How Dining Trends Are Reshaping Shopping Centers

DJM Capital's Chad Cress on why restaurants have become anchor tenants in many of his company’s lifestyle properties.

Americans’ appetite for eating out is not going anywhere, with many of them spending more time and money dining out.

The average household allocated more than 53 percent of its food budget in 2023 to meals away from home, according to the U.S. Agriculture Department’s Economic Research Service. This record-high rate marked a 10 percent increase since 2003, and generated a 5.4 percent growth in sales for restaurants, as reported by the National Restaurant Association. This surge in dining out is not only boosting restaurant revenue, but also transforming commercial real estate.

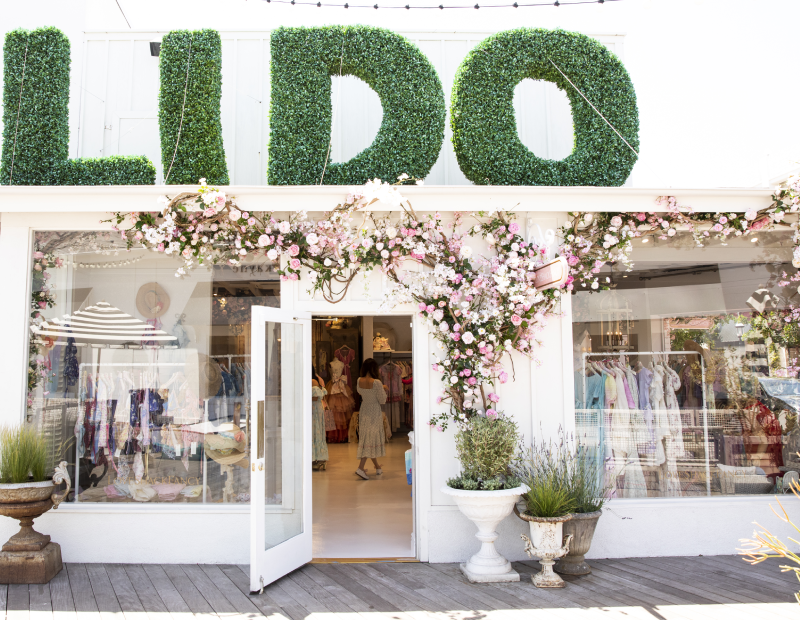

DJM Capital, a California-based firm with more than 3 million square feet of retail assets in its portfolio, is one of the companies capitalizing on this trend. Chief Creative Officer Chad Cress told Commercial Property Executive that DJM’s lifestyle centers such as Bella Terra in Huntington Beach, Calif., and Lido Marina Village in Newport Beach, Calif., have seen significant increases in visitor numbers due to the opening of popular restaurants. But beyond dining, consumers are also increasingly seeking memorable social experiences, a shift reshaping spending patterns and, simultaneously, the future of retail.

In the interview below, Cress talks about the growing emphasis on restaurants in the retail mix and how Americans’ eating habits are impacting the sector.

READ ALSO: Underserved Areas Are Grabbing Retail Investors’ Attention. Here’s Why.

In your opinion, what key factors are driving the increase in spending at restaurants?

Cress: The pandemic changed how people live and want to spend their money. Now consumers are looking for dining experiences more than ever. Additionally, with more people working from home, it cuts commuting time which has been reallocated to experiences such as dining.

And how do you see this shift in consumer behavior affecting the retail real estate industry overall?

Cress: I think we’ve seen the percentage of food and beverage in relation to the entire merchandising mix at retail projects continue to increase, as well as the rise of entertainment-based retail. Consumers are pickier about where they spend their money, but when a retail project puts placemaking first, customers will visit. This has put more emphasis on design and how we think about placemaking.

Has your vision for lifestyle centers changed as a result of these shifts?

Cress: Having an experiential and placemaking mindset has always been part of the DNA of what we do and we’ve been doing this since before this type of thinking became the norm. Part of the reason for that is being located in California, where outdoor walkable centers are everywhere, so creating something special for the customers and tenants has become important to differentiate.

We’ve also increased our attention on marketing and events over the years. In the past, landlords merely collected rent and operated a center. Today, landlords like us find it important to come alongside the tenants and actively work to drive foot traffic to the center. We’ve been successful at this through increased food and beverage, and a focus on events and activations.

Have there been any challenges in accommodating the growing demand for food and beverage tenants?

Cress: We are seeing the desire for smaller restaurant spaces so in some cases—like at Village Del Amo in Torrance, Calif.—we have created several smaller restaurants from bigger restaurant vacancies and have created a more robust dining district.

Additionally, while restaurant sales and foot traffic trend upward at our centers, restaurants across California are having a harder time due to rising costs and labor. We have seen an increased need for second-generation space and more landlord contribution.

And are there any specific types of dining establishments you’re looking to bring into your shopping centers?

Cress: It really depends on what categories we still need at the center or the DNA of the center itself. In Hollywood, Calif., for example, we have focused on bringing more local flavor and chef-driven concepts in order to help message to the market that the project is evolving and not only attract tourists, but locals as well.

To what extent has adding more restaurants led to an increase in visitor numbers at Bella Terra, for example?

Cress: Property visits are now up nearly 10 percent year-over-year and nearly 30 percent from three years ago—a result driven by the improvement of tenants through new leasing, a redesigned public space that has led to increased marketing activations and two additional hot restaurants coming to the property.

Since having acquired it in 2005, DJM has transformed the shopping center into a vibrant community hub by curating a diverse array of dining, retail and entertainment options. In 2023, before the two new restaurants came to the property, Bella Terra only saw a 1 percent increase in visitors year-over-year, showcasing the importance of these tenants to the community.

READ ALSO: Mixed-Use Malls and the 15-Minute Neighborhood

How do you see the rise in food and beverage-driven traffic influencing the broader retail landscape in the long run?

Cress: I think that restaurants reflect the desire for experience and retail has been evolving across the industry to incorporate more emphasis on experiential. This has been going on for a while, but as customers spend more time and money on experiences, brands in other sectors need to also raise the bar on customer experience and the ability for customers to interact with them across all channels—physical and digital.

And how are you positioning your properties to stay in fashion?

Cress: I think restaurants have become the new anchor in projects and the attention on getting the right names to our centers helps unlock and attract other quality tenants.

You must be logged in to post a comment.