How Rising Interest Rates Impact CMBS

Despite pressure on volume, CMBS remains an excellent alternative for long-term, fixed-rate debt.

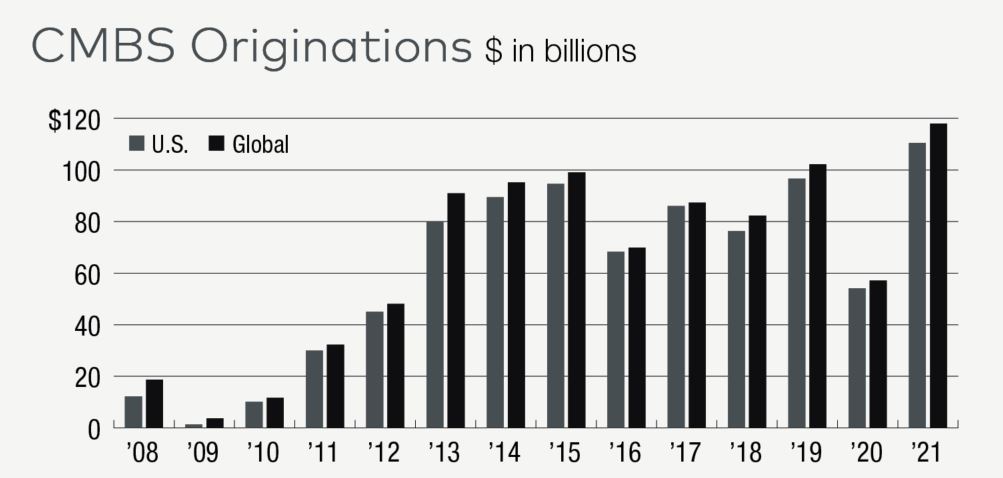

CMBS lending has been muted this year. Interest rate hikes, soaring inflation, market volatility and eroding confidence and other factors are to blame.

Increased interest rates particularly impact lending because higher rates place pressure on debt service, increasing cost to borrowers, said Constantine (“Tino”) Korologos, NYU clinical assistant professor and founding principal of Leonidas Partners LLC. In addition, higher debt expenses can also blend with equity return expectations, hiking cap rates.

Higher cap rates impact values because NOI and cap rate are indications of value. If the NOI doesn’t rise, downward pressure on value ensues. “Given economic pressures on expenses from inflation, and concern about recessionary conditions, it’s possible to see the numerator—revenue less expenses—actually go down,” said Korologos, co-author of the upcoming textbook, Real Estate Capital Markets; Evaluation, Structure and Participants. “This could amplify the affect of higher rates on value.”

Higher rates, uncertainty and market volatility could spur bond investors who purchase CMBS to look for higher yields on their bonds to capture elevated risk, he added. These factors introduce greater near-term sensitivity to market changes.

If a silver lining exists, it may be the secured nature of the collateral, commercial real estate assets, Korologos added, noting this sector has long been a comfort and safety haven for domestic and international investors.

The response of CMBS to rising interest rates can be an economic bellwether, said Joseph Cioffi, partner at law firm Davis+Gilbert LLP. That’s because cash flows reflect the health of economic sectors from retail to industrial.

Thus far, interest rate volatility has introduced additional uncertainty into an already shifting post-pandemic economy and, by extension, secondary market. “The uncertainty for both lenders and borrowers is reflected in the sharp drop in new issuances in June and July, after a good start to the year,” Cioffi added.

Pluses and minuses of CMBS

An attractive aspect of CMBS is that by design, it is non-recourse to borrowers. If borrowers comply with the lender’s agreement, they can always “give the keys back,” and avoid being held personally responsible, Korologos said.

CMBS loans also typically come with fixed-rate coupons, which counter today’s rising interest rates, said Rajul Sood, head of commercial lending solutions at research analytics and business intelligence provider Acuity Knowledge Partners.

CMBS furnishes lenders with capital release and liquidity and offers real estate investors higher yields compared to government bonds. The attractiveness of CMBS for investors also results from its varied investment options, as well as its more flexible options for workout over an extended period, unlike conventional lending.

“The COVID-19 pandemic has established CMBS’s resilience to economic distress,” Sood said. In the current environment, this security type is being structured more conservatively, and boasts stronger deal fundamentals and underwriting standards.

But with inflation near a 40-year high and the pandemic creating volatility, CMBS financing has come under pressure, Sood added. Rising interest rates, along with usually higher loan-to-value may reduce debt coverage ratios on floating loans, making these loans and investments riskier.

At a time when commercial real estate struggles to regain pre-COVID levels, investors remain spooked by prospects of new variant outbreaks, high energy costs and inflation’s negative impact on cap rates and occupancy levels in troubled retail, office and hospitality sectors. “This may lead to high refinance risk for some sectors witnessing double-digit erosion in property values stressing LTVs,” Sood opined.

Thirty Capital Financial CEO Kevin Swill said the only attractive aspect of CMBS today is the ability to lock in a rate for 10 years and sleep through the night knowing that rate can be handled for the next 10 years. The downside is volatility and the velocity with which increased interest rates peak and start turning downward. “What is your threshold to accepting a rate and being able to sleep at night?” he asked.

Forecasting future

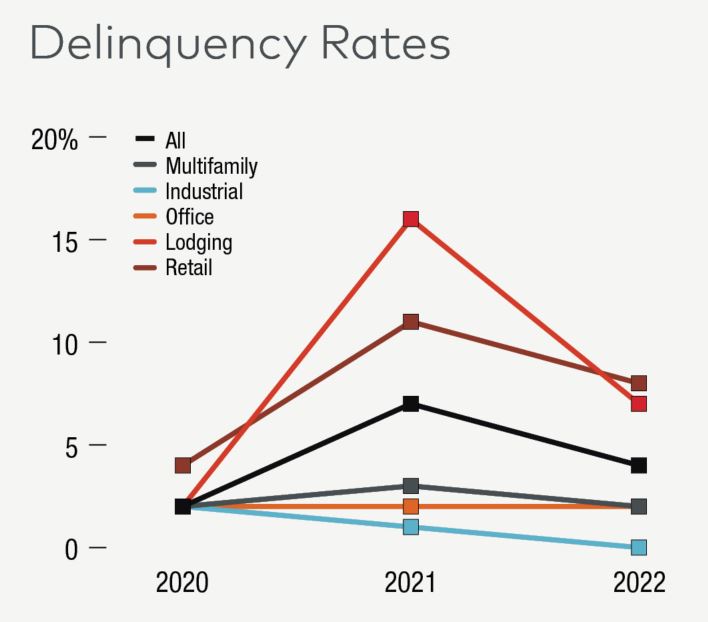

Trepp’s CMBS Delinquency Rate ticked higher in June for just a second time in almost two years. The delinquency rate hasn’t been impactful or concerning for originators, though, said Maverick Commercial Mortgage president and founder Ben Kadish. “It’s interest rates that are slowing the market down,” he added.

A month after that uptick, the Trepp CMBS Delinquency Rate declined 14 basis points month-over-month in July to 3.06 percent. That reinforced notions the June numbers were not conclusive, Sood said. Though delinquency rates improved in July, inflation continues to drive revenue and expenses, hurting overall income.

The trend in delinquency rates must be monitored over the next several months to fully grasp how current economic events impact the CMBS market, she said.

Economic sentiment seems to presage moderate CMBS lending over the next several years, Sood added. An Urban Land Institute survey estimated subdued commercial real estate transaction volume of $735 billion next year, and $750 billion in 2024, both lower than the record-setting $846 billion last year and projected $800 billion this year.

“Widening spreads and a weakening economy are hinting at shrinking investor demand—already evident in this year’s volumes—effects possibly lingering into 2023, given recessionary fears,” Sood reported. “Also, the pipeline of CMBS loan maturities for 2023 is high, $70 billion, with the majority of office and hotel loans having weaker metrics, [such as] high LTVs and lower debt yield, culminating in likely elevated refinance risks.”

As well, she said, composition of CMBS portfolios may expand beyond the typical five property types, in the process gaining traction from would-be investors.

In the near term, Cioffi observed, valuation stands to be of paramount concern for CMBS lending given turbulence buffeting the market, especially in the office sector. If performance weakens and battles erupt over loss allocation, valuation disputes will probably be at the center of the donnybrooks.

“Market uncertainty and losses may seed fertile ground for disputes over projected net operating income and occupancy levels, and the role of valuation in setting key loan ratios such as debt service coverage or loan to value,” he said.

You must be logged in to post a comment.