Hotel Development Pipeline to Slow: HVS

Projects under construction are generally continuing but the new hotel development will face feasibility and financing challenges.

Developers will be cautious in taking on new building projects because of impacts from the COVID-19 crisis, leading to a slowdown in new supply, according to the latest HVS report on U.S. hotel development costs.

READ ALSO: Service Properties Trust Terminates Agreements for 122 Marriott Hotels

The U.S. Hotel Development Cost Survey 2020 released by the global hospitality consulting company states that during recessionary years the development pipeline slows significantly because of two factors: feasibility and financing, The 17-page report was authored by Luigi Major, managing director & partner at HVS Los Angeles. Other contributors were Suzanne Mellen, Lizzette Casarin, Kathryn Lutfy and Astrid Clough McDowell.

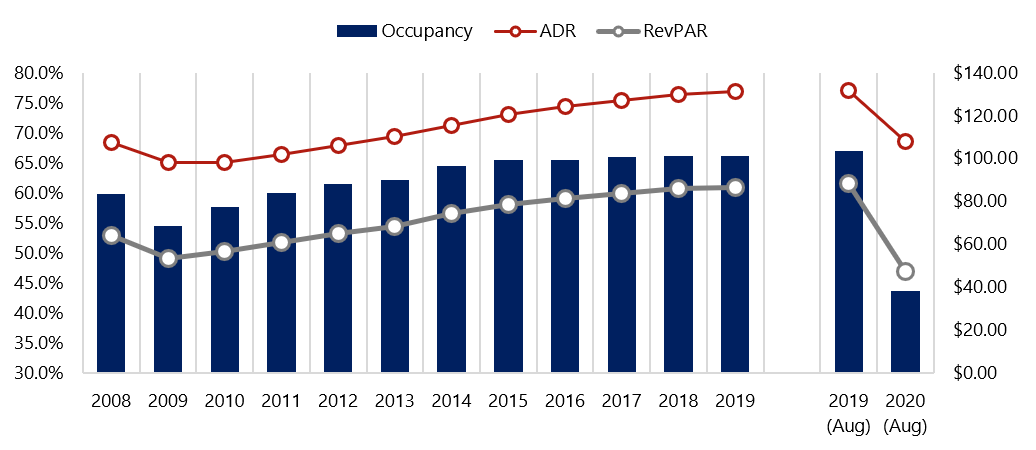

The report states that even though a proposed hotel will not open for two to three years, decreases in occupancies, and particularly average daily rates, affect future forecasts for the property’s business. Financing for new developments in the years following a recession can also become harder because lenders are uncertain about the industry’s future and want to avoid high-risk investments. The limited availability of capital becomes an issue, and even those developers who can get capital may do so with much lower loan-to-cost ratios and higher interest rates. HVS notes that compared to the recession of 2008-2009, the capital markets are functioning due to government efforts, but liquidity challenges are likely to remain going forward and may actually deepen.

Estimates lowered

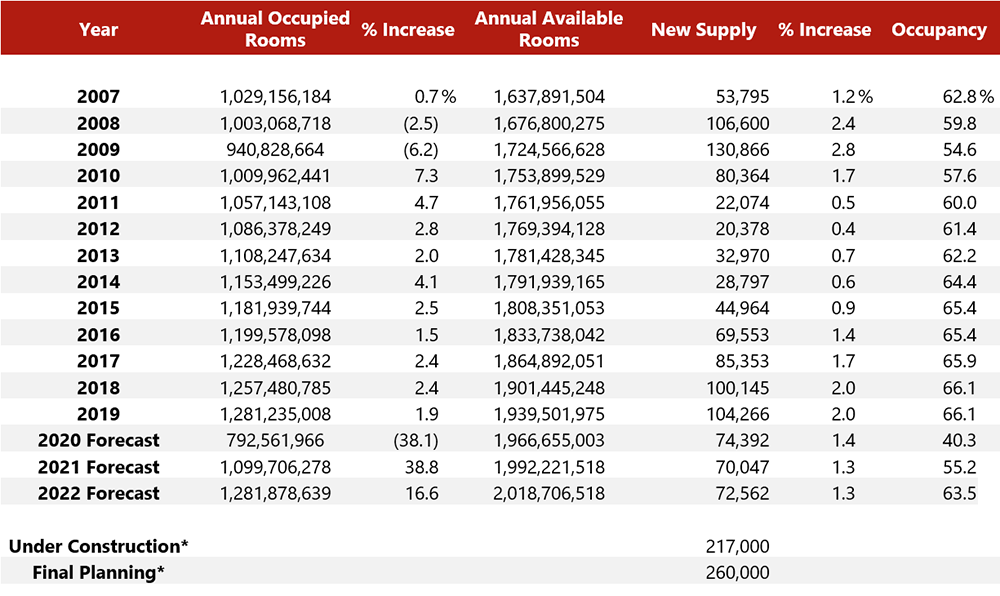

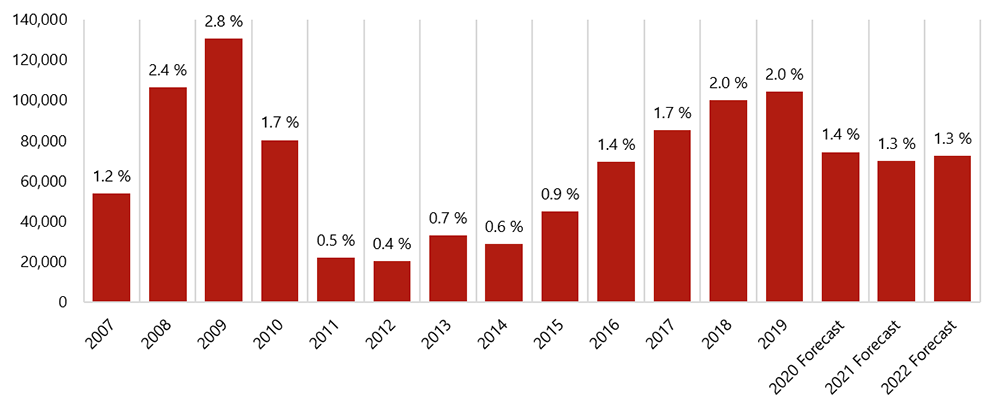

The pandemic-related challenges are coming after a record year for U.S. hotel development in 2019, when the industry had the highest occupancy and ADR ever recorded. HVS notes there was a 2 percent increase in new supply in 2019, representing about 104,000 new hotel rooms. Another 2 percent boost in supply was expected this year. Then COVID-19 hit the United States in March, which led to many hotels closing temporarily or permanently.

New supply growth is now estimated at 1.4 percent by the end of 2020, as it looks like a number of new hotel developments will not be completed this year. Citing statistics from STR, a hospitality industry data benchmarking and analytics firm, the HVS report estimates the new supply growth to be about 1.3 percent for 2021 and 2022.

The pace of new supply growth slowed substantially to an average of 0.6 percent from 2011 through 2015, following the 2009 downturn. But despite the current economic doldrums, hotel supply will increase due to the number new projects already underway.

“New supply resulting from new hotel openings is expected to remain elevated in 2020 and 2021, given most hotels with openings in these two years have recently opened or are already under construction,” said Major. “This increase may be offset somewhat by hotels that suspend operations (temporarily or permanently) as a result of COVID-19.”

Major said it is still too early to tell how many hotels may suspend operations because the full effects of the pandemic on hotel demand remain uncertain.

“Ultimately, we may see a noticeable decrease in supply in 2022 and 2023, as projects with openings in those years will need to begin construction in the next 12 months and it is unlikely developers will undertake new projects in the immediate future given the current climate,” Major told Commercial Property Executive.

As of July, there were about 217,000 new hotel rooms under construction across the country, according to the American Hotel & Lodging Association. An additional 260,000 rooms were in the final planning stages and expected to begin construction within the next year. But some of those projects may be put on hold until revenue levels support feasibility of development. During the last recession, lower revenue, net operating income and estimated values caused some projects to be held up.

However, HVS notes that some developers have decided to move ahead with their plans because it can often take three to five years for a project to be completed, and they anticipate less competition for new supply. Major writes that recessionary periods can often be the best times to move projects through the lengthy predevelopment process. An added bonus—“construction costs can often decrease during a period of correction and deflation.” The report points to a gap between general inflation and construction inflation that has narrowed significantly in 2020 leading to lower construction costs so far in 2020, similar to the dynamic from 2008-2009.

Read the full report by HVS.

You must be logged in to post a comment.