Global Real Estate Returns Decelerated but Currency was a Key Factor

Global returns decelerated to 2.9 percent quarter-on-quarter in local currency terms during the 3-months ended June 2022, according to the MSCI Quarterly Property Index.

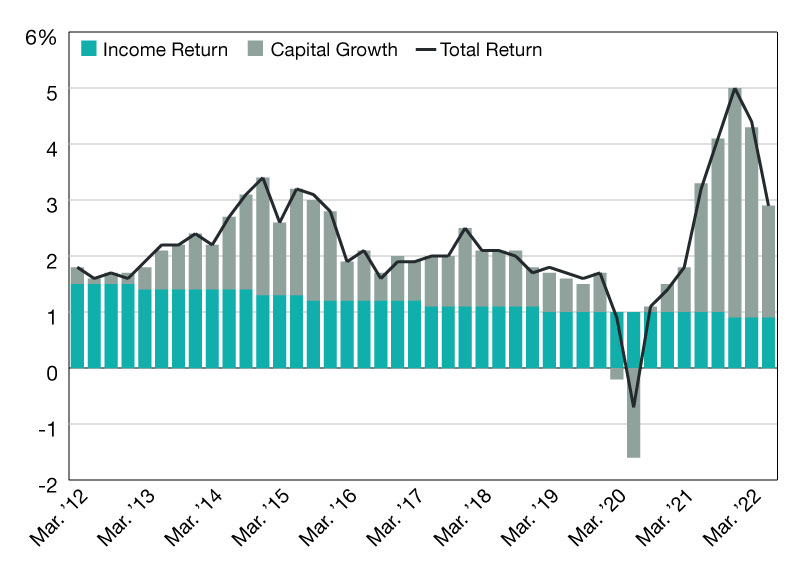

Quarterly Total Return; Local Currency

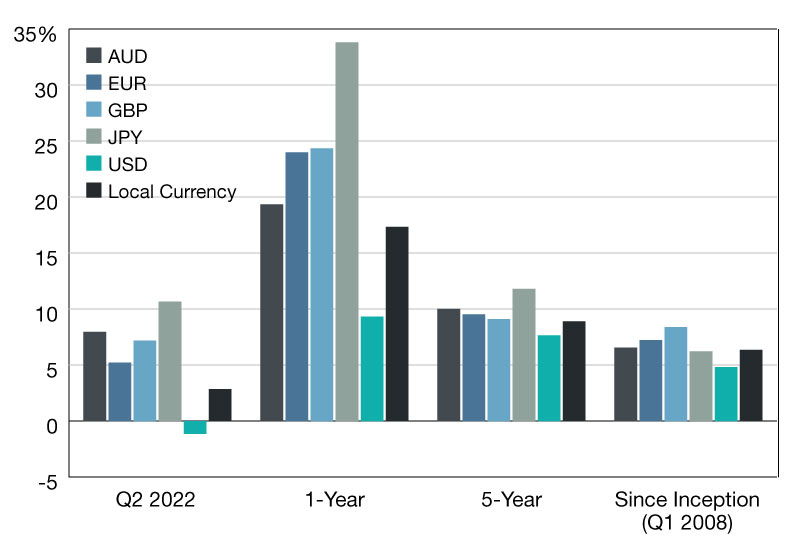

Annualised Total Return For Major Currencies

Global real estate returns decelerated to 2.9 percent quarter-on-quarter in local currency terms during the 3-months ended June 2022 amid rising inflation and interest rates in most key markets. This was the second consecutive quarter of slowing returns after the MSCI Global Quarterly Property Index reached a record high quarterly return of 5.0 percent return seen in Q4 2021.

The index’s all asset quarterly total return comprised an income return of 0.9 percent and a capital growth of 2.0 percent which has halved since the 4.0 percent of Q4 2021. The slowdown in returns was reported across property types and geography as 44 of the index’s 57 country and sector combinations reported deceleration in capital growth quarter-on-quarter.

For cross-border investors, foreign exchange movements were an additional factor to consider as the major currencies all experienced sharp shifts in the year-to-date June. After two decades of being stronger than the dollar, the euro recently receded to parity while the pound and yen both fell to multi decade lows against the dollar. Consequently, the 2.9 percent index’s quarterly, local currency return of 2.9 percent translated into a 10.7 percent gain for Yen-denominated investors while those investing in USD recorded a 1.1 percent decline.

As higher interest rates and recession risks increasingly weigh on real estate, higher frequency global indexes will be crucial to understand global and regional returns differences.

You must be logged in to post a comment.