Global Property Fund Returns Underpinned by Industrial

In 2021, the MSCI Global Quarterly Property Fund Index recorded its highest annual return in at least 13 years.

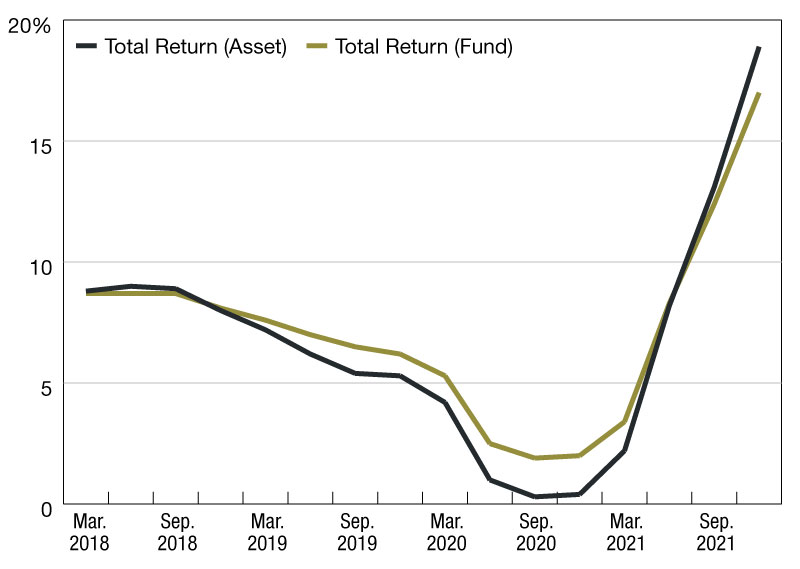

Annual Total Return

In 2021, global property funds recorded its highest annual return in at least 13 years, according to the MSCI Global Quarterly Property Fund Index.

According to the index, which measured the performance of unlisted, core, open-ended, quarterly valued funds, funds’ real estate assets produced a total return of 17 percent. On a total portfolio level (which includes the impact of leverage, cash and other items), property funds’ return for the year ended December 2021 was 190bps higher at 18.9 percent.

While there was some divergence across regions, the main driver of the index’s return was the outperformance of the industrial property sector which delivered a total return of 36 percent for 2021, up from 2020’s return of 11.1 percent. In fact, so strong was the performance of industrial property that 2020’s annual return was surpassed by Q4 2021’s quarterly return of 11.4 percent.

The other property sectors also rebounded off their 2020 returns but none as strong as the industrial sector, which has benefitted from an acceleration in the secular tailwinds driven by increased ecommerce penetration.

MSCI is a leading provider of critical decision support tools and services for the global investment community. With over 45 years of expertise in research, data and technology, we power better investment decisions by enabling clients to understand and analyze key drivers of risk and return and confidently build more effective portfolios. We create industry-leading research-enhanced solutions that clients use to gain insight into and improve transparency across the investment process.

You must be logged in to post a comment.