How New-Model Cities Are Attracting CRE Investment

A new report from JLL and The Business of Cities looks at new economic models that are impacting global real estate demand and cross-border investment decisions.

Global cities that adapt to new economic models focusing on quality of life, innovation, sustainability, governance and resilience are becoming new sources of real estate demand and attracting higher cross-border investment, according to a new report from JLL and The Business of Cities, a London-based intelligence and strategy firm.

Issues like technological disruption, concerns over climate change and geopolitical tensions are also changing what businesses need from cities, Jeremy Kelly, director, global research at JLL, said in a prepared statement about the 21-page report, “Demand & Disruption in Global Cities 2019.”

READ ALSO: Coworking to Overtake Tech as Office Leasing Driver

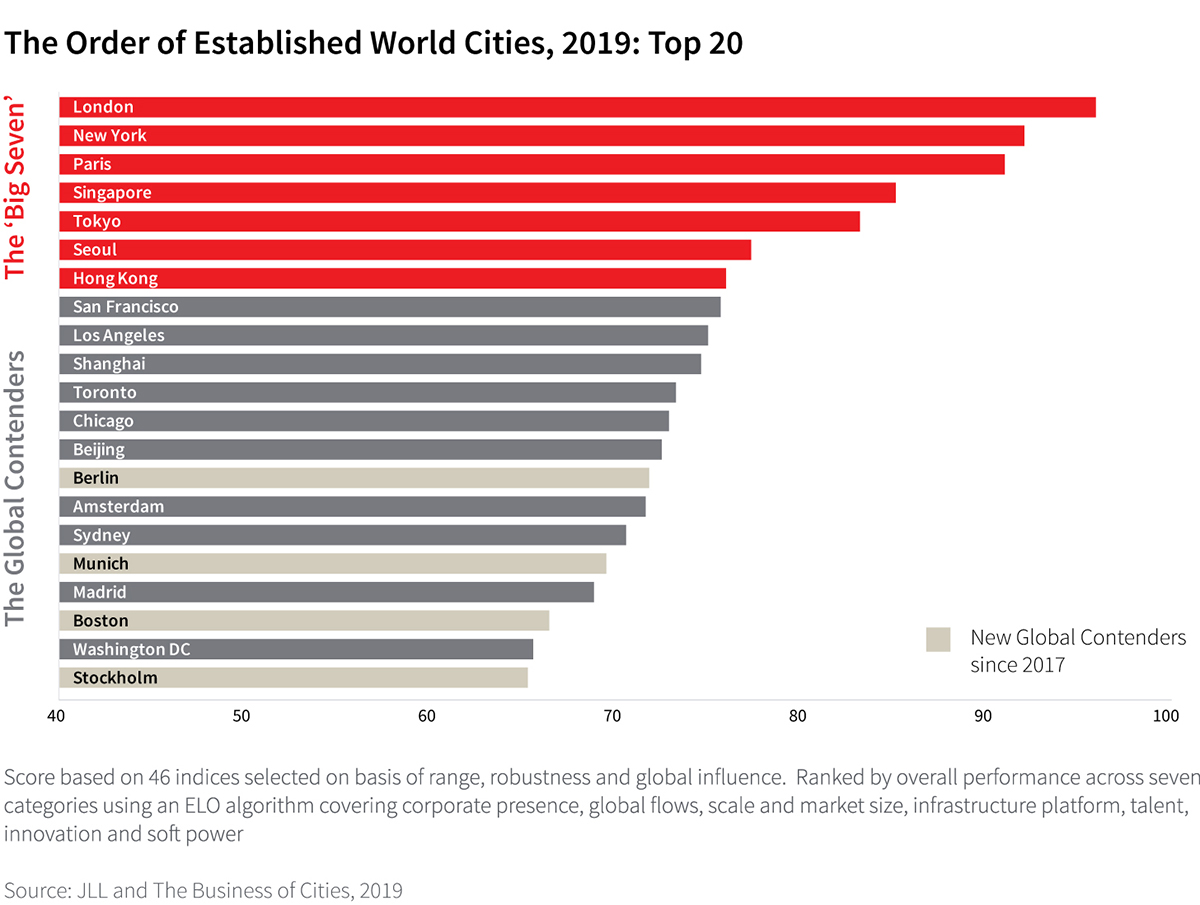

The report describes four new economic models—innovation economy, experience economy, sharing economy and circular economy—and notes they are having a strong impact on global cities, including four that have joined the global leader board—Berlin, Munich, Boston and Stockholm. The innovation economy demands locations become more flexible in use of space and also renews focus on central business districts as venues for increased collaboration. The experience economy thrives on customized experiences and services, while offering a mix of activities. The sharing economy promotes new living and working patterns like coworking and co-living and raises demands for spaces that can be reconfigured. The circular economy emphasizes operational efficiencies and resilience in buildings.

Six of the seven cities that have topped JLL and The Business of Cities’ Established World Cities list since 2013—London, New York, Paris, Singapore, Tokyo and Hong Kong—continue to maintain their stronghold. Seoul is also on the list. Dubbed “The Big Seven,” they are followed closely by “The Global Contenders”—San Francisco, Los Angeles, Shanghai, Toronto, Chicago, Beijing, Amsterdam, Sydney, Madrid and Washington, D.C.

Together they are the top 20 in “The Order of Established Cities” but the report uses more than 500 benchmarks to track cities’ ability to attract businesses and investments, build their jobs base, improve their infrastructure platforms and sustain their growth over the long term. The authors noted the benchmarks, up from about 300 in the 2017 report, produced more in-depth data that also looks at quality of life, urban vibrancy, resilience, economic inclusion and social cohesion, as well as prospects for long-term economic competitiveness. Noting that corporate occupiers and investors are making decisions based on a much broader set of factors than in the past, the report shows a correlation between cities’ all-around competitiveness and their ability to attract cross-border real estate investment.

Topping the list

Despite some challenges like increasing risks from Brexit and a recent slowdown in momentum, London still leads all the global cities. The report notes that London continues to record excellent performance because of its diversification into fintech, robotics, medtech and retailtech, as well as its ongoing cycle of infrastructure investment and redevelopment. Paris, number 3 on the list, continues to benefit from innovation, especially in terms of talent and the business climate, and is also beginning to be a leader in circular economy adoption.

The four cities that are part of the “second division” of “The Global Contenders” have seen their all-around performance improve in the global benchmarks and they are successfully competing on the global stage due to quality of life advantages, innovation capabilities or institutional strength. For example, Munich is in the top 10 because of its transportation system, reputation, student appeal and its increase in investments across assets.

“It is interesting to see that all the new global contenders are medium-sized cities which have developed strengths in the innovation economy. Despite their smaller populations, they are now stepping up and competing on a global stage. These cities are successfully embracing the new economic models to attract capital, corporates and talent,” Kelly told Commercial Property Executive.

While “The Big Seven” and “The Global Contenders” are at the core of the top global cities, the report also breaks down the cities into several other categories, including “New World Cities” and “Emerging World Cities” as well as “Hybrids” and “Natural Growth Engines.” The report states the hybrids—Santiago, Cape Town, Abu Dhabi, Dubai, Warsaw, Prague, Budapest and Bucharest—are all medium-sized cities that have attributes of both “Emerging” and “New World Cities.” They compete in specialized markets and have a superior livability compared to regional and national peers. But their labor force and customer appeal are more like those of “Emerging World Cities.”

“National Growth Engines” are cities that are in stable, developed national economies that have large domestic markets, have few competitors and are often built around services or supply functions. Cities that fall into this category are Dallas, Houston, Atlanta, Osaka, Nagoya and Buenos Aires.

New additions to the “New World Cities” list this year are Manchester, Stuttgart, Lisbon, Montreal and Philadelphia. The report points to several “Emerging World Cities” as locations to watch and they include Guangzhou, Shenzhen, Taipei, Istanbul and Moscow.

You must be logged in to post a comment.