How Private Wealth Is Seizing the Day

Billionaires, family offices and UHNW investment managers are striking while the iron is hot, according to JLL's Nicco Lupo.

Institutional capital flows—or lack thereof—have been a quiet driver for a dislocated transaction market during the past 18 months.

As a result, private capital has filled the void in the risk tranche typically occupied by insurance companies, domestic and foreign pensions, ODCE funds and core+ evergreen capital. Billionaires, family offices and UHNW wealth managers are seizing the opportunity to grow and diversify their portfolios amid a disruptive period in investment history.

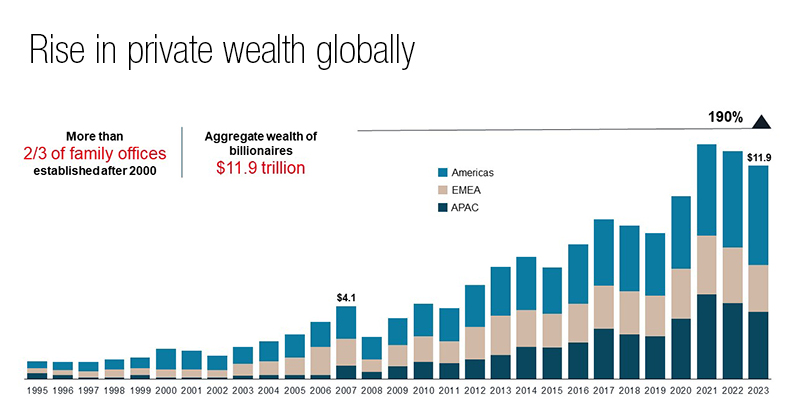

With the aggregate wealth of billionaires reaching $11.9 trillion globally, an increase of 190 percent since 2008, the rise in private wealth presents a vast reserve of capital for investment opportunities.

READ ALSO: 5 Strategies for Distress Buyers

New York City, with its significant concentration of centi-millionaires and gateway city status, is at the forefront of these transactions. A safe haven for the largest open-ended funds, New York has seen an uptick in liquidity-driven institutional transactions. Driven by an influx of fund redemption requests, the most liquid assets—multi-housing, industrial and thematic distressed office—have captured significant demand from private capital looking to capitalize on broader market dislocation.

The history

During the recession of the early 1980s, family offices—such as those established by the Rockefellers, the Phipps and the Carnegies—gained prominence in the financial world, laying the foundation for New York’s family office history. Those pioneering families led the way in pursuing greater scale and diversity in their portfolios. As the world witnessed a rise in super-wealthy individuals, the 21st century saw the emergence of a new generation of institutional-style private money.

READ ALSO: Alternative Financing Is CRE’s New Lifeline

While private capital and family office investment in CRE is not a new concept, the current evolution has seen a higher percentage allocated to real estate, with a newfound sophistication. The focus of investments is not just on purchasing single assets that private capital finds attractive. Equity capital infusions at the operating company level and structured equity for thematic platforms have become commonplace. Given the massive amount of private capital available, there has also been a shift toward major cities such as New York.

(Previously, larger cities were dominated by the institutional and public money that is currently facing liquidity constraints due to redemptions and an increased cost of capital.)

Private capital has the unique abilities to (1) be flexible in duration—family offices are not beholden to closed-end fund life limitations—and (2) capitalize on “‘moment-in-time alpha.”

Private capital today

Private capital investors now demonstrate an institutional focus that aligns them with capital market’s most sophisticated players. They are pursuing high-quality assets in core cities, leveraging their expertise to make informed decisions and venturing into new territories. JLL recently facilitated a high-net-worth family investment into a $200 million ground-up multi-housing transaction for a developer client in Manhattan, exemplifying a shift in the size, structure and quality of investments being considered by private capital investors.

Another private investor successfully acquired a Class A office building in Manhattan’s Midtown East neighborhood. With most of the building’s space due to expire by the end of 2023, JLL advised an experienced shopping mall investor and helped turn what could have been a challenge into a generational opportunity. They are now partnering on a venture to implement a long-term strategy that leverages the demand from boutique office tenants seeking a Class A Midtown East experience. The investment horizon of private capital investors could be just what the office sector needs to weather the storm (the long-term fundamental shift in how investors and users alike are looking at office going forward).

READ ALSO: Braving the Debt Restructuring Minefield

In this post-pandemic and rising interest rate environment, long-term investment sentiments and larger capital allocations require thorough underwriting and expertise in the fundamentals. It is critical to ensure that assets can support growth strategies in a sector heavily impacted by the pandemic. While office assets have faced challenges, private capital has stepped in to fill the void left by traditional lenders and investors. Private capital has demonstrated the ability to execute transactions quickly and efficiently, while multi-generational family offices lean on dedicated real estate advisors whose established internal resources can help them identify and pursue investments directly.

Despite challenges in CRE—particularly office—first movers will capitalize on opportunities. The NYC office market has adjusted to the hybrid work environment, providing a relative level of certainty for future leasing trends. Underperforming assets are being traded at a substantial discount. However, JLL’s first-quarter 2024 Manhattan Office Insights report shows top of market demand continues for top-quality office spaces. During the first quarter of this year, 23 deals were signed with starting rents exceeding $100 per square foot, including nine deals surpassing $150 per square foot.

Looking ahead, private capital is expected to engage in more transactions, not only offering rescue capital for distressed assets but also investment in opportunistic development, operating businesses and acquiring legacy-driven trophy assets. The broader CRE landscape, including the infrastructure, logistics and energy sectors, will also appeal to private capital during this opportune moment in the market cycle.

Private capital sees beyond the current capital markets environment, armed with credible data and unhindered by regulatory pressure. Maturing CRE debt and broader macro capital flow challenges present opportunities to buy basis and wait for growth. Private capital has the chance to make significant strides while institutional investors wait for their moment in the sun, which will come when redemptions clear and capital flows normalize.

Nicco Lupo is a director, JLL Capital Markets.

You must be logged in to post a comment.