Hotel, Retail Lead Late Loans—Will Other Assets Follow?

As signs of stress appear, Paul Fiorilla of Yardi Matrix takes stock of what's ahead for mortgage performance.

Paul Fiorilla, Director of Research, Yardi Matrix

The number of commercial mortgages in arrears continued to grow in May, with problems concentrated in hotels and retail centers. Although delinquencies remain low in other property types, signs of stress are beginning to appear.

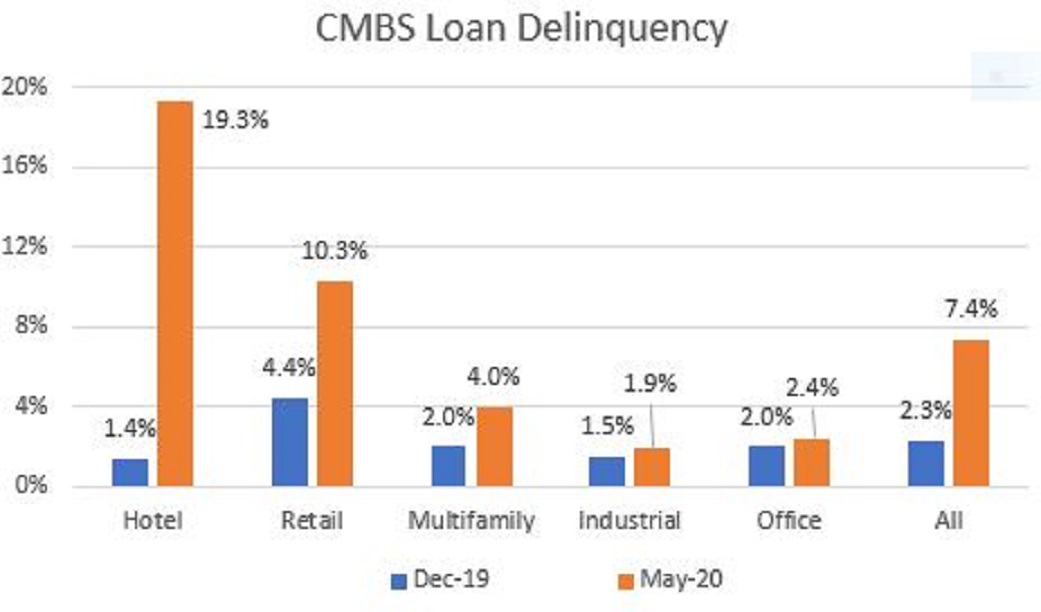

The percentage of delinquent CMBS loans rose in May to 7.4 percent, and the rate has more than tripled from 2.3 percent in December 2019, according to Trepp. The spike in delinquencies is driven by hotels, which rose to 19.4 percent in May from 1.4 percent in December, and retail, which hit 10.3 percent in May from 4.4 percent in December, Trepp said. The multifamily delinquency rate was a relatively low 4.0 percent in May, but double its December rate, while office (2.4 percent in May) and industrial (1.9 percent in May) each rose 40 basis points, Trepp said.

“We all expected May to be much worse than April, and we’re pleasantly surprised it didn’t turn out like that,” said one loan servicing executive. Monthly payments on properties backed by multifamily, office and industrial properties continue to top 95 percent, according to some servicers.

Forbearance Wave

All lenders have had a wave of borrowers seeking forbearance for loan payments, although perhaps not as large a wave as they expected. Forbearance requests are reviewed on a case-by-case basis. Borrowers must document that the reason they need extra time to make payments is due to COVID-19. In some cases, the demand for documentation causes some borrowers to rescind the request, and in other cases the request is not granted by the servicer.

Most of the data released on recent loan performance involves CMBS, but portfolio lenders are having a similar experience with loan performance bifurcated by property type and geography, said Jamie Woodwell, vice president of research and economics at the Mortgage Bankers Association. “Much of the larger challenges reside in lodging and retail, which makes sense given how close we are to the impact of the virus,” Woodwell said. CMBS pools have a larger portion of hotels and retail centers than portfolio lenders such as banks and insurance companies, which tend to concentrate on less risky asset classes, he said.

Source: Trepp

——

Multifamily rent payments were surprisingly strong again in May. The National Multifamily Housing Council reported that 93.3 percent of renter households had made payments as of May 27, a decrease of only 1.5 percent compared to the same period in May 2019 and an uptick from 91.7 percent on April 27. The strong performance likely reflects the extra $600 per week in emergency unemployment aid; that federal program has two more months to run before it expires.

The federal CARES Act requires Fannie Mae and Freddie Mac to give qualified borrowers 90-day forbearance. Last week Freddie reported that through May, borrowers on slightly more than 1,000 loans totaling $6.4 billion were granted forbearance. That represents 4.3 percent of Freddie’s loans and 2.3 percent of its securitized loan balance. The forborne loans have concentrations are proportionately higher in Freddie’s small-balance, student housing and senior housing loan programs.

Next steps for aid

For the near future, key questions include how long portions of the economy will stay shut down and whether the federal government will continue to pump in financial aid. For hotel and retail properties, the outlook appears to be grim. Revenue per available room (RevPAR) fell nearly 80 percent year-over-year in April and will decline 57.5 percent this year, estimates STR, the hotel data firm. Meanwhile, retailer bankruptcies continue to pile up, and in many retail centers, fewer than half of tenants are paying rent. Even in property sectors that have performed relatively well so far, that will change if the recession goes on much longer or gets much deeper.

Some of the positive loan performance to date is the result of federal support through unemployment aid and aid to businesses such as the Paycheck Protection Program, which has pumped more than $500 billion into the economy. The PPP was distributed in the form of loans that will be forgiven if at least 75 percent of the money goes toward payroll. However, that stipulation means that little of the PPP loans can be used to help businesses pay rent. There is an effort to lower the 75 percent requirement down to 60 percent so more of the funds can be spent on expenses other than payroll.

In April, the Federal Reserve announced its $600 billion Main Street Lending Program to help small businesses get through the crisis. Congress is debating whether to extend extra federal unemployment benefits and whether to provide aid to help state and local governments avoid massive layoffs in the wake of lost tax revenue.

You must be logged in to post a comment.