Growing Cloud Fuels Data Center Boom: JLL Report

New challenges await, but the cloud will continue to accelerate demand this year.

By Barbra Murray

The data center market is on fire, and it’s getting cloudier out there. JLL just released its latest Data Center Outlook report, and demand continues to soar globally, due in no small part to the widespread transfer from corporate servers to the cloud.

“In 2016, the data center market saw big deals from major players, new economic and regulatory policy, and the wild card that is strategic cloud adoption. These factors are changing the rules of the game, from data center pricing models to location selection tactics–and everything in between,” according to the report.

Data center users’ attraction to the Internet of Things and cutting-edge technologies offered by the three major cloud computing providers–Amazon Web Services, Microsoft Azure and IBM–will only increase the cloud momentum. As a result, service providers in hub locations around the world will be compelled to expand. Some leading cloud providers, per the report, expect to triple infrastructure by 2020 in order to accommodate mounting demand.

Activity in leasing is also being impacted by the cloud, which is sparking a change in data center footprints. As more five-year leases expire in 2017, users will have the option to move to cloud technology and restructure or right-size their colocation footprint. Regardless, leasing activity will continue on the upswing. In 2016, absorption hit record highs. In the U.S., the top 15 markets reached 357.5 megawatts, with Northern Virginia leading the pack–by a longshot. The suburban Washington, D.C. was also at the top of the list in 2015, but the numbers weren’t quite as large. What a difference a year makes.

“The biggest change since last year was the significant positive year-over-year absorption in Northern Virginia, Northern California and Chicago, coming from the growth of cloud providers and their hyper-scale requirements,” Bo Bond, managing director and data center solutions co-lead with JLL, told Commercial Property Executive. “Absorption in Northern Virginia grew from 63 MW in 2015 to 113 MW in 2016, Northern California grew from 38 MW to 59.1 MW and Chicago grew from 32.5 MW to 56 MW.”

Tysons Technology Center, Vienna, Va., recently acquired by a joint venture of Central Colo and Legacy Investing L.L.C. from The Meridian Group.

While the data center market is on track to escalate further in 2017, there are definite changes ahead, as well as a few unknowns. Stricter data regulations are emerging, as is the case in Canada, where companies are mandated to store their data on Canadian soil, and in Russia, which is tightening its data sovereignty law. In Europe, only time will tell how Brexit will affect the industry, and in the U.S. the new presidential administration presents uncertainty.

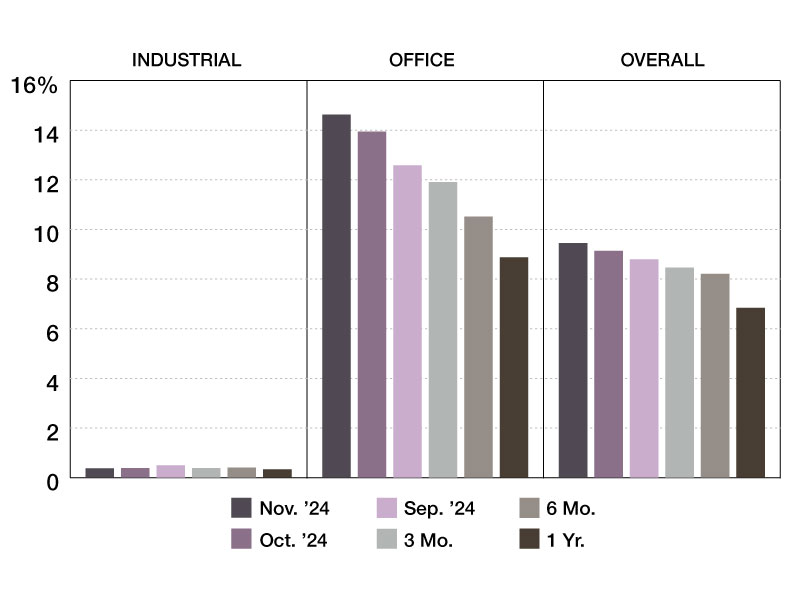

There are other trends on the horizon for 2017. As noted in the report., JLL expects that increasing M&A activity will “disrupt the playing field, while raising barriers to entry for newcomers to join the game.” Retail pricing may become a thing of the past, as wholesale pricing becomes the norm. And investor appetite for data center REITs will only grow stronger, driven by this REIT niche’s admirable average return on investment, which is generally in the 10-15 percent range.

However, the big takeaway from the report circles back to growth. “User demand for smart data center solutions will only continue to heat up, with operators feeling the pressure to deliver more data, faster and more flexibly than ever,” said Jon Meisel, managing director and data center solutions market director with JLL, said in prepared remarks. “Smart maneuvering will be necessary for users and operators alike to flourish in the coming months.”

You must be logged in to post a comment.