Global Real Estate Returns Highest Since 2006 on Industrial Strength

A snapshot of the market’s big rebound, from the MSCI Global Annual Property Index.

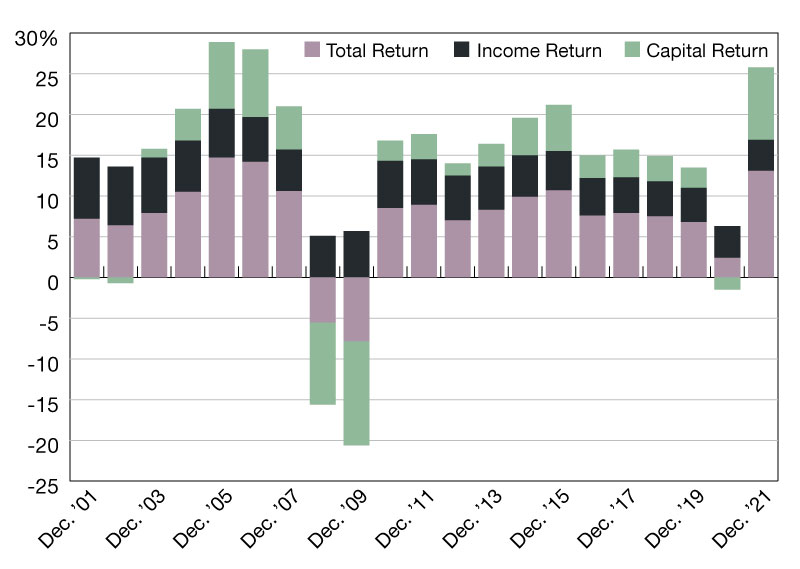

Global Annual Property Returns

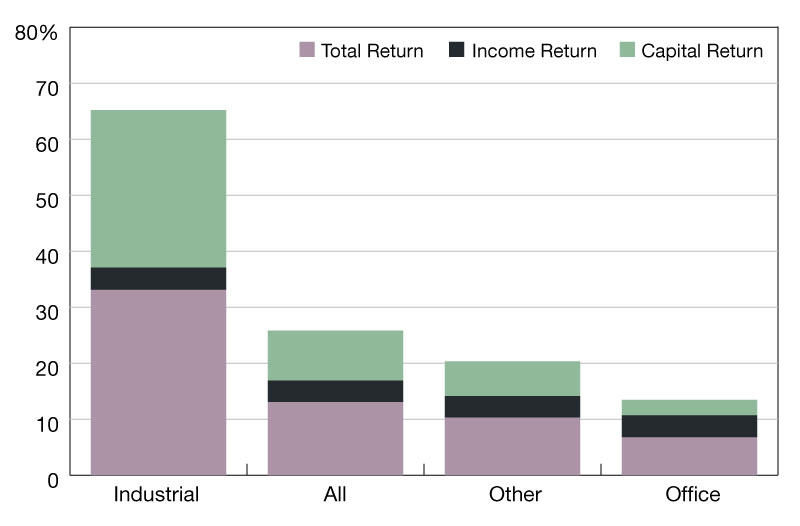

Global Sector Returns

The MSCI Global Annual Property Index for 2021, showed a strong rebound in performance from 2020.

The index recorded a total return of 13.1 percent for 2021, which was the best annual performance since the 14.2 percent of 2006. Capital growth was the main driver of return at 8.9 percent, the highest since the index’s inception in 2000, while income return was down marginally from 2020.

The index, published annually, tracked the performance of 57,887 property assets worth USD 2.1 trillion at December 2021. At the end of 2021, the index comprised of 37 percent office and 19 percent industrial.

On a sector level, industrial property provided much of the impetus to the index’s acceleration in 2021 with an annual return of 33.1 percent. Burgeoning ecommerce activity combined with low vacancy has seen demand for industrial property outstrip supply across most of the major geographies.

This was the sector’s best annual performance by some margin as it surpassed its previous high of 15.4 percent, which was recorded in 2005.

The office sector also recorded improved returns in 2021 but its performance remained relative muted in comparison to industrial property.

MSCI is a leading provider of critical decision support tools and services for the global investment community. With over 45 years of expertise in research, data and technology, we power better investment decisions by enabling clients to understand and analyze key drivers of risk and return and confidently build more effective portfolios. We create industry-leading research-enhanced solutions that clients use to gain insight into and improve transparency across the investment process.

You must be logged in to post a comment.