How Are Driverless Cars Reshaping CRE?

Autonomous vehicles are expected to impact commercial real estate on several levels, from design to new development opportunities. Partner Engineering and Science's Joe Derhake zeroed in on the extent of these effects.

By Adina Marcut

Autonomous vehicles are steadily becoming a more commonplace, but the question that many people ask is how will this trend change our cities and, in particular, the commercial real estate market? Joe Derhake, CEO of Partner Engineering and Science, spoke with Commercial Property Executive on how parking demand will be affected by autonomous vehicles, especially in the office sector, and what is the overall impact of driverless cars on CRE.

What impact will driverless cars have on parking demand?

Derhake: Overall, parking demand will be significantly lowered, due to three major effects of driverless cars: People will rideshare even more than they do now with services like Lyft and Uber; driverless cars will park more efficiently and compactly; many driverless cars will be a roving fleet that drop off people or deliveries and go elsewhere, thereby not needing parking.

By how much will parking space be reduced? Will this mean that we will see extended commercial developments?

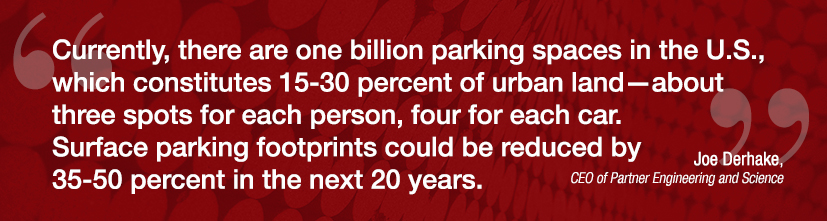

Derhake: Driverless cars can park efficiently using only 60 percent of the space of a current vehicle. Additionally, a reduction in car ownership (or multiple car ownerships), paired with roaming services, will reduce overall parking space needs. Currently, there are one billion parking spaces in the U.S., which constitutes 15-30 percent of urban land—about three spots for each person, four for each car. Surface parking footprints could be reduced by 35-50 percent in the next 20 years. Commercial spaces will be able to build more densely, which is better for prime real estate locations.

What are the downsides of this transition?

Derhake: Some properties will become obsolete very quickly, and owners and developers will scramble to adapt, while others will lose value in their investments. Similarly to Blockbuster (and other) video stores going out of business when Netflix came about or Borders bookstores shutting down in the face of Amazon e-commerce, large-scale change inevitably renders certain sectors and building types obsolete.

Which sector will be most impacted?

Derhake: Office. Accommodating for parking is hard on office space developers, so this will increase the breadth of building design options and locations and simplify office layouts. Secondly, commute tolerance will increase with driverless cars, which will impact the kind of workforce offices can attract.

What amenities will CRE developers have to include in their projects in order to adapt?

Derhake: Buildings will have to implement dedicated drop-off areas for ride share and delivery, a small sub-segment of buildings will allot space for efficient parking and computerized (automated) valet systems.

How are driverless cars influencing where we’re seeing new CRE development?

Derhake: The higher commute tolerance levels will most greatly impact office and residential sectors. Prime real estate locations may be redefined and expansion into secondary, tertiary markets and exurbs may increase.

What will be the financial impact driverless cars will have on CRE development?

Derhake: On the positive side, driverless cars will create opportunities to build and some developers will capitalize on this. Others will flat out get lucky. On the downside, some owners will be on the wrong side of obsolescence and development opportunities.

Parking revenues average approximately 10 percent of a central business district office building’s gross revenue. How will businesses cope with the profit loss?

Derhake: Some businesses will expand footprints and/or sublease to other vendors to maximize space density. Others will attempt to repurpose office garages. This will be difficult to do if they have sloped levels.

Image courtesy of Partner Engineering and Science

You must be logged in to post a comment.