Health Care REITs Outperform

This property type posted the highest one-year average dividend yield in the sector and outperformed the broader SNL U.S. REIT Equity Index by 1.78 percentage points.

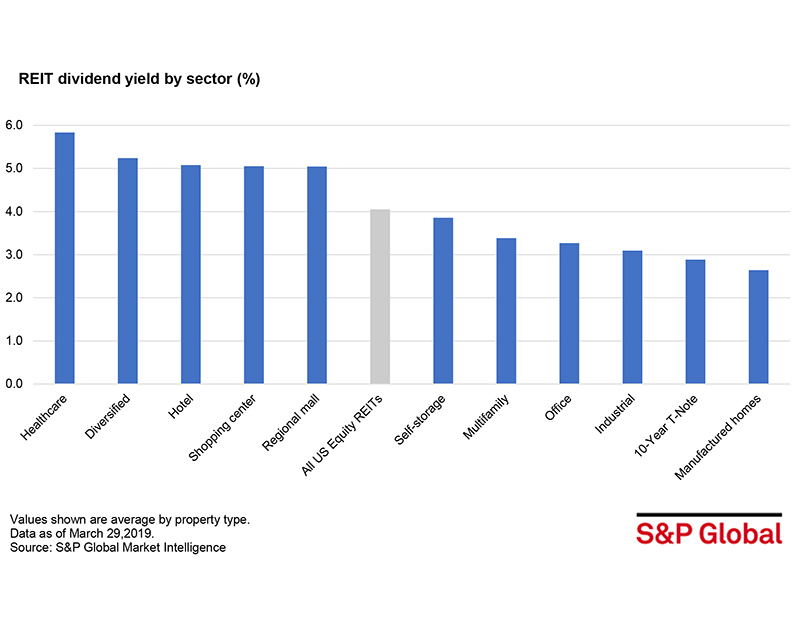

The health care REIT sector posted the highest one-year average dividend yield among the group, at 5.83 percent, outperforming the broader SNL U.S. REIT Equity Index by 1.78 percentage points. The diversified and hotel REIT sectors followed with 5.24 percent and 5.08 percent one-year average dividend yields, respectively.

The manufactured home REIT sector, on the other hand, registered the lowest one-year average yield at 2.64 percent. This dividend yield trailed the one-year average 10-year treasury note by 24 basis points.

Carter Phillips is an analyst in the real estate client operations department of S&P Global Market Intelligence.

You must be logged in to post a comment.