Has the Return-to-Office Trend Peaked?

A new white paper from Placer.ai tracks some of the recovery’s key aspects and surprises.

The history of the post-pandemic “return to office” is not yet resolved, according to a new report from Placer.ai, and that means that it’s still hard to make complete sense of it all.

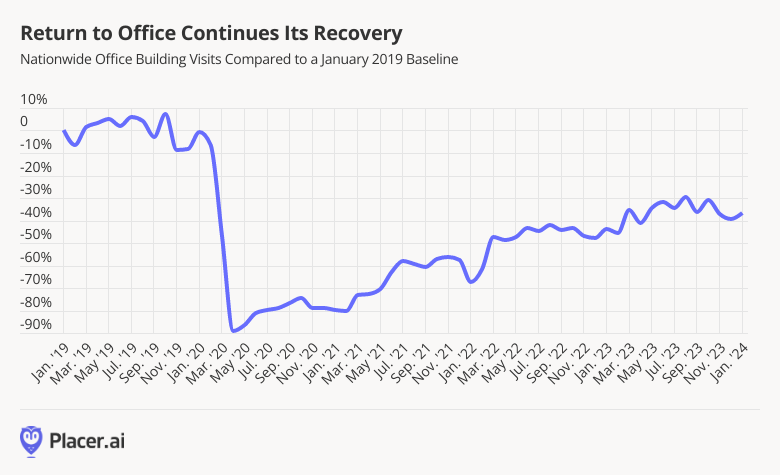

Placer.ai’s analysis of office building foot traffic over the past several years shows that after nosediving during COVID, office visits across the U.S. began an upward climb in 2021, reaching about 70 percent of January 2019 levels in August 2023.

The recovery seems to have stalled at that time, Placer.ai reports, leading some to conclude that RTO has peaked. The company suggests, however, that winter weather and holiday work patterns obscured any true setbacks to RTO. “Indeed, if 2024 is anything like last year, office visits may yet experience an additional boost as the year wears on,” the report states.

Placer.ai describes a growing consensus that even though in-person work carries important benefits, plugging in remotely at least part of the time also has its upsides. The report notes that “there’s evidence to suggest that remote work can enhance productivity by limiting distractions and letting workers lean into their individual biological clocks (so-called ‘chronoworking’).”

READ ALSO: Where to Find the Bright Side of Office

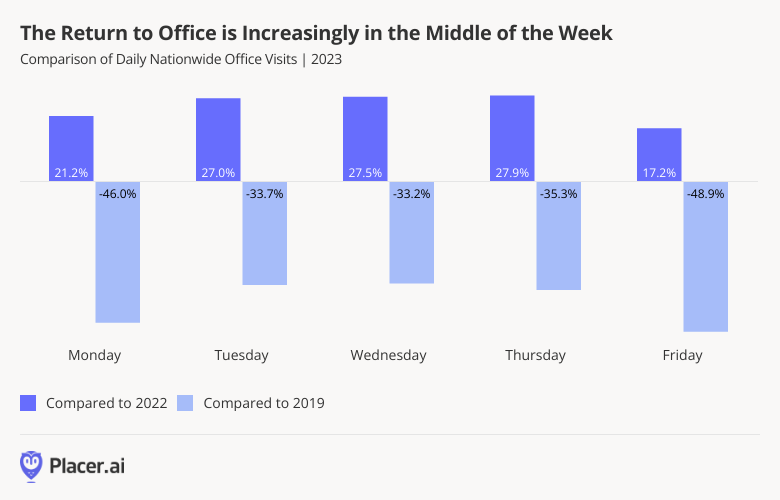

One illuminating observation is the “TGIF work week.” Data on office building foot traffic indicates that this past year, “office recovery was heavily concentrated mid-week, and more sluggish on Mondays and Fridays.”

Another interesting aspect of RTO is a potential segregation by socioeconomic status. Although higher-HHI (household income) employees typically sheltered at home during the early pandemic period, and have access to remote and hybrid work arrangements, more and more of them are part of the RTO trend. Similarly, high-HHI young singles too were prominent in RTO in 2023, as were affluent Gen Xers.

Placer.ai states that “early-career professionals appear eager to take advantage of the benefits of working in-person with colleagues, while more established Gen Xers—many of whom no longer have small children at home—may be coming into the office to lead by example.”

Geographic variations

The finance sector seems to be a leader in RTO. New York, for example, with an office tenant mix heavy with FIRE (financial, insurance and real estate) employees, appears to be “ahead of the office recovery curve,” Placer.ai says.

Miami too is at the front edge of RTO. Like New York, it had 2023 office foot traffic nearing 80 percent of pre-pandemic levels.

You must be logged in to post a comment.