Houston Office Figures Lag Behind National Metrics

Deliveries declined by nearly half year-over-year, according to the latest CommercialEdge report.

Houston’s office sector continued to show mixed signals in the fourth quarter of this year. Despite signs of improvement in vacancy, which decreased 120 basis points year-over-year as of November to 24.3 percent, there is still a large share of available space, CommercialEdge data shows.

Developments and completions in metro Houston were below national figures as well. About 1.8 million square feet were under construction as of November, accounting for 0.7 percent of total stock. In terms of deliveries, less than 1.4 million square feet came online in the first eleven months of the year.

The metro’s investment volume remained steady, registering $940 million during the same period. However, assets traded well below the $179 per square foot national threshold, also due to several foreclosures in the metro.

Developments and completions remain below national figures

As of November, Houston’s underway pipeline consisted of almost 1.8 million square feet. This accounts for 0.7 percent of the metro’s total stock, faring better than Washington, D.C. (0.4 percent) and Phoenix (0.4 percent), but slightly below the 0.8 percent national index. Boston (3.6 percent) and Nashville (3.6 percent) had the largest share of under-construction space out of total inventory.

The market’s share of office space in the development and planning phases stood at 1.9 percent of existing stock, still under the national figure (3.0 percent). Atlanta (2.3 percent), Dallas (4.9 percent) and Austin (12.9 percent) were some of the more active metros.

One of the largest projects underway in Greater Houston is Building 5 within the South Campus Research. The University of Texas System is developing a seven-story, 600,000-square-foot office and research facility, expected to come online in the third quarter of 2027.

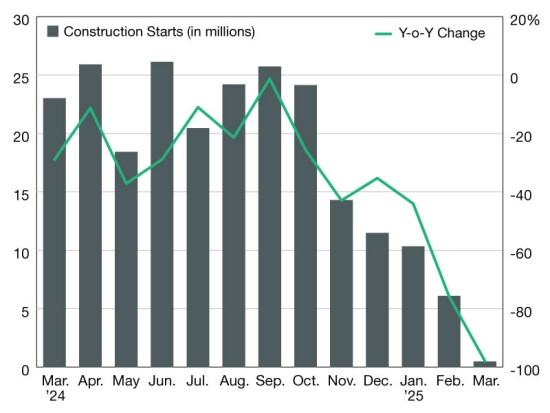

In terms of completions, Houston’ office sector saw roughly 1.4 million square feet coming online year-to-date as of November, accounting for 0.5 percent of its total stock. This figure was also lower than the national average, which stood at 0.6 percent, and represented an almost 50 percent drop year-over-year.

Among other major markets, the metro fared betted than Denver (1.3 million square feet) and Phoenix (646,629 square feet) but trailed behind Austin (2.1 million square feet) and Dallas (2.8 million square feet).

Earlier this year, Skanska completed 1550 on the Green, a 28-story, 382,000-square-foot office building in the city’s downtown. The high-rise is LEED Platinum-certified and has ground-floor retail space.

Office-to-residential conversions gain traction

Last year, CommercialEdge introduced the Conversion Feasibility Index, a tool powered by Yardi designed to evaluate the potential of converting office buildings into multifamily residences. As the trend of office-to-residential adaptive reuse gains traction, the CFI offers crucial insights for investors.

While Texas metros may not rank among leading U.S. markets for repurposing buildings, Houston currently has 152 office properties—totaling 24.9 million square feet—with a score higher than 75, placing them as Tier I and II candidates for potential conversions.

Earlier this year, DeBartolo Development completed the $100 million office-to-residential conversion of 1801 Smith Street, a 20-story office building in downtown Houston which had a CFI score of 86, indicating that the asset bore strong conversion potential. Dubbed Elev8, the residential property now features 372 luxury units.

Additionally, the company is currently working on another adaptive reuse project: the conversion of a 19-story office high-rise totaling 827,596 square feet. Upon completion, the development will generate 311 apartments.

More Houston assets doomed to foreclosure

Houston’s office investment volume year-to-date as of November clocked in at $940 million. The metro was surpassed by markets such as Austin ($990 million) and Atlanta ($1.1 million), while Denver ($768 million) and San Francisco ($747 million) were at the opposite pole.

Assets traded at $107 per square foot on average, well below the $179 national figure. Manhattan ($379 per square foot) remained the most expensive market, followed by Washington, D.C. ($213 per square foot) and the Bay Area ($293 pe square foot).

In November, The National Bank of Kuwait sold the Twentyfour25 Galleria for $27 million, after it foreclosed on the 285,000-square-foot office building. The previous owner, an entity associated with Jetall Capital, defaulted on a $51.7 million loan.

Earlier this summer, Interra Capita Gorup acquired The Esperson Buildings, two properties spanning 600,000 square feet, following foreclosure. The firm paid $12 million for the assets, previously owned by Contrarian Capital Management.

Houston’s vacancy rate decreases year-over-year

Houston’s office vacancy rate at the end of November clocked in at 24.3 percent, a 120-basis-point decrease year-over-year. Despite the drop, the metro’s share of available space was considerably larger than the 19.4 percent national figure.

Among other secondary markets, Austin (27.7 percent) fared worse, while Dallas (23.0 percent) and Atlanta (17.8 percent) performed better.

In September, Enterprise Products Partners signed a 23,537-square-foot leasing agreement with Frost Brown Todd at its 1.3 million-square-foot 1100 Louisiana St. The legal counselors will occupy a full floor at the high-rise.

Greater Houston’s listing rates as of November reached $30.2, posting a 0.8 percent growth year-over-year. This figure was also below the $32.9 U.S. index, but closer to peer metros Dallas ($30.5) and Nashville ($31.0).

Coworking inventory remains constant

Houston’s office shared space inventory as of November totaled 4.5 million square feet across 229 locations. This accounted for 1.8 percent of the market’s total inventory, slightly below the 1.9 percent national rate.

The metro’s inventory was on par with Dallas, but surpassed Philadelphia (1.5 percent) and Austin (1.7 percent). Miami remained in the lead, with 3.7 percent of its total stock designated as coworking space.

Regus remained the largest coworking operator in the metro, with 574,106 square feet across 34 properties. The Cannon (444,341 square feet) and Workstyle Flexible Offices (372,169 square feet) rounded up the top three.

You must be logged in to post a comment.