GLP Strikes Again in the U.S.

Global Logistics Properties will boost its U.S. presence by 50 percent with a gigantic new purchase.

By Gail Kalinoski, Contributing Editor

Global Logistics Properties Ltd., a Singapore-based global provider of logistics facilities, will boost its U.S. presence by 50 percent with the $4.55 billion purchase of a 58 million-square-foot industrial portfolio from Industrial Income Trust. The acquisition of the Denver REIT’s assets, expected to close later this year, would make GLP the second largest owner of U.S. industrial real estate.

The deal comes just a few months after GLP made its first foray into commercial real estate in the United States with the purchase of a 55 percent stake in IndCor Properties, an industrial platform with 117 million square feet of high-quality properties that Blackstone had sold to GIC, Singapore’s sovereign wealth fund for $8.1 billion. The amount GLP paid GIC for the IndCor stake was not released. With both portfolios, GLP’s U.S. footprint will expand to 173 million square feet, putting it behind U.S. industrial leader Prologis Inc. Upon closing of the IIT deal, GLP’s global portfolio will have more than 500 million square feet in the U.S., China, Japan and Brazil and approximately $33 billion in assets under management.

The Wall Street Journal reports the acquisition will be one of the largest real estate deals this year. The first half of 2015 was marked by an uptick in M&A activity and CRE experts recently told Commercial Property Executive the deals were expected to continue the rest of the year fueled by plentiful capital, activist investors seeking to raise shareholder values and an influx of foreign investors like GLP. When GLP and GIC announced the IndCor deal in December, they said they were attracted to the U.S. industrial market in part because it had 18 consecutive quarters yielding positive net absorption.

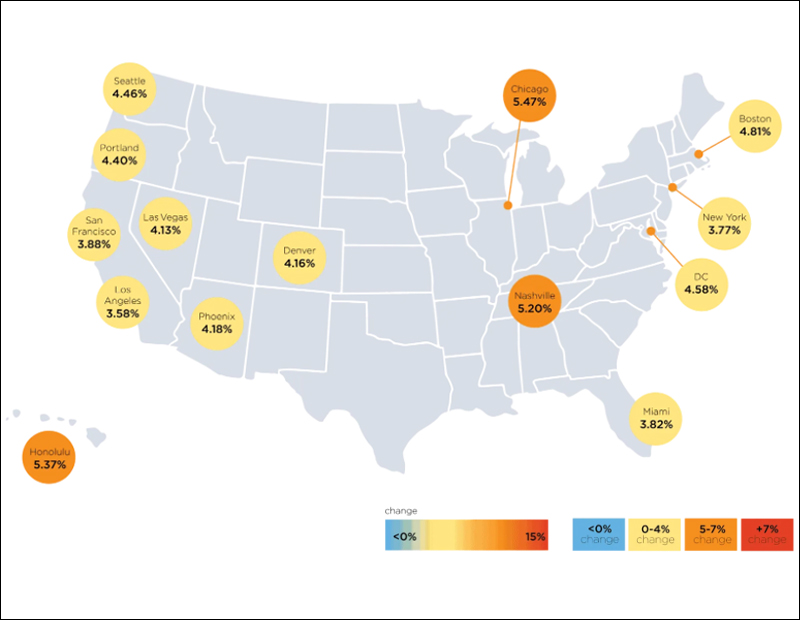

The IIT portfolio consists of assets in 20 markets, including logistics and transportation hubs in Arizona, California, Florida, Georgia, New Jersey, Pennsylvania, Texas and the metropolitan Washington D.C. region. The portfolio was 93 percent leased as of June 30. GLP is aiming to increase that to 95 percent.

“This transaction complements our existing portfolio well, expanding GLP’s size and scale in the U.S.,” Stephen Schutte, GLP Chief Operating Officer, said in a prepared statement. “We feel particularly good about the quality and location of the facilities, which have an average building age of 15 years and a strong concentration in major distribution markets. We are excited about the synergies the combined portfolio is expected to generate and see upside potential from increasing occupancy and rents.”

GLP will own 100 percent of the assets when the deal is expected to close in November, but then will pare its ownership down to 10 percent by April 2016. The firm said in its prepared statement that demand from major institutional investors – both new and existing capital partners – looking to invest with GLP in U.S. industrial real estate is strong.

“This is an accretive opportunity for GLP that allows us to strengthen our U.S. market presence and growth prospects with minimal incremental overhead,” GLP CEO Ming Mei said in a prepared statement. “The fund management platform is one of GLP’s main sources of capital to fund our growth. The fund syndication offering for our first U.S. income fund was significantly oversubscribed. Building on the positive momentum, we remain confident of injecting this portfolio into our fund management platform by April 2016.”

GLP said its initial equity commitment of $1.9 billion will be funded by cash on hand and existing credit facilities.

The IIT Board of Directors has unanimously approved the deal, although stockholders of the non-traded REIT must also OK the transaction. If all the approvals are in place, the acquisition by Western Logistics II L.L.C., a GLP affiliate, will be completed no later than Nov. 16. IIT said in a prepared statement that it will also transfer 11 properties that are under development or in the lease-up stage to a liquidating entity, which will sell the excluded properties following the closing of the GLP deal to maximize the value for IIT’s stockholders. IIT said it estimates stockholders could receive approximately $11.12 per share.

Tom McGonagle, IIT’s CFO, said in the IIT prepared statement that the deal would be “the successful result of a thorough process that we and our board undertook over the past 12 to 18 months.”

IIT purchased its first property in June 2010 and through 2013 raised approximately $2.2 billion of equity capital from investors.

“Over the past few years our team has built an extremely high-quality portfolio of nearly 300 industrial properties aggregating over 60 million square feet, including our projects under development,” IIT CEO Dwight Merriman said in the prepared statement.

He added that he believed the deal “provides compelling value for all of our stockholders.”

Both firms said the portfolio was being acquired at a 5.6 percent cap rate.

“We believe the cap rate of 5.6 percent represented by the purchase price reflects the outstanding quality of our properties across the portfolio,” McGonagle said in his prepared statement.

IIT said BofA Merrill Lynch was acting as its financial advisor and Hogan Lovells U.S. L.L.P. was providing legal services.

You must be logged in to post a comment.