How Brexit, Ecommerce Are Disrupting UK Real Estate

The biggest theme in the UK market over the past year has not been political turmoil. It has been the structural change in retail, according to Matthew Goulding of CenterSquare Investment Management.

Matthew Goulding Image courtesy of CenterSquare Investment Management LLC

Brexit has been an incredibly frustrating process for both Brexiteers and Remainers. The UK had originally planned to leave the EU on March 29th, however, an extension of Article 50 has been agreed to by EU leaders until up to Oct. 31st. This has averted the prospect of a no-deal Brexit this April. The British Prime Minister’s position has become increasingly weakened, having already lost a vote three times in parliament for her version of Brexit, which remains unpalatable to either side.

In the long run, while Prime Minister Theresa May could still achieve her deal, it remains more likely that the UK’s options become more polarized between no-Hdeal and no-Brexit, making a second referendum and or general election more likely.

Understandably, this has created a significant amount of uncertainty within the UK real estate market, particularly in London. Capital that would have otherwise made a home in London is now awaiting further clarity. There are likely a number of long-term opportunities regardless of the final outcome, but the delay only continues this uncertainty.

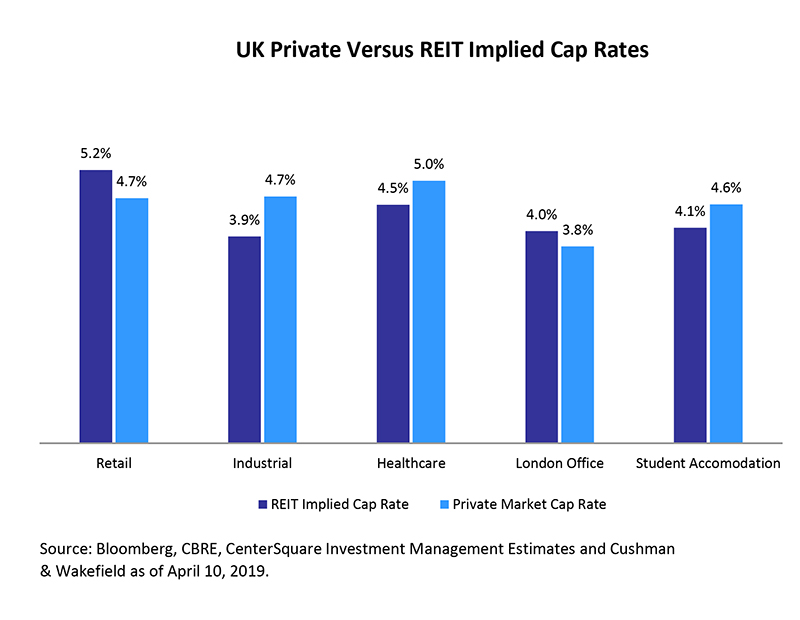

The below chart shows average implied cap rates within the UK listed real estate sectors in comparison with private market cap rates. While there are many UK listed companies with diversified property type exposure, we can still see a good representation of the various asset classes and where they are trading.

Contrary to popular belief, the biggest theme in UK real estate over the past year has not been Brexit but has been the structural change in retail that has benefitted industrial and hurt retail assets. While London retail has held up better than other regions, we expect these structural trends to continue. Changes in consumer behavior have led to an acceleration in store closures and company failures, and because of this, rents will continue to be under pressure. As online penetration grows, the strong demand for logistics space and last-mile delivery should benefit the sector, and we expect industrial to continue to have strong rental growth and modest yield compression.

Contrary to popular belief, the biggest theme in UK real estate over the past year has not been Brexit but has been the structural change in retail that has benefitted industrial and hurt retail assets. While London retail has held up better than other regions, we expect these structural trends to continue. Changes in consumer behavior have led to an acceleration in store closures and company failures, and because of this, rents will continue to be under pressure. As online penetration grows, the strong demand for logistics space and last-mile delivery should benefit the sector, and we expect industrial to continue to have strong rental growth and modest yield compression.

Outside of prime, Central London valuers have begun to materially mark down retail assets and this trend should also continue. CenterSquare believes that the higher implied cap rates in retail REITs are likely a sign of further yield expansion in the sector. Likewise, in industrial, CenterSquare believes that private market yields will tighten, as reflected in the REIT market today.

Listed vs. Unlisted

In office, despite Brexit uncertainties, rents and yields for prime Central London assets have remained fairly stable. Hard Brexit aside, there are still opportunities for pure play nimble operators to crystallize value through redevelopments and utilize low leverage for opportunistic investments. CenterSquare sees this as the main reason for the small discount in the REIT cap rate vs. private market cap rate in London office.

The biggest risk for UK real estate remains political uncertainty rather than Brexit. It is for this reason CenterSquare prefers smaller niche sectors, such as healthcare and student accommodation (student housing), which are both more immune to Brexit and tend to have more support from both sides of the political spectrum. Both of these sectors are currently trading at premiums in the REIT market vs. the private market, and there remains plenty of capital to be deployed despite Brexit uncertainty.

Matthew Goulding, CFA, Portfolio & Regional Manager Europe, Listed Real Estate Securities at CenterSquare Investment Management LLC.

You must be logged in to post a comment.