Manufactured Home REITs Trade at Greatest Premium to NAV

At the other end of the spectrum, the regional mall REIT sector traded at the greatest median discount to NAV.

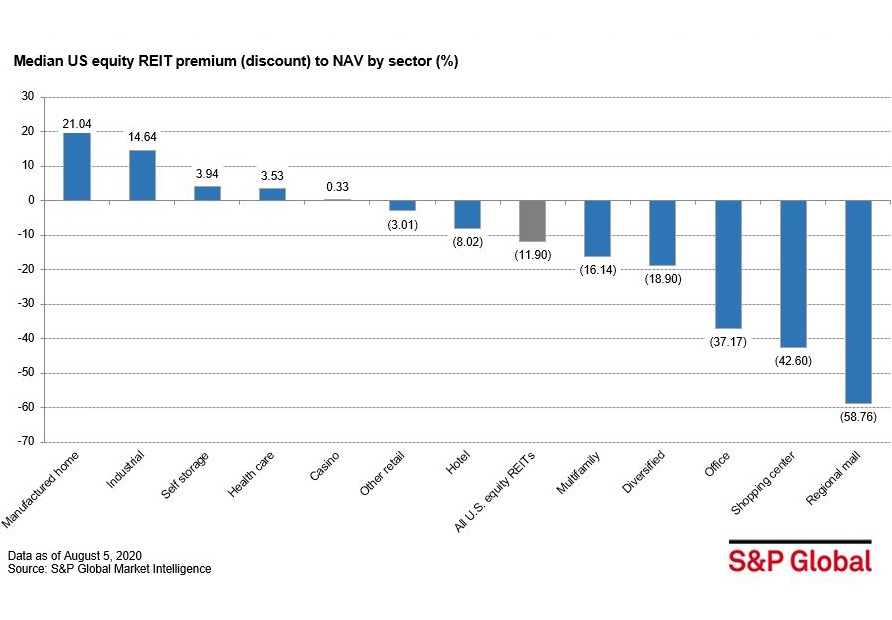

As of Aug. 5, 2020, publicly listed U.S. equity REITs traded at a median discount to consensus net asset value of 11.90 percent.

As of Aug. 5, 2020, publicly listed U.S. equity REITs traded at a median discount to consensus net asset value of 11.90 percent.

The manufactured home sector traded at the greatest median premium to NAV, at 21.04 percent. The industrial REIT sector was next in line, trading at a median premium to NAV of 14.64 percent.

At the other end of the scale, the regional mall REIT sector traded at a discount of 58.76 percent, currently the greatest median discount to NAV. The shopping center REIT sector followed with 42.60 percent median discount to NAV.

At the company level, hotel REIT, Park Hotels & Resorts, Inc. traded at the largest premium to NAV, at 156.57 percent. Right behind were Community Healthcare Trust Incorporated and Safehold, Inc., trading at premiums to NAV of 106.56 percent and 88.08 percent, respectively.

Pennsylvania Real Estate Investment Trust traded at the largest discount to NAV of all U.S. REITs, at 130.95 percent. CBL & Associates Properties, Inc. a regional mall REIT, and shopping center Cedar Realty Trust, Inc., were also at the bottom of the list with large discounts to NAV of 79.16 percent and 74.25 percent, respectively.

Diana Rose Barrun is an associate in the real estate client operations department of S&P Global Market Intelligence.

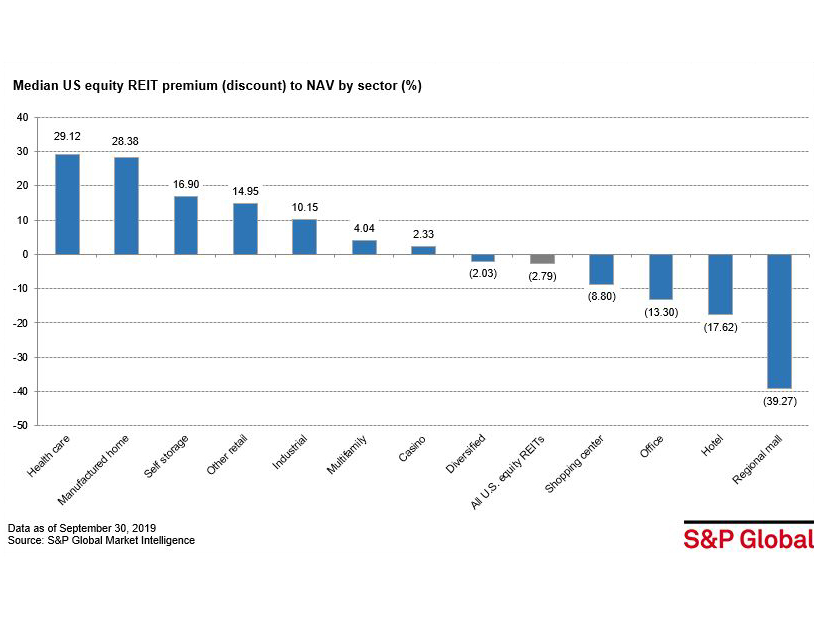

As of Sept. 30, 2019, publicly listed U.S. equity REITs traded at a median discount to consensus net asset value of 2.79 percent.

The health-care sector traded at the greatest median premium to NAV, at 29.12 percent. The manufactured home and self storage REIT sectors were next in line trading at median premiums to NAV of 28.38 percent and 16.90 percent, respectively.

At the other end of the scale, the regional mall REIT sector traded at a discount of 39.27 percent, currently the greatest median discount to NAV. The hotel REIT sector followed with 17.62 percent median discount to NAV.

At the company level, hotel REIT Community Healthcare Trust Inc. traded at the largest premium to NAV, at 98.88 percent. Right behind were Omega Healthcare Investors, Inc. and Realty Income Corp., trading at premiums of 57.11 percent and 44.65 percent, respectively.

CBL & Associates Properties Inc. traded at the largest discount of all U.S. REITs, at 55.2 percent. Ashford Hospitality Trust, Inc., a hotel REIT and speciality REIT Farmland Partners Inc. , were also at the bottom of the list with large discounts of 46.18 percent and 45.87 percent, respectively.

The U.S. multifamily REIT sector traded at a median premium to consensus net asset value of 4.04 percent as of Sept. 30, 2019.

Within the sector, NexPoint Residential Trust Inc. traded at a premium to NAV of 13.8 percent. Essex Property Trust, Inc. and Equity Residential were next in line at 12.28 percent and 11.45 perent premiums, respectively.

Trading at the greatest discount among multifamily REITs was Bluerock Residential Growth REIT, Inc. at 19.05 percent. Preferred Apartment Communities, Inc. and BRT Apartments Corp. followed, trading at 9.91 percent and 4.2 percent discounts to NAV as of Sept. 30, 2019.

Aftab Alam is a senior associate in the real estate client operations department of S&P Global Market Intelligence.

You must be logged in to post a comment.