How New Entertainment Concepts Are Impacting Retail

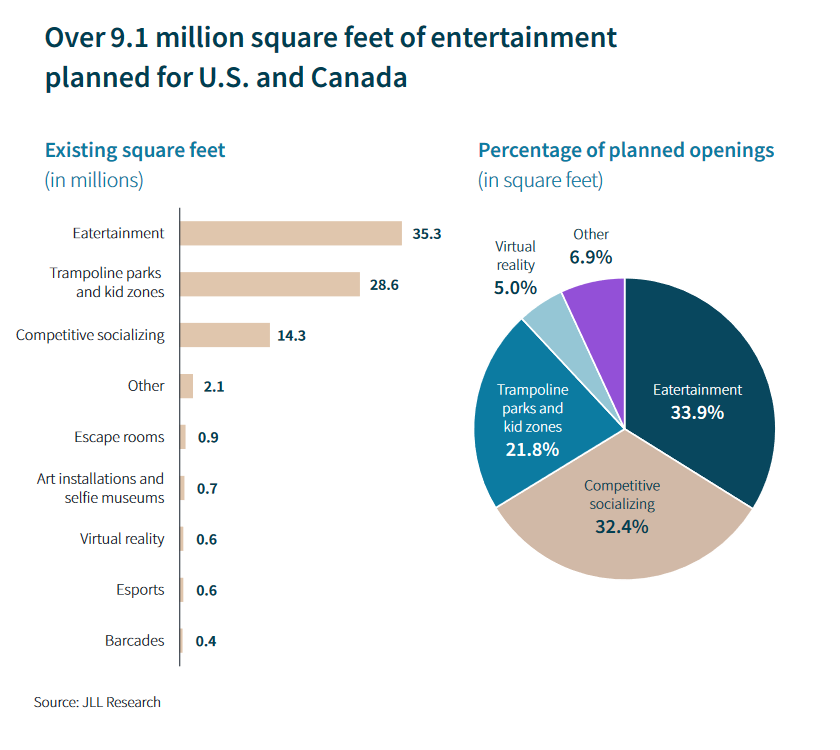

More than 9 million square feet is scheduled to open in the U.S. and Canada over the next two years, according to JLL.

A broadening variety of retail entertainment concepts beckons consumers—and therefore operators, developers and investors, too—but even though entertainment spending is growing, numerous obstacles need to be navigated, according to a new report from JLL.

“Consumers want fun experiences,” the report says, “and entertainment concepts plan to open new locations to give them what they want.”

The dollars are there, JLL makes clear. In the fourth quarter of last year, spending on dining out in the U.S. jumped by 13.7 percent year-over-year, while spending at amusement parks and arcades surged by 20.6 percent year-over-year.

READ ALSO: Retail Leasing Trends to Watch

The most popular category, “eatertainment,” features food, drink and multiple games in one venue and is expected to see the highest number of new locations. Dave & Busters, for example, is among the legacy brands. Promising new concepts include Andretti Karting & Games, Fat Cats and EVO Entertainment.

The categories of Virtual Reality (VR) and “Competitive Socializing,” a single game along with food and drink, are estimated to have the second and third most openings planned. Brands to watch are Immersive Gamebox, Sandbox VR and Zero Latency VR, and Puttshack, Chicken N Pickle, X-Golf and Flight Club, respectively.

Over 9.1 million square feet of entertainment planned for U.S. and Canada. Chart courtesy of JLL Research

Many of these concepts need substantial space, and JLL has identified 9.1 million square feet of new entertainment space scheduled to open in the U.S. and Canada over the next two years.

Economic obstacles

So that’s the sizable potential, but there are also hurdles.

Those larger spaces that many concepts need are costly to build, assuming the raw space can be found. JLL cautions that the biggest obstacle in negotiations between landlords and tenants is the amount of money the landlord needs to contribute in upfront construction dollars, while tenant improvement allowances for an expensive concept could cost as much as $400 per square foot.

Higher upfront construction costs naturally lead to higher rents over the lease term, typically 10 to 15 years. In an environment of rising interest rates, this therefore favors landlords and tenants that can avoid borrowing.

In brief, JLL says, landlords want a proven concept led by a strong team and/or backed by a solid business plan, a creditworthy tenant (Puttshack got $150 million in growth capital from BlackRock last year), a tenant that fits within a project’s overall vision, and the potential for repeated visits to the tenant.

You must be logged in to post a comment.