How CRE Will Return to the Office: The CPE 100 on Next Steps

Our latest survey also offers an outlook of the industry's prospects for the second half.

The return to the office is a central issue for the commercial real estate industry’s operations no less than it is for the clients the industry serves. The results of the latest CPE 100 Sentiment Survey indicate that that the industry’s own use of space is likewise in a time of transition, although whether the changes are permanent remains to be seen.

Real estate decision-makers are applying a key lesson of the past year to their own workforces: They need not be tied to an office full time in order to conduct business effectively.

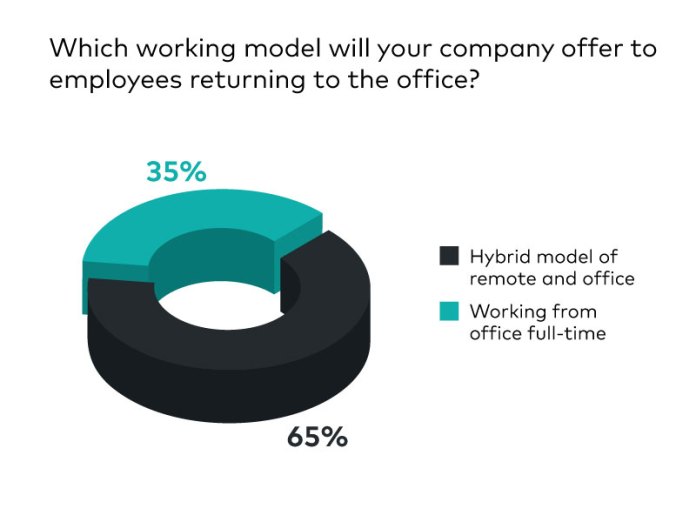

Nearly two-thirds of respondents say that their teams will be offered a hybrid schedule, according to the latest quarterly survey of the CPE 100, an invited group of industry leaders. Only 35 percent of respondents surveyed say that their entire workforce will return to the office full time, according to the survey, which was conducted in June.

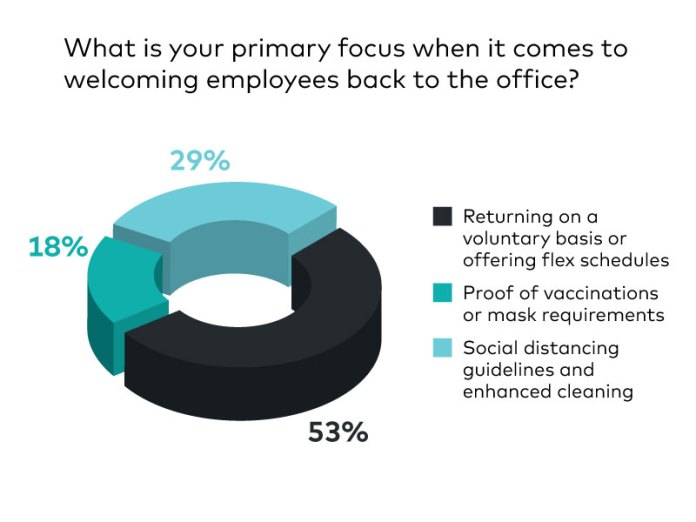

That trend is also reflected in the strategy for the return. For the majority of respondents—53 percent—offering flexible schedules and voluntary return is the top priority. That is nearly twice the number (29 percent) whose firms will emphasize masks or proof of vaccination.

Two other steps that have become standard practice, social distancing and stepped-up cleaning, are the focus of just 18 percent of survey participants.

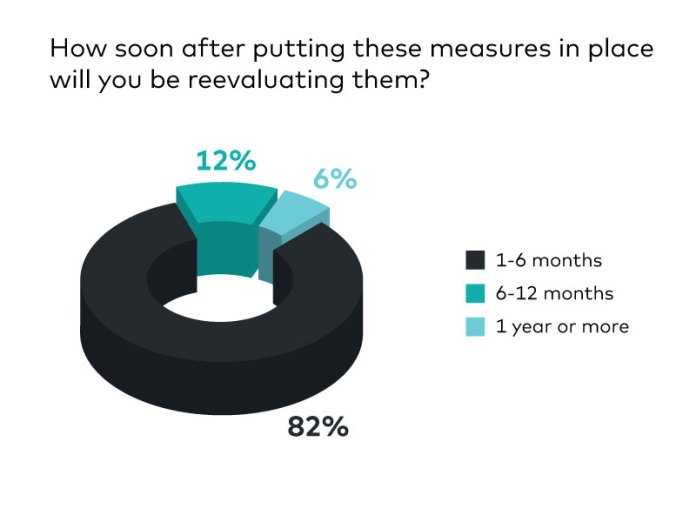

Though this suggests a paradigm shift, adjustments to the way commercial real estate firms run their business are not written in stone. The CPE 100 indicates that any changes will be reviewed promptly; 82 percent of respondents expect to evaluate their policies within six months of their implementation.

The results of the latest CPE 100 survey offer informative comparisons with broader studies of office occupant intentions. The latest survey of tenants commissioned by Building Owners and Managers International found that the share of employees working in the office full time is likely to decline dramatically over the next 12 to 18 months, from 70 percent before the pandemic to 43 percent.

That said, the BOMA survey, which was developed by Brightline Strategies and underwritten by Yardi Systems, also revealed that the physical office is still highly valued by tenants. The latest study, which was conducted this spring, found that 78 percent of decisionmakers still consider the physical office vital to their business. That marked a 4 percent increase from the fourth quarter of 2020.

Steady, upbeat outlook

The CPE 100’s views of prospects for the industry and their own business continue to show steady, if measured, optimism.

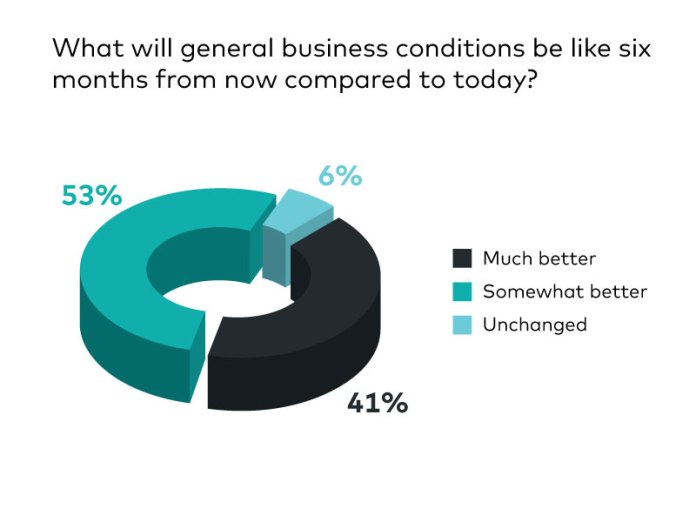

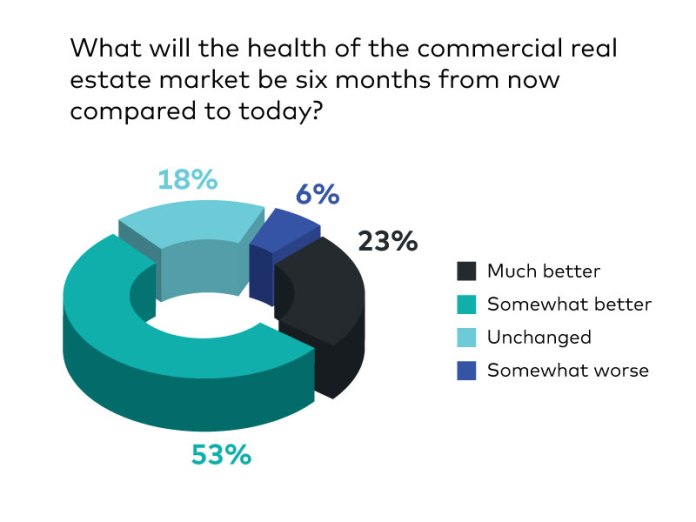

Expectations in the second-quarter survey are strikingly consistent with predictions in the first-quarter poll. Fifty-three percent of respondents in the latest survey said that business conditions would be somewhat better in six months, nearly identical to 56 percent in the previous poll.

All told, 94 percent of respondents agree that the economy will be better six months from now, slightly more than 87 percent in the first quarter.

A similar pattern emerges from views of the commercial real estate industry’s prospects. Seventy-six percent of respondents to the latest survey expect the health of the industry to improve in six months. That is close to the 81 percent of respondents who held that view in the previous poll.

The slightly smaller share of the CPE 100 which expects improvement does not necessarily indicate renewed pessimism. Instead, it may reflect growing expectation of stability. From the first to second quarters, the portion of the CRE 100 who say that the industry’s health will be unchanged over the next six months has tripled to 18 percent.

The most recent results also point to a significant uptick in optimism compared to a year ago. At this time in 2020, only 63 percent of the CPE 100 expected the industry’s health to improve over the next six months.

Another 31 percent predicted then that the industry would be in worse shape. Today, that pessimistic view is held by only 6 percent.

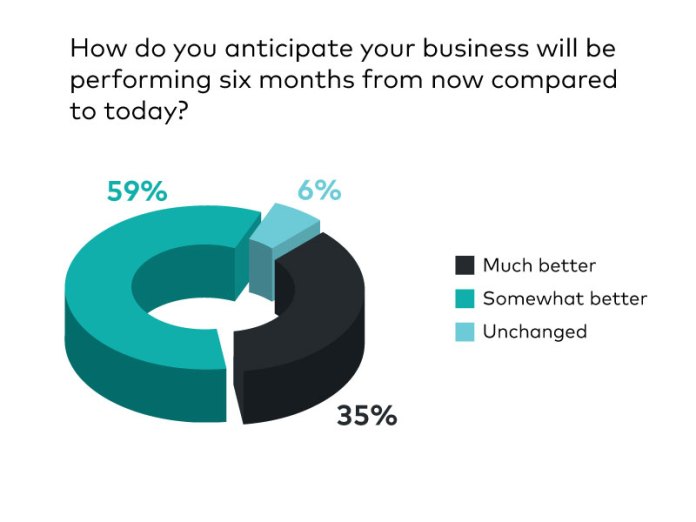

Expectations of company performance remain upbeat, as well. In the latest survey, 59 percent of respondents say that their companies will perform somewhat better in six months, close to the 63 percent recorded in the year’s first poll. All told, 94 percent of the CPE 100 predict that their firms’ performance will be somewhat or much better six months from now.

You must be logged in to post a comment.