The Magnetism of Medical Office Buildings

Institutional investors are stepping up activity in MOBs, attracted by demand for health care, steady occupancy and rising rents, CBRE reports.

Driven by a steady vacancy rate, sustained increase in asking rents and strong demand for health-care services due to an aging population and other demographic trends, institutional investors are increasingly getting more active in the U.S. medical office sector, according to a new CBRE report. The report states transaction volume for medical office buildings is 50 percent higher this year than before the recession, though it has receded from its early-2018 peak.

READ ALSO: Health Care Shows Strong Vitality

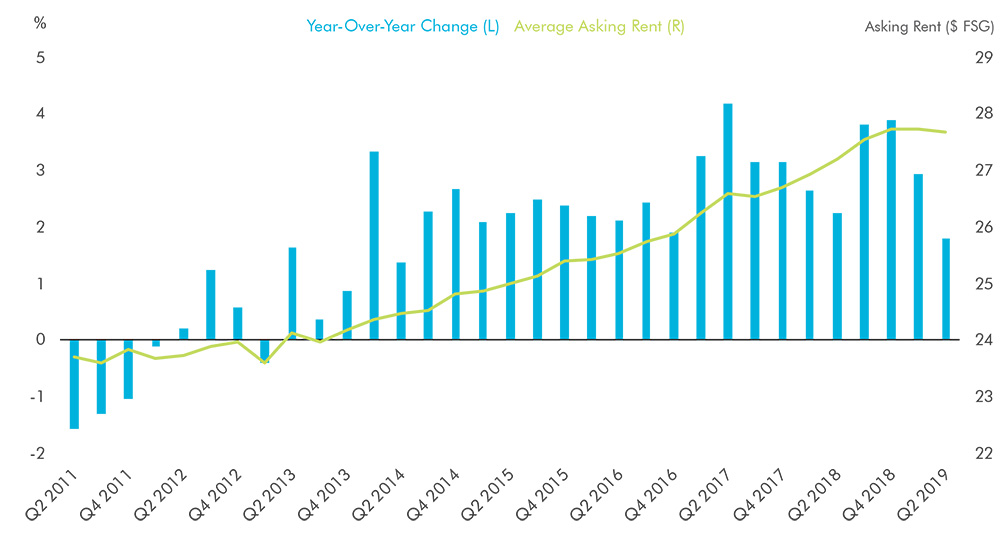

Ian Anderson, CBRE head of Americas office research, notes there is a continued rush by capital to the medical office sector by foreign investors, top-tier domestic institutions and REITs. The institutional investors are attracted to the strong fundamentals for the sector, including a steady vacancy rate at 10.3 percent despite a 10-year high in construction completions during the second quarter of 2019 and a sustained increase in asking rents since 2013. While rent growth was down 1.8 percent year-over-year in the second quarter, the report notes rent growth has stayed near record levels and has been averaging 2.6 percent increases over the past five years. While medical office investment volume is down from 2018, the report states pricing remains strong and aggressive, when compared with conventional office assets. Cap rates have pulled even with those of traditional office investments.

“Part of the attraction for medical offices has historically been a higher yield, but that has begun to change as the sector has become more institutionalized and familiar to the investment community. The data in our report shows how cap rates between conventional and medical offices have narrowed to near-parity in the last couple of years,” Anderson told Commercial Property Executive.

Christopher Bodnar, CBRE vice chairman of investment properties, U.S. health-care capital markets, said in prepared remarks there has also been a move toward more outpatient treatment to reduce the rising costs of health care. He described it as a long-term, fundamental shift that points to continued healthy growth for the sector that is also attractive to institutional investors.

Anderson puts it even more bluntly. “The top reason for growing institutional interest in medical offices would ultimately have to be persistent and growing demand for the space. That demand, caused primarily by secular demographic and socioeconomic factors, is the main generator behind the rise of this property type as such a popular destination for investment capital,” he told CPE.

Growing markets

The CBRE report identifies several markets that are experiencing strong demand, as well as those with the tightest vacancy rates and highest medical office rents. Chicago led the top 10 markets in the U.S. for medical office demand. Chicago had 915,000 square feet and 7.3 percent net absorption as percentage of net rentable area. Atlanta came closest in second place, with an absorption of 557,000 square feet and 2.3 percent of net absorption as percentage of net rentable area. Also on the top 10 list in descending order were: New Jersey, N.J.; Nashville, Tenn.; Inland Empire, Calif.; Cleveland; Columbus, Ohio; San Francisco; Portland, Ore.; and Cincinnati.

While Chicago led with more than 900,000 square feet of positive absorption over the past year, Inland Empire led in absorption as a percentage of total medical office inventory, at 9.5 percent. Chicago also had the most medical office completions over the past year, both in total square feet and as a share of total inventory. Despite the significant new supply, Chicago’s vacancy rate fell by 1.3 percentage points year-over-year. While Houston had the third-highest level of completions for the first half of the year, it came in ninth for completions as a share of total inventory, largely because it has the highest total medical office inventory in the U.S., according to the report.

Anderson told CPE absorption trends can vary across markets for several reasons. “Demand (net absorption) can be higher simply due to a greater supply of new medical office building in markets where it is easier to build. There are more medical offices under construction in the Inland Empire than Los Angeles, where it is more difficult to build,” he said. “In other cases, there are local trends in the health-care industry, such as a merger between health-care systems, that may affect demand for space. But generally speaking, higher demand for medical office space by market results from a combination of favorable demographics, either in the form of a growing total population or an existing, abundant elderly population, supported by attractive and growing incomes. The latter has likely supported stronger demand in some of these Midwestern markets.”

Western markets had the lowest medical office vacancy rates, including 7.6 percent for Orange County, Calif.; 7.0 percent for Sacramento, Calif.; 6.3 percent for San Diego; 5.2 percent for the San Francisco Bay Area; and 3.9 percent for Seattle. The report noted St. Louis, Dallas-Fort Worth and Philadelphia had the highest vacancy rate increases over the year, either due to weak demand, large supply growth or a combination of those factors.

West Coast markets were also among the markets with the highest medical office rents, although Manhattan had the highest rent in the U.S., with $65.06 per square foot. Greater Los Angeles led the West Coast asking rents with $40.56 per square foot. Other asking rents ranged from $34.56 in Seattle to $40.56 in the San Francisco Bay Area.

You must be logged in to post a comment.