Global Capital Targeting CRE Stays High at $435B

The global wall of money available for real estate investment declined 2 percent compared to last year’s peak of $443 billion, but it remains at its second-highest value since 2009, according to Cushman & Wakefield's latest global capital markets report.

By Alexandra Pacurar

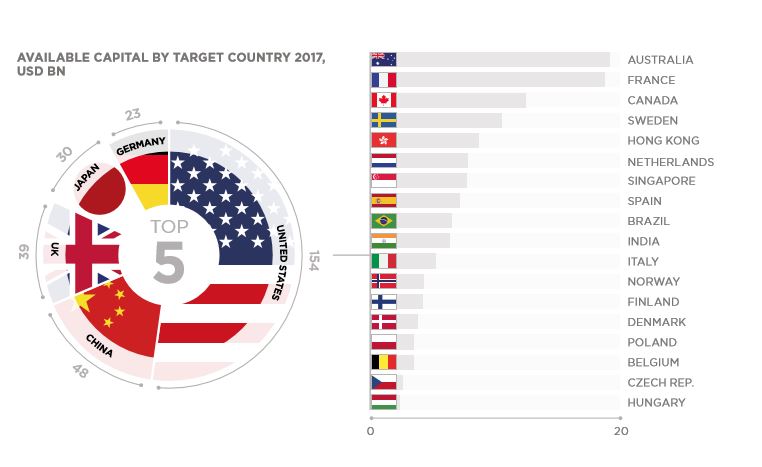

London—While the amount of new capital available for real estate investment, including debt and equity, registered its first decrease in the last six years, it’s still at its second highest value since 2009, totaling $435 billion, according to Cushman & Wakefield’s recent Great Wall of Money report. The country taking the top spot in terms of total available capital by target country was the U.S., with $154 billion.

The research also shows that, for the first time on record, the Americas hold the most attractive markets for investors, leaving EMEA to take the No.2 spot. However, this switch may just be the result of currency changes. “Figures reported in dollars and thus a weaker pound/euro has influenced reported figures,” Nigel Almond, partner & head of EMEA capital markets research at Cushman & Wakefield, told Commercial Property Executive.

This year is expected to be very competitive in terms of placing capital and finding attractive opportunities. Also, unlisted funds remain the dominant source of capital in global real estate markets accounting for more than half of available debt and equity raised.

In 2016, global capital peaked at $443 billion, but cautious lending policies have led to a drop in debt levels, which resulted in a two percent decline in global capital, according to Cushman & Wakefield research. “If you look at the dry powder (equity) that is available, you can see that it’s up, so investors targeting lower leverage is a factor behind the decline,” Almond added. According to the report, there was also a slowdown in investment deals volumes.

Where to Invest?

The Americas represents the most attractive market and retains the highest market share (41 percent), despite a fall year-on-year, followed by Asia Pacific (34 percent) and EMEA (25 percent). However, almost three quarters of the investors in North America are domestic.

Capital targeting EMEA shrunk nine percent to $130 billion, while the capital focusing on the Americas grew two percent to $173 billion. The report underlines the surprising growth in capital targeting Asia Pacific, totaling $132 billion for 2017. The increase reflects the maturity and growth of opportunities in the region and the attractive long-term return prospects. For the first time on record, there is more equity targeting the Americas ($79 billion) than EMEA ($72 billion), with close to 80 percent of funds directed toward Europe. Growing investor demand in Asia Pacific triggered a 7 percent rise in available equity to $65 billion.

“We expect to see strong levels of investment moving forward. We have seen new raising slip this year, as investors focus on deploying existing capital. We do still see pockets of fresh raising, especially from those investors who have been successful in deploying capital and returning to the market for more equity,” Almond said.

One of the most interesting revelations from the report is that single-country investments grew by 55 percent over the last three years and now represent 61 percent of total available capital. Cushman & Wakefield predicts that the U.S. is likely to keep its top spot as the most targeted investment market in 2017, with China coming in second and the U.K. in third.

However, some investors took a “wait and see” approach towards Britain as the Brexit negotiations unfold, hoping for more product to come online and for pricing to weaken. Japan took fourth place, with mostly domestic capital, the same as in the U.S. and China. Germany closed the “top five” thanks to its strong economic performance. This European market could benefit from the capital being diverted from the U.K., the report noted

What to Invest In?

Though the majority of real estate capital is targeted at diversified strategies (69 percent of total investment), single-sector strategies (31 percent of total) have seen a significant 55 percent increase over the past three years. The change comes as interest grows in alternative assets that require specialist management, such as car parks, hotels and health care properties.

“Some investors do not have the expertise to access more niche sectors or markets where lot size prohibits the ability to diversify. Or they may need specialist management. Placing money into a specific fund to gain exposure to such assets classes is a natural means to invest and it can provide better liquidity than holding direct,” Almond explained.

Residential remains the top choice for investors looking for a single property type. U.S. funds targeting the domestic multifamily sector continue to be sought after despite the long run of exceptional returns after the crash. “As more people live in cities and we see increased demand for renting in some markets, the sector will remain popular for investors. We do see increased interest in other sectors, but they will not challenge residential in the near term,” Almond told CPE.

In Europe, Germany, the Netherlands and parts of the Nordic region are the preferred markets for residential investments, while China tops that list in the Asia Pacific region. Together with multifamily properties, warehouses and shopping centers in China, India, Southeast Asia and Australia mark the most appealing investment options.

With quality assets getting harder to find, investors are adapting their strategies, making the “build-to-core” approach more and more popular. “Unable to find enough existing core assets, investors are engaging in ‘build-to-core’ strategies targeting development or redevelopment projects that create core assets in top markets. In addition to new investment strategies, we expect new sources of capital to be unlocked around the world with countries such as China, Malaysia, Taiwan and South Africa to the fore,” Elisabeth Troni, head of EMEA research and insight at Cushman & Wakefield, said in a prepared statement.

Investment Planning in 2017

As market dynamics continue changing, the appetite for risk is on decline. Opportunistic strategies are preferred in EMEA and Asia Pacific, while value-add dominates the Americas. Capital focused here targets the core to value-add spectrum in the U.S. and Canada, reflecting a focus on quality and secure income over risk. As opportunistic strategies are more common at the beginning of a cycle, the Cushman & Wakefield analysis predicts a firmer shift towards core strategies in the coming years.

While the amount of capital in real estate is still near record levels, experts tell investors not to lose focus nor agility. In recent years, it paid off to hold lower risk and high-quality assets, but things may change. Lower-risk strategies will bring lower returns, while investors deploying capital outside of core markets and sectors (where structural change factors drive demand) will be increasingly rewarded, the report reveals. Build-to-core strategies, aimed at creating modern, better-performing assets, are also expected to increase in popularity.

Lenders will remain conservative in 2017 because of greater regulation and the experience of the last downturn. At the same time, investors will be cautious about taking on high levels of debt, according to Almond.

The interconnectedness of markets, either through infrastructure or clusters of knowledge, will convince investors looking for longer-term growth. Investors with a flexible investment strategy will have a competitive edge in current market conditions. The lack of product is also expected to continue into 2017, as well as managers focusing more on deploying capital rather than raising fresh funds. There will be exceptions though when it comes to specific strategies for niche funds. Also, larger established blockbuster funds will continue to implement diverse strategies.

Image courtesy of Cushman & Wakefield

You must be logged in to post a comment.