Have Cap Rates Peaked?

Key results from CBRE’s latest survey, plus predictions from a variety of experts.

Cap rate expansion may have very well peaked, but uncertainty will delay sales volume recovery until 2025, according to CBRE’s cap rates survey for the first half of the year.

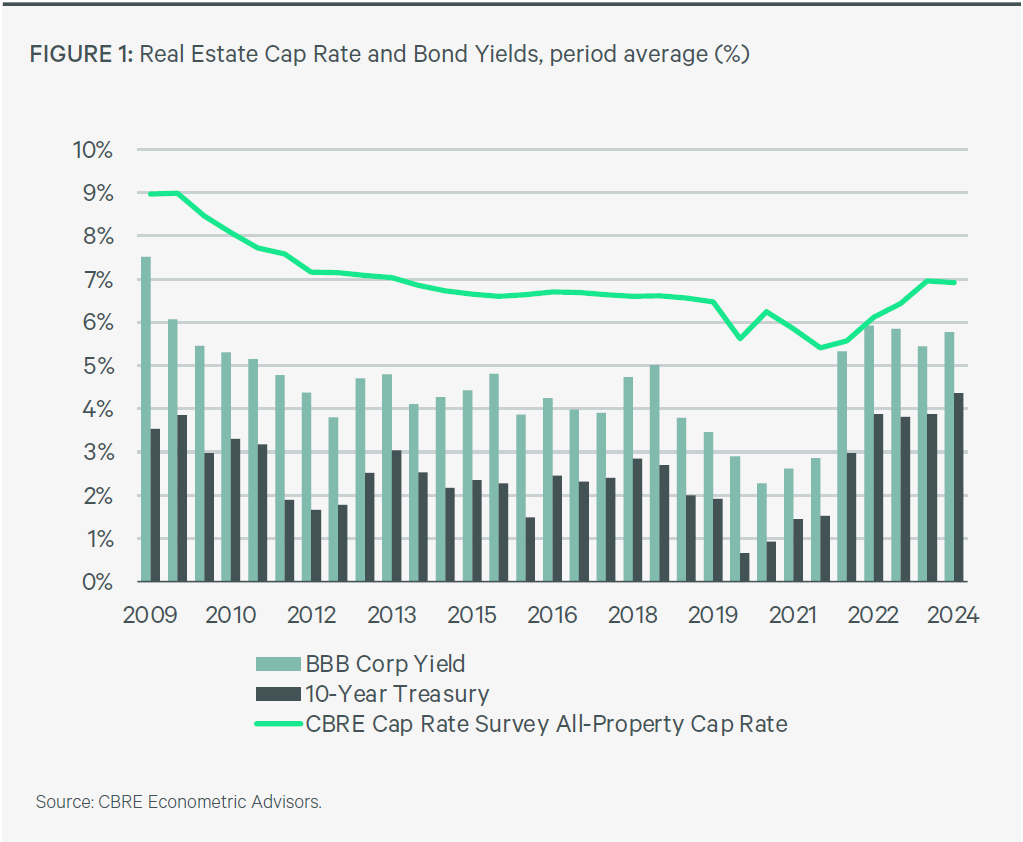

Treasury yields remained volatile during the first half of 2024, reacting to economic data that sent mixed signals about the outlook for inflation, Federal Reserve policy and long-term interest rates. The 10-Year Treasury yield started 2024 below 4 percent and peaked at 4.7 percent in late April.

Ultimately, continued disinflation and expectations for a Fed rate cut held the 10-year Treasury yield to 4.2 percent as of June.

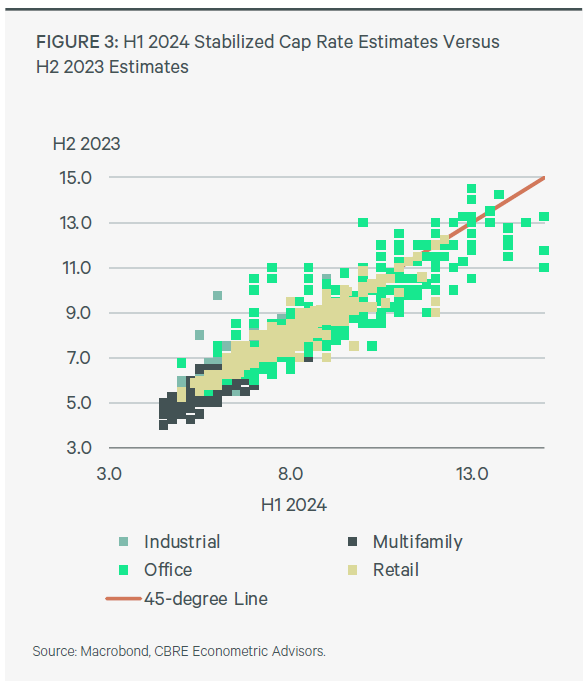

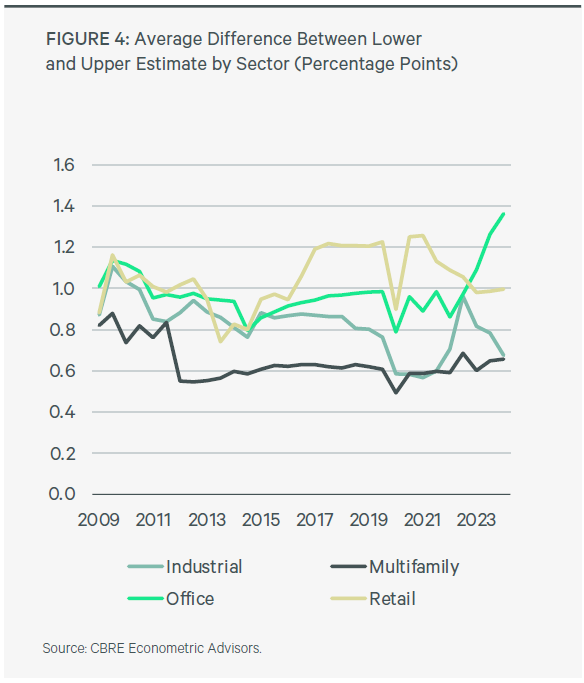

“Interestingly, different property types did not move in unison but rather reacted uniquely to changing fundamentals and capital markets drivers. For instance, industrial cap rates fell on average and office yields continued their climb,” according to the report.

READ ALSO: CRE Sentiment Ticks Down

More than 250 CBRE real estate professionals completed the survey with their real-time market estimates between May and June. The report captured 3,600 cap rate estimates across more than 50 geographic markets to generate key insights.

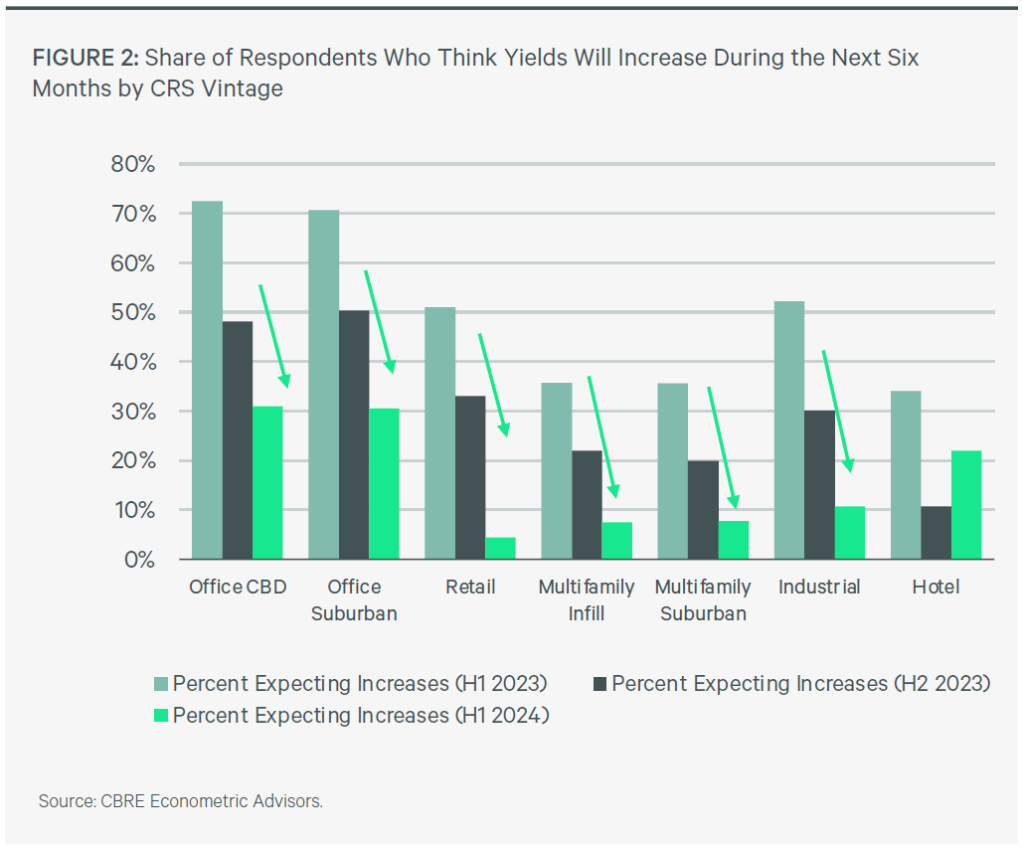

Every one of CBRE’s reports in the series asked respondents to estimate the direction of cap rates and the magnitude of the expected change during the next six months. This quarter, the most common response across all categories was “no change.” Fewer respondents believe cap rates will increase during the next six months compared to the previous two publications.

“This improved sentiment is likely driven by more accommodative signals from the Fed and the decline in bond yields from their October 2023 peak,” the survey revealed.

The share of respondents expecting further devaluations was highest within the office sector, reflecting the uncertainty around market fundamentals.

Buyers coming off the sidelines

Doug Ressler, manager of business intelligence at Yardi Matrix, told Commercial Property Executive that it appears that cap rates have indeed peaked but ongoing uncertainty is expected to delay sales volume recovery until 2025.

“During the first half of 2024, cap rates held steady despite fluctuations in Treasury yields,” Ressler said. “Different property types reacted uniquely to changing market conditions, with industrial cap rates decreasing and office yields continuing to rise. Most respondents in the survey believe that cap rates will remain stable in the near term.”

Peaking will differ by market and property type, Ryan Severino, chief economist at BGO, told CPE.

“There has been tentative evidence of peaking broadly, and that looks almost certain with the Fed set to start cutting rates,” Severino said. “The first-order effect of a rate cut won’t have much impact. But the second-order effect, decreasing the risk premia embedded in cap rates, should be more meaningful—especially with the record amounts of dry powder sitting on the sidelines like Pavlov’s dogs waiting for the Fed to ring the bell.”

Matthew Lawton, executive managing director at JLL, mentioned cap rates peaked in the second quarter and have a downward trend based on some recent transactions, including the KKR portfolio acquisition and other recent one-off transactions in the multifamily space.

“We are seeing a significant number of buyers coming off the sidelines due to several factors, including discount-to-replacement costs, lack of new starts that will lead to outsized rent growth and bringing in residual cap rates due to treasuries stabilizing and coming in more recently,” Lawton pointed out.

Equilibrium must avoid negative leverage

Recent data suggests there is uncertainty in office cap rates in some major markets, according to Jeff Holzmann, COO at RREAF Holdings.

He further added, “But that peak assumption is only a short-term observation since the cap rates are closely related to interest rates. The equilibrium can only survive long term as long as we are not in the zone referred to as negative leverage. This occurs when the effective cap rate is lower than the interest rate of the debt, which means that even a functioning property that is producing cash flow can’t service its own debt, not to mention profits. That’s when properties fail, loans stop, and a new equilibrium must emerge.”

“Hence the future trajectory of the cap rates in the industry will depend on what the Federal Reserve does with the interest rates in the coming months. The consensus seems to be that rates will remain steady or possibly even decrease for the first time in a long time. This suggests we may see peak cap rates for quite some time,” Holzmann concluded.

Neil Schimmel, Investors Management Group founder & CEO, noted that with inflation and debt pricing falling, cap rates are poised to follow suit.

“Loan rates have dropped 50 basis points in the past few weeks. Today’s underwhelming jobs report confirms the Fed’s success in cooling inflation. As a result, cap rates have likely peaked and will decline, though not to the lows of 2021 and 2022.”

David Camins, principal at Xroads Real Estate Advisors, told CPE that the argument could be made that cap rates have peaked in the office sector; however, they may be “the least of the worries for a potential buyer,” considering the number of lenders still not lending to the office sector.

“Anyone underwriting a loan or investment in the sector is not solely focused on a cap rate, as underwriting the cash flow for a multi-tenant office property is not as linear as it once was,” Camins said. “These days, it’s more akin to how hotel cash flows used to be underwritten.”

“Even if lease rates are relatively the same, they are materially different given the ‘new’ creativity within the concession packages. These all contribute to challenging cash flow projections, regardless of what economic factors are under consideration,” he concluded.

READ ALSO: 2024 Single-Tenant Office Quarterly Sales Volume & Cap Rates

The turbulence in the office sector is likely to continue into the next year, said Jay Rubin, principal at Lee & Associate, L.A. North/Ventura.

“The office leasing market still has not found its footing. … There is a lot of discussion and directives from corporations to bring employees back, but the process has been slow, and space needs have decreased,” Rubin noted, adding that cap rates may still increase depending on the submarkets, due to the current vacancy rates, the cost of improvements, interest rates and the upcoming presidential election.

It’s ‘irresponsible’ to call a peak

Patrick Nutt, senior managing principal & co-head of national net lease at SRS Real Estate Partners, told CPE that “Identifying the “peak” or “trough” of any valuation or market can only be done by looking in the rearview mirror after some time has passed, so it would be irresponsible to call a peak in cap rates today no more than it would to call the trough in late 2021.

“We are nearing a point of equilibrium or can sense that point coming in the near term, which should call for cap rate expansion to level off with slight compression of cap rates for specific assets, tenants and geographies,” Nutt said, also mentioning the emergence of two positive trends in the coming 12 to 28 months.

“First, the Fed’s beginning to cut interest rates, causing the yield on savings accounts, CDs, and money market funds to come down, incenting those investors to seek alternative destinations for those dollars. Secondly, the anticipation of rate cuts has already lowered the benchmark US Treasury yield.”

The second trend will spur two outcomes, according to Nutt:

“a) lower Treasury yields improve borrowing costs and raise leverage points given the recent constraint for debt being debt coverage ratios, and b) as short-term Treasury bills mature, replacing those same bond products would result in materially lower yields, driving the proceeds of these short-term Treasury bills back into active investments.”

Nutt further detailed that “If borrowing costs continue to march lower in an organized fashion, the velocity of transactions across all asset classes will improve … which can only have a positive effect on pricing and cap rates.”

Elections pose political risk

Brandon Polakoff, principal & vice president of tri-state investment sales at Avison Young, said it was too soon to say that cap rates have peaked, as “Values are at, or at least near, the bottom of the market. Rate cuts appear imminent, but there have been far too many false starts over the last few years and it’s best not to assume a soft landing.”

“The upcoming U.S. election poses a political risk factor on cap rates,” Polakoff noted. “After several years of volatility, real estate advisors can best serve their clients by staying informed, practicing nimbly and avoiding trying to be an oracle by making predictions. New legislation negatively impacting real estate will create more upward pressure on cap rates. Any major curve ball can immediately shake the market.”

J.D. Blashaw, vice president with MetroGroup Realty Finance, mentioned stability in the capital markets as the best indicator for transaction volume and the trajectory of cap rates moving forward.

“Though the sustained higher rate environment over the last 2 years has certainly put upward pressure on cap rates across asset classes, the volatility of interest rates has dampened transaction volume,” according to Blashaw.

“Buyers and sellers need a more sustainable and predictable cost of capital to price efficiently and increase the flow of transactions. If we look at the 10-year T-bill over the last 12 months, the rates on Aug. 1, 2023, and Aug. 1, 2024, are about the same, around 4 percent. However, over every three months, the rate whipsawed up and down between 50 and 75 basis points as the markets tried to predict future Fed movement with every inflation and jobs report.”

Blashaw said as things stand today, rates have been down over 50 basis points since the start of July, as inflation has cooled off again.

“Recent job reports show potential cracks in the economy, and pricing in at least one or more rate cuts this year,” Blashaw continued. “Even with treasuries down, all-in rates may not move in lockstep as lenders may increase credit spreads due to deteriorating economic indicators. If the recent trend stands and the Fed starts to reduce rates sustainably, we expect cap rates to stabilize or compress a bit and volume to pick up in the first half of 2025.”

Here come rate cuts

Robert Martinek, director at EisnerAmper, told CPE he expects cap rates to remain steady for the short term, but start trending down if inflation maintains its current path and rate cuts occur.

“I would not rule out cap rate increases for certain asset classes in weaker markets. Tenant quality will be a big driver of asset demand. If interest rates move lower, I anticipate more Class B and C product to trade,” Martinek said, adding that Class A product in Class A locations will be in focus and attract the greatest transaction interest.

READ ALSO: As Office Pipeline Shrinks, Existing Class A Buildings Should Benefit

David Druey, Florida regional president of Centennial Bank, noted: “Traditionally, rising interest rates lead to higher cap rates. However, over the past two years, cap rates have either remained steady or decreased, reaching historically low levels. These low cap rates indicate high property valuations. If cap rates rise slightly, it could be beneficial for the economy by bringing valuations closer to more sustainable levels.”

“I anticipate the Federal Reserve will cut rates by 25 to 50 basis points,” Druey continued. “Lower rates are likely to boost sales activity, leading to an increase in transactions. We should also see cap rates normalize somewhat in response to these rate adjustments.”

David Frosh, CEO of Fidelity Bancorp Funding, said coastal markets have very low cap rates and transaction volume is still very low.

“Cap rates are up almost everywhere, but the two primary data points are distressed deals and really good deals,” Frosh said, adding that the data set is obviously accurate but not helpful because of limited and unique data.

“In healthy markets, cap rates should be 150 to 250 basis points over interest rates. The real question is what happens to mortgage rates once the Fed starts dropping rates. Will mortgage rates follow? It is not certain.”

Jeff Brown, CEO of T2 Capital Management, mentioned that “A deeper analysis is necessary to project the dispersion of cap rates by property type, location and other variables. It seems reasonable to expect high-demand assets such as multifamily and build-to-rent properties to outperform.”

Benjamin Kadish, president at Maverick Commercial Mortgage, identified a sudden drop in the treasuries, allowing for buyers to secure more attractive loans and prices to stabilize.

“It’s notable that I do not expect this dynamic to apply to office buildings, which have their own set of challenges,” Kadish went on. “Industrial and retail should absolutely benefit from the lower rates this market dynamic is expected to bring.”

You must be logged in to post a comment.