How Job Losses Impact Manufactured Home Production

An expected slowdown in shipments in several states across the country may affect the sector's dynamics and deepen the affordable housing crisis.

Image via Public Domain Pictures

Manufactured housing community operators have been reporting rent collections above 90 percent for MHCs and mobile home parks for April and May, an encouraging sign for the segment’s resilience during these turbulent economic times. With demand for affordable housing remaining on the rise—especially in states that took the hardest hit during the pandemic—the segment is expected to maintain a strong outlook in the coming years and to remain essential for boosting the supply of affordable housing.

Nevertheless, the recent disruptions in all housing sectors have led MHC owners and operators to pay more attention to a number of factors that may affect demand in the following quarters.

READ ALSO: Operating Manufactured Housing Communities During Tough Times

A recent Fannie Mae market commentary on the manufactured housing landscape indicates that the number of manufactured home shipments is expected to be lower in the coming months as production factories have been experiencing labor reduction and order cancellations. The study quotes the findings of a Next Step Network survey stating that manufactured home builders estimate a reduction ranging between 20 percent to 30 percent in new home production in the coming months. In addition, the respondents have expressed their concern about a disruption in the supply chain of construction materials such as lumber, drywall and fixtures.

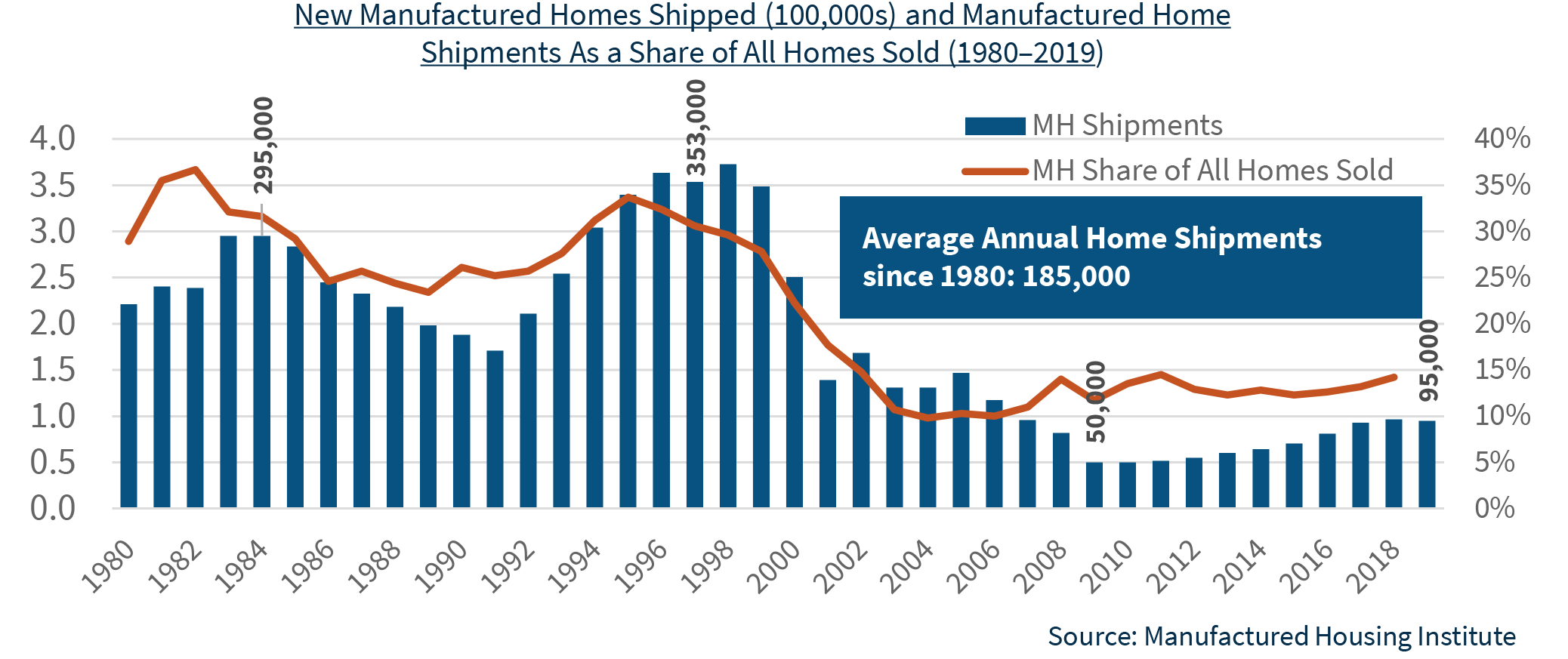

Meanwhile, manufactured home retailers and showroom managers are also expecting a decline in home sales as a result of state or local ordinances related to COVID-19. The same survey estimates that the number of new orders of manufactured homes may decline from 95,000 in 2019 to 85,000 by the end of 2020 and even more, to 77,000 in the event of a slow recovery.

Other factors that could have a significant impact on MHC demand in the coming quarters include:

- the rising cost of home construction;

- a lower number of factory-built homes;

- zoning restrictions;

- acquisition financing limitations.

Declining trends

The share of manufactured home shipments compared to all homes sold has remained considerably low after the 2008 economic downturn, mainly due to increased restrictions regarding zoning and land use.

Nevertheless, among the top states that usually receive the largest share of manufactured homes shipments annually, only Louisiana reported a notable decline, from 7.4 percent in 2012 to 5 percent at the end of 2018. This shows that the decline is affecting states that were receiving fewer shipments to begin with. Nevada, Oregon, New Jersey and Wisconsin have been receiving fewer than 500 new manufactured homes annually. Southern states, on the other hand, continue to lead in new manufactured homes demand.

Zoning restrictions in urban areas, where demand for manufactured homes tends to be higher, are among the factors impacting shipment trends. Nevertheless, manufacturers have started using designs that make the manufactured homes visually indistinguishable from site-built homes, which is expected to alleviate local zoning barriers.

Financing options available for purchasing new manufactured homes are another reason for declining shipment volumes. Factory-built homes produced to HUD Code are considered either personal property (chattel) or real property and the way these assets are titled can affect the financing process. Conventional mortgage loans are applicable only to real properties, which leaves the majority of potential owners with the chattel financing option, which can be more expensive. Conventional mortgages are secured by both the land and the home, whereas chattel financing is only secured by the home, which raises the risk level.

In addition, the costs to deliver and set up a manufactured home can be higher than those of site-built homes, which require no shipment or installation costs, the Fannie Mae commentary shows. Next Step Network estimates the average cost to deliver, set and finish a single-section home to be $21,000, while for a double-section home these costs average $34,000. Nevertheless, the average sales price of a new manufactured home built and shipped in 2018 was less than $100,000, less than half of the sales price of a new site-built home.

Overall, just like in the case of other housing asset classes, any discussion on manufactured housing demand and supply trends will need to take into account a geographical and urban versus rural segmentation as the concentration of homes varies regionally.

You must be logged in to post a comment.