CRE Bank Loans Mount a Comeback

What to expect from terms and underwriting at commercial banks for the rest of 2021.

Assuming that the economy continues to recover and job numbers keep improving for the rest of 2021, borrowers should have access to plenty of commercial bank debt at competitive rates, even as lenders remain cautious.

“I’m not seeing any indication yet that the second half should necessarily be a sort of boom,” said Matt Anderson, managing director of applied data and research at Trepp. “Given what we’ve seen so far, I think by and large, lenders will continue to tread pretty cautiously.”

Lending in the second half will be characterized by very modest leverage or low leverage, predicts Mitchell Kiffe, co-head of national production for the debt and structured finance Group at CBRE Capital Markets. He sees the majority of banks loans closing with 65 percent LTV—on the conservative side, and a trend over the past few years. The vast majority of those loans are five- to seven-year floating-rate loans priced attractively at 1.59 percent.

Originations are still down overall, but not nearly as much as they were during the second and third quarters of 2020. Lending volume for office declined 34 percent year-over-year during the first quarter and industrial was up 66 percent, according to the Mortgage Bankers Association. Overall commercial origination volume is expected to increase 11 percent this year compared to 2020, reported Jamie Woodwell, vice president in MBA’s research and economics group. That would represent a distinct change of direction from last year, when lending dropped 27 percent.

Money Center Action

A trend to watch is the significant uptick in loan placements with money center banks—institutions holding assets greater than $100 billion, which tend to favor larger loans. During the first half of 2020, money center banks accounted for 14 percent of CBRE’s bank placements and 6 percent of loans by number. That rose to 30 percent of volume and 16 percent of total loans this year. All told, CBRE’s money center placements total $6 billion with 151 different banks.

A trend to watch is the significant uptick in loan placements with money center banks—institutions holding assets greater than $100 billion, which tend to favor larger loans. During the first half of 2020, money center banks accounted for 14 percent of CBRE’s bank placements and 6 percent of loans by number. That rose to 30 percent of volume and 16 percent of total loans this year. All told, CBRE’s money center placements total $6 billion with 151 different banks.

One recent CBRE placement featured a $91 million loan basis on a pool of East Coast office buildings, with 5-year term, 60 percent loan-to-value, priced at LIBOR plus 155 basis points with an initial pay rate of 1.65 percent. In contrast, a recent placement with a non-money center institution featured a $17 million loan on a West Coast industrial asset, with a 5-year term, 57 percent LTV, priced at LIBOR plus 185 basis points with an initial pay rate of 1.95 percent.

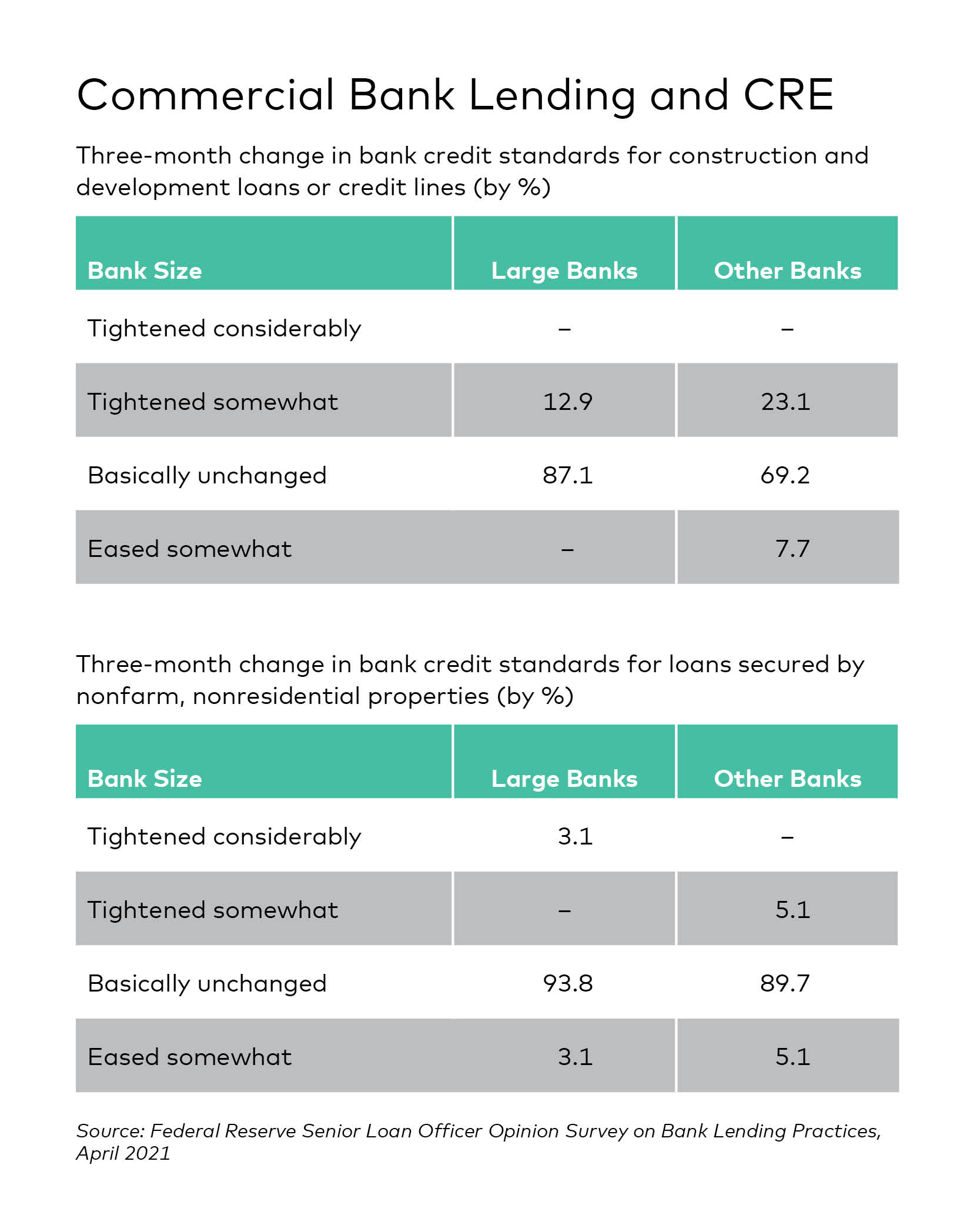

A sign of stability in bankers’ views of commercial real estate comes from the Federal Reserve’s most recent survey of bank officers, released in April. Participants were asked about credit standards for loans secured by commercial real estate assets (formally defined by the Fed as nonfarm, nonresidential properties).

The vast majority of lenders—91.5 percent representing 65 banks—said that their credit standards for approving new applications had remained basically unchanged over the previous three months. The results were remarkably similar among institutions of different sizes; 93.8 percent of respondents from large banks reported that their standards were basically unchanged, as did 89.7 percent of participants from all other banks.

Even so, lenders will likely wait until after Labor Day—when many companies are expected to bring workers back to the office—before they consider relaxing their stance on the sector, said Matthew Stearns, senior managing director & head of originations at Black Bear Capital Partners.

Office Questions and Answers

Bankers are closely monitoring changes in the office market, and those changes are factoring into their lending decisions. “With so many factors at play, workplaces will likely use a hybrid model in the near-term which may impact the market,” said Al Brooks, managing director & head of commercial real estate at JP Morgan Chase. Office borrowers can expect more conservative lending, although talent magnets like Silicon Valley, Austin and New York City are generating a steady stream of loans.

Whenever bankers discuss office properties, they mention that neither they—nor workers in general—are back in the office yet, said Michael Gigliotti, senior managing director and co-head of the New York City office of JLL Capital Markets. That is likely to influence a mindset where bank officers require stringent terms for office loans. Despite those hurdles, the financing market for the sector by no means shut down. Office borrowers with a solid business plan and a good story still have a path to crossing the finish line.

In Texas, Black Bear recently arranged a $10.2 million bank loan to refinance a stabilized 121,000-square-foot multi-tenant office. Terms for the 5-year loan feature 3.99 percent fixed-rate interest, 12 months of interest-only payments, and flexible prepayment structure and release provisions.

Industrial Strength

In the near term, the industrial sector will continue to be a favorite of lenders and investors, and bank lending volumes are projected to keep growing. That said, the demand for the asset category far exceeds the product available to investors. Moreover, banks face competition from institutional lenders and private funds. As a result, Anderson noted, “There are only so many industrial loans that you can make.”

In the near term, the industrial sector will continue to be a favorite of lenders and investors, and bank lending volumes are projected to keep growing. That said, the demand for the asset category far exceeds the product available to investors. Moreover, banks face competition from institutional lenders and private funds. As a result, Anderson noted, “There are only so many industrial loans that you can make.”

Industrial loans typically account for 7 percent of commercial bank lending volume; for the past few quarters, volume has held steady at about 11 percent. Office loans historically make up about 30 percent of lending volume but have been clocking in at about 23 percent over that stretch.

Keith Kurland’s team at Walker & Dunlop has completed numerous bridge financings on vacant industrial sites to stabilize the assets, as well as plenty of construction financing, including several large loans for spec development. “We’ve also done a number of pre-leased industrial construction loans for tier-one and tier-two credit borrowers that garnered tremendous interest,” said Kurland, senior managing director & co-head of the firm’s New York City-based capital markets practice.

Multifamily and industrial debt notwithstanding, the reduction in loan volume means that large banks are “sitting on bigger and bigger piles of cash,” Anderson notes. Dry powder now totals $4 trillion, up 26 percent since the end of 2020.

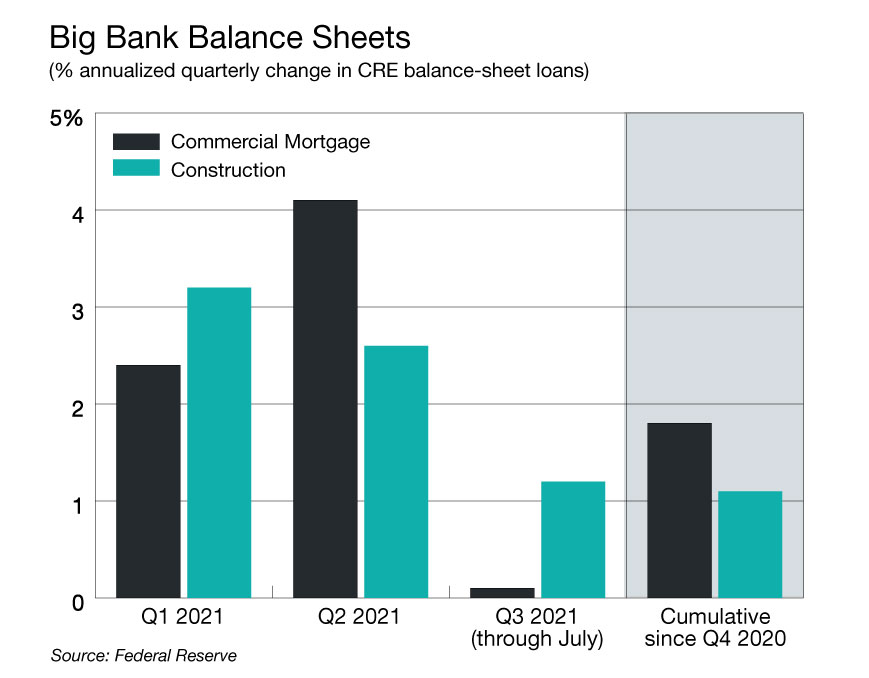

While lenders wait to see how the office sector shakes out—when and how workers will return to the office and how much space landlords will ultimately take—another hopeful trend is that construction lending has continued to grow throughout the pandemic. That is a departure from conditions in a typical recession, when, as Anderson notes, “construction lending is the first domino to fall.”

A couple of other trends track unknown variables. Experts agree that the Delta variant of the COVID-19 virus is creating renewed uncertainly about the return to the office sector, with a potential ripple effect on bank lending. In addition, the transition from LIBOR is likely to create confusion for borrowers, making the process more complicated, Kiffe predicted.

In addition to short-term bridge loans in the industrial space, MBA’s Woodwell cites Real Capital Analytics data indicating that mortgage originations are moving in lockstep with investment sales. That coincides with what Woodwell has been seeing across asset.

Banks are often “extremely aggressive” when competing for industrial loans, said Michael Gigliotti, senior managing director and co-head of the New York office of JLL Capital Markets, Americas. That translates to LTVs of 70 percent or higher on fully leased properties to a credit tenant. He’s also seeing local and regional banks cast their nets far in pursuit of yield. For instance, New York City-based banks are placing loans as far away as California and Florida. Construction loans may come with some level of recourse guarantee or require partial repayment and 60 percent LTV.

You must be logged in to post a comment.