of the average portfolio has diminished.

Insights and data provided by MSCI Real Estate, a leading provider of real estate investment tools. A Vice President in MSCI’s global real estate research team, Reid focuses on performance measurement, portfolio management and risk related research for asset owners and investment managers. Based in Sydney, he covers APAC as well as global markets.

You must be logged in to post a comment.