Global Investors Are Still Betting on the US, AFIRE Finds

Industry execs shared their insights on the association's latest annual survey and what it means for America's real estate markets.

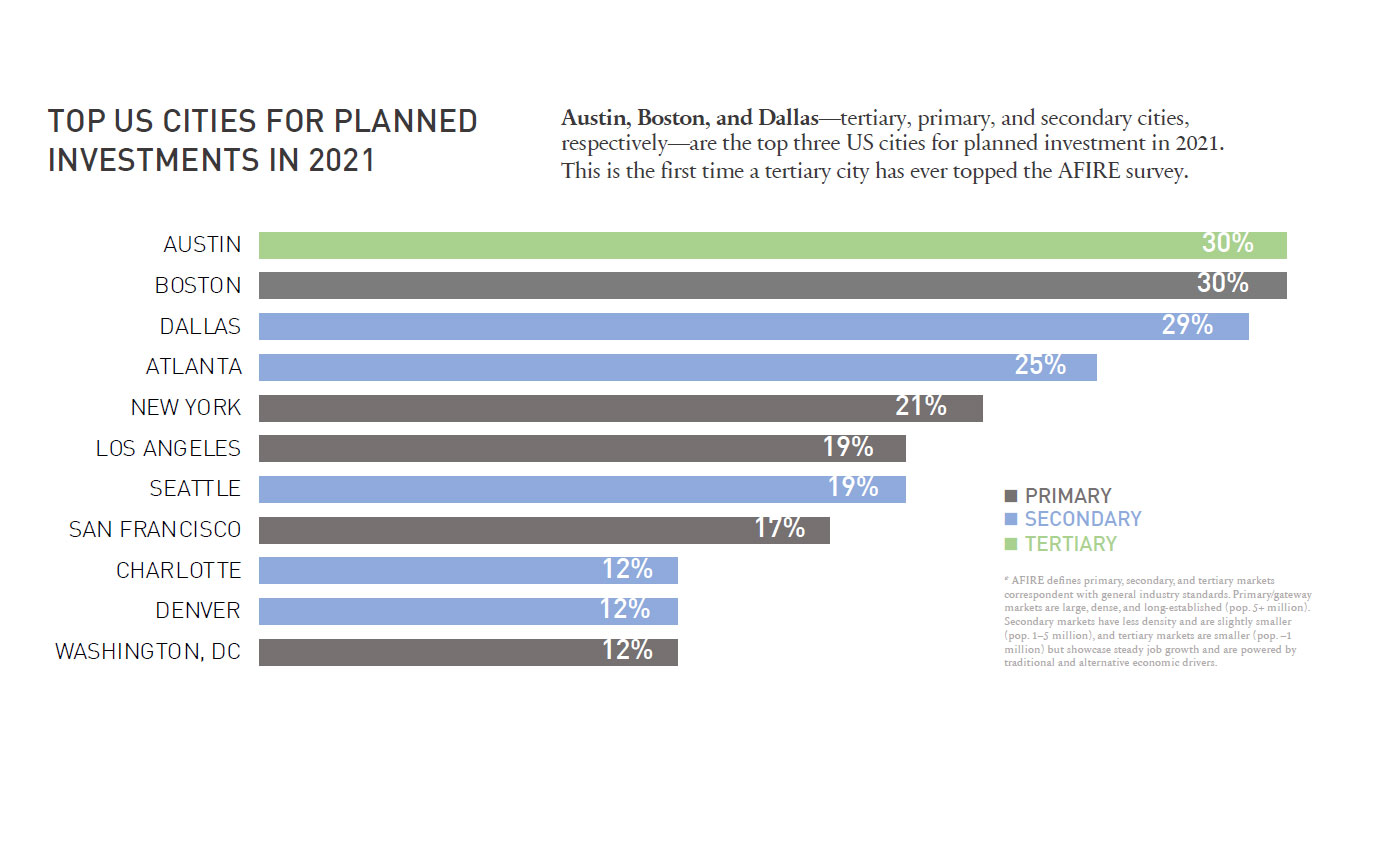

Global investors plan to ramp up their purchases of U.S. commercial real estate this year, with a growing focus on secondary and tertiary markets including Austin and Dallas, according to the latest annual survey by industry association AFIRE.

The newly released survey of more than 100 leading investors and institutions found that three in four respondents intend to boost their U.S. real estate investments in the next three to five years. U.S. investment allocation by non-U.S.-based investors is poised to increase 71 percent over that period, just behind the 79 percent allocation expected of U.S. investors. Europe, the U.K. and Asia-Pacific are also expected to draw more capital from global real estate buyers.

READ ALSO: Watch These ‘Global Emerging Trends,’ Say ULI and PwC

Austin ranked as the top U.S. city for planned investments in 2021, marking the first time that any tertiary market placed in the top three in AFIRE’s survey. The Texas capital was trailed by Dallas, a secondary city, which came in third place after Boston—signaling a potential shift in investor focus away from gateway cities and towards smaller and less-dense metros.

Strong universities, a young and educated population, relatively low costs and a low-tax regime are among the factors that are propelling investor interest in fast-growth markets such as Austin, AFIRE CEO Gunnar Branson told Commercial Property Executive.

“It’s migration that’s been going on for a while, a lot of it to the Sunbelt, and a lot of it to those markets that are more affordable and where there’s new growth,” he said. Atlanta; Phoenix; Charlotte, N.C.; and Nashville, Tenn., have also risen in AFIRE’s ranking since last year, while Tampa, Fla.—which previously didn’t appear on the list—ranked number 12.

Secondary markets are becoming more attractive as investors chase yields in a low interest rate environment, noted Will McIntosh, global head of research for USAA Real Estate, during a virtual panel discussion on the report’s findings.

“When I would talk to international investors, if I happened to mention Austin or Nashville or Charlotte, a lot of times they would look at me and go: can you land a Triple Seven there?” he said.

Now, with intense competition in the gateway markets, investors are looking at secondary markets for the opportunity to boost yields, “particularly when their actuaries are telling them I need a 7 or 8 percent return for my total portfolio” and the core markets might only offer a 5 or 6 percent return, McIntosh added.

Wants and worries

AFIRE virtual event. Clockwise from top left: Peter Grey-Wolf, Will McIntosh, Gunnar Branson, Zeb Bradford

Cooling interest in office and retail assets have emerged as another theme, while investor enthusiasm for multifamily and industrial continues to trend upward. Eighty-six percent of respondents said they plan to increase their multifamily exposure over the next several years, while 79 percent intend to boost their warehouse investments.

McIntosh flagged an increasing appetite for non-traditional property types including self storage, data center, life science, senior housing and student housing assets, which also tends to drive interest in certain secondary and tertiary markets. “We continue to be more bullish on what we call the intersection of technology and real estate,” he said, adding that media real estate is increasingly compelling due to surging demand for digital media content.

AFIRE’s survey highlighted rising tax rates, U.S. economic growth and interest rate fluctuation as top business climate concerns for investors in U.S. real estate. Not surprisingly, public health issues were ranked as the number one social and political worry, with net concern of 79 percent, followed by climate change at 76 percent.

Peter Grey-Wolf, vice president of Munich, Germany-based WealthCap Management, noted that inflation has an uneven impact on the economy, including his firm’s investors. “Those that are involved in development projects that are rolling out now do see (…) a huge spike in construction costs, particularly with lumber.”

Investors are also placing higher importance on environmental, social and corporate governance criteria. Thirty-one percent of respondents said that new investments must explicitly meet certain ESG requirements, such as net zero, green building certification, sustainability construction and regulatory compliance.

“The acceleration of the importance and the priority on ESG issues was surprising,” said Zeb Bradford, chief investment officer at Metzler North America during the same panel. “That train is moving, and I think it’s either you’re on board the train or you’re being left behind.”

You must be logged in to post a comment.