How Much Longer Is ‘Higher for Longer’?

Rather than wait for interest rates to fall, borrowers would be better off seeking alternatives, according to Avison's Young's Jay Maddox.

As we entered the new year, commercial real estate investor sentiment was positive. Interest rates were already dropping in anticipation of multiple Fed rate cuts that were widely anticipated to open the deal floodgates. Lenders and investors were awash in dry powder, and most of them had budgeted substantial improvement in deal volume compared to the doldrums of 2023, which saw transaction volume fall 50 percent or more across most markets and property types.

Hopes for multiple rate cuts this year have been dashed by persistently high inflation numbers. We’ve become a nation of Fed watchers. The often-conflicting signals from the Fed over the last six months—and particularly the last month—have made it more difficult to predict the number and the timing of interest rate cuts, which many market players see as the key to opening up deal flow. Still, investors remain ready to pounce when a decline in rates occurs.

What’s the Fed is waiting for?

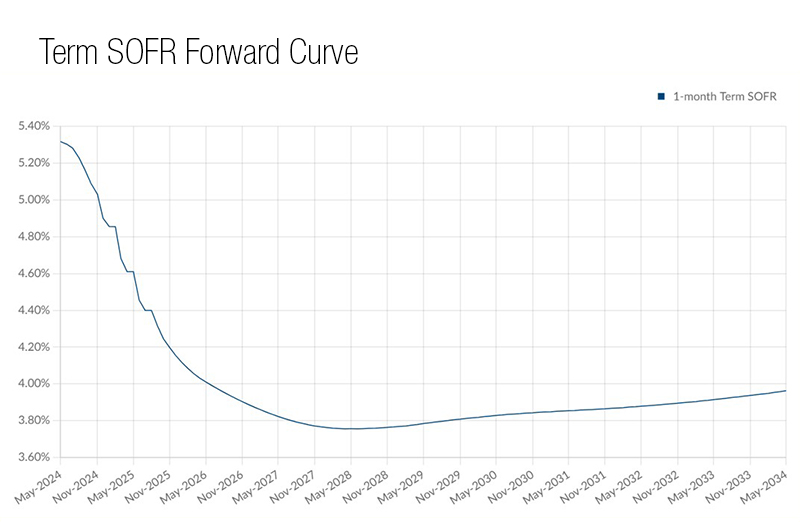

The hope is that the Fed will move closer to market expectations, which based upon the forward interest rate curve, still anticipate rates dropping and “normalizing” later this year and in early 2025.

However, despite market expectations, economic data simply doesn’t support a compelling need to cut rates. The Fed’s two main concerns are price stability and maximum employment. The second of those is in good shape, but the first one is still a work in process. Economic growth and employment remain surprisingly robust, and the stock market is continuing to hit historic highs, indicating that the economy is able to function just fine in a higher rate environment.

The hard truth is that the Fed pays attention to data, not market expectations. Despite significant improvement over the past couple of years, inflation is still running at 2.6 percent to 3.0 percent, well above the Fed’s 2 percent target. The Fed will need to be confident that inflation is likely to average 2.0 percent over time to begin lowering the federal funds rate and to dial back restrictive monetary policy. Further, the Fed is concerned about inflation resurging if it cuts rates too fast, which would force another hike that would potentially have serious implications for almost all sectors of the economy. Add that we are in an election year, and you have a recipe for uncertainty and volatility.

Traditionally, the Fed tries not to make major monetary policy changes a few months before an election. About the only good news is that further rate hikes seem highly unlikely given the signals we’ve had from the Fed. If it does cut rates, the most likely scenario would be a rate cut in June or July, and then a pause until the November election.

What to expect?

Given these realities, it’s quite possible that rates will stay high for a long time. “Higher for longer” is bad news for highly leveraged borrowers with a lot of debt maturing in the near term, as well as for new development.

Borrowers with maturing debt will likely face significant cash flow pressures if they refinance at current rates. Many will need to contribute more equity or collateral to maintain ownership, or they may be forced to sell properties. New developments will likely require added equity compared to a few years ago and will be more difficult to pencil. There are other creative solutions available such as recapitalizing with new equity or debt, or a negotiated restructuring. In turbulent times such as these it pays to consult with seasoned capital markets professionals.

Jay Maddox is a principal, Capital Markets, Avison Young.

You must be logged in to post a comment.